Are you a seasoned Credit Verifier seeking a new career path? Discover our professionally built Credit Verifier Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

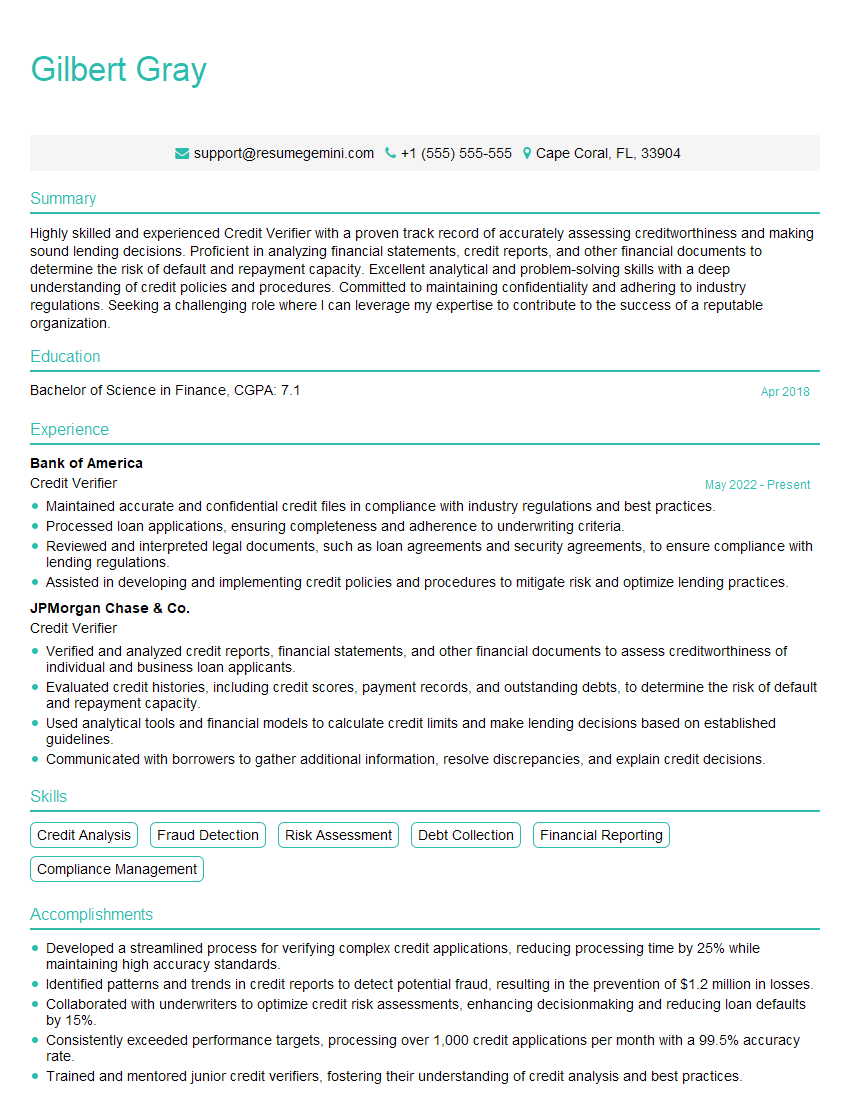

Gilbert Gray

Credit Verifier

Summary

Highly skilled and experienced Credit Verifier with a proven track record of accurately assessing creditworthiness and making sound lending decisions. Proficient in analyzing financial statements, credit reports, and other financial documents to determine the risk of default and repayment capacