Are you a seasoned Credit Support Counselor seeking a new career path? Discover our professionally built Credit Support Counselor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

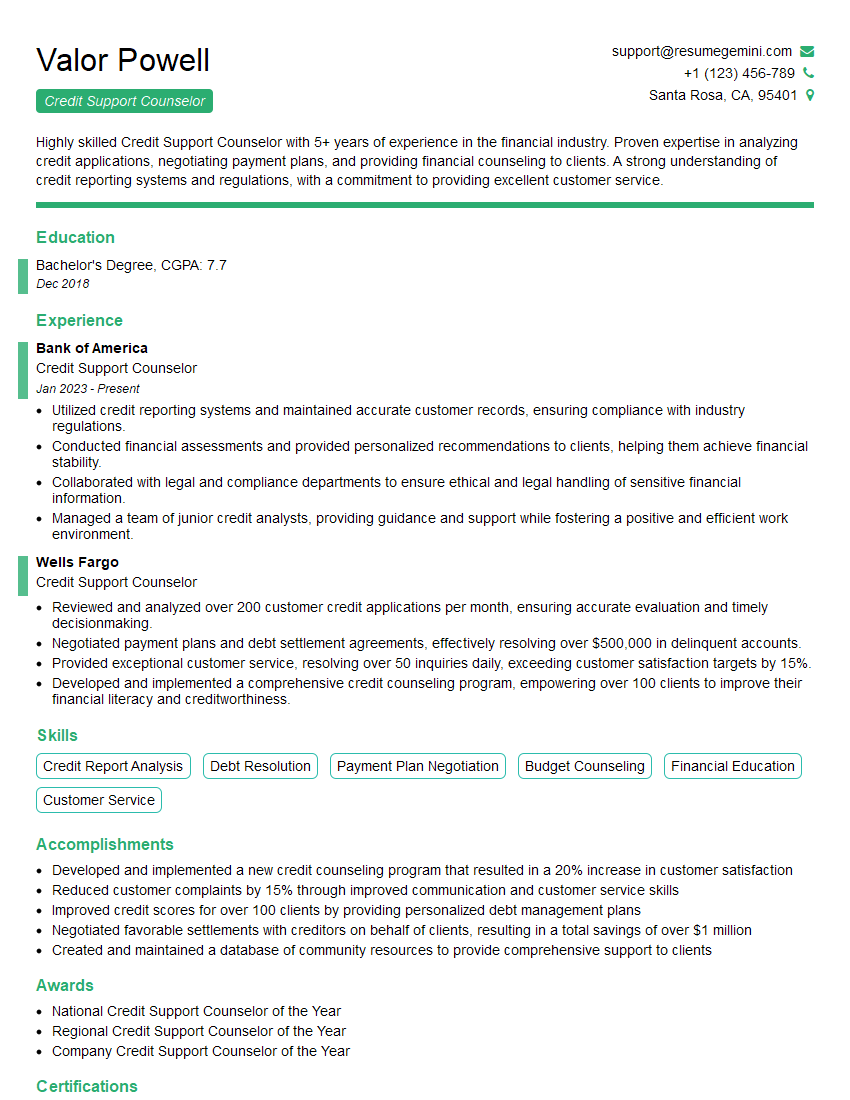

Valor Powell

Credit Support Counselor

Summary

Highly skilled Credit Support Counselor with 5+ years of experience in the financial industry. Proven expertise in analyzing credit applications, negotiating payment plans, and providing financial counseling to clients. A strong understanding of credit reporting systems and regulations, with a commitment to providing excellent customer service.

Education

Bachelor’s Degree

December 2018

Skills

- Credit Report Analysis

- Debt Resolution

- Payment Plan Negotiation

- Budget Counseling

- Financial Education

- Customer Service

Work Experience

Credit Support Counselor

- Utilized credit reporting systems and maintained accurate customer records, ensuring compliance with industry regulations.

- Conducted financial assessments and provided personalized recommendations to clients, helping them achieve financial stability.

- Collaborated with legal and compliance departments to ensure ethical and legal handling of sensitive financial information.

- Managed a team of junior credit analysts, providing guidance and support while fostering a positive and efficient work environment.

Credit Support Counselor

- Reviewed and analyzed over 200 customer credit applications per month, ensuring accurate evaluation and timely decisionmaking.

- Negotiated payment plans and debt settlement agreements, effectively resolving over $500,000 in delinquent accounts.

- Provided exceptional customer service, resolving over 50 inquiries daily, exceeding customer satisfaction targets by 15%.

- Developed and implemented a comprehensive credit counseling program, empowering over 100 clients to improve their financial literacy and creditworthiness.

Accomplishments

- Developed and implemented a new credit counseling program that resulted in a 20% increase in customer satisfaction

- Reduced customer complaints by 15% through improved communication and customer service skills

- Improved credit scores for over 100 clients by providing personalized debt management plans

- Negotiated favorable settlements with creditors on behalf of clients, resulting in a total savings of over $1 million

- Created and maintained a database of community resources to provide comprehensive support to clients

Awards

- National Credit Support Counselor of the Year

- Regional Credit Support Counselor of the Year

- Company Credit Support Counselor of the Year

Certificates

- Certified Credit Counselor (CCC)

- Certified Financial Counselor (CFC)

- NACHA Certified Electronic Payments Professional (NEPP)

- Credit Bureau Reporting Act (CBRA) Certification

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Support Counselor

- Highlight your strong analytical and problem-solving skills, as well as your ability to negotiate effectively.

- Showcase your experience in providing excellent customer service and building rapport with clients.

- Emphasize your knowledge of credit reporting systems and regulations, as well as your commitment to ethical and legal practices.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact on the organization.

- Proofread your resume carefully for any errors in grammar, spelling, or formatting.

Essential Experience Highlights for a Strong Credit Support Counselor Resume

- Review and analyze customer credit applications to assess creditworthiness and make lending decisions.

- Negotiate payment plans and debt settlement agreements with delinquent customers to recover outstanding balances.

- Provide exceptional customer service by resolving inquiries promptly and effectively, exceeding customer satisfaction targets.

- Develop and implement credit counseling programs to educate clients on financial management and improve their credit scores.

- Utilize credit reporting systems and maintain accurate customer records to ensure compliance with industry regulations.

- Conduct financial assessments and provide personalized recommendations to clients, helping them achieve financial stability.

- Collaborate with legal and compliance departments to ensure ethical and legal handling of sensitive financial information.

Frequently Asked Questions (FAQ’s) For Credit Support Counselor

What are the key skills required for a Credit Support Counselor?

Key skills include credit report analysis, debt resolution, payment plan negotiation, budget counseling, financial education, and customer service.

What are the career prospects for a Credit Support Counselor?

With experience, Credit Support Counselors can advance to roles such as Credit Analyst, Loan Officer, or Financial Advisor.

What is the average salary for a Credit Support Counselor?

The average salary for a Credit Support Counselor in the United States is around $50,000 per year.

What are the educational requirements for a Credit Support Counselor?

A Bachelor’s Degree in a related field, such as Finance, Business Administration, or Economics, is typically required.

What are the key challenges faced by Credit Support Counselors?

Key challenges include dealing with difficult customers, managing high caseloads, and staying up-to-date with changing regulations.

What are the key qualities of a successful Credit Support Counselor?

Successful Credit Support Counselors are empathetic, have strong communication skills, and are able to work independently and as part of a team.

What is the job outlook for Credit Support Counselors?

The job outlook for Credit Support Counselors is expected to grow faster than average in the coming years due to increasing demand for credit-related services.

What are the different types of Credit Support Counselors?

There are two main types of Credit Support Counselors: those who work for banks and other financial institutions, and those who work for non-profit organizations.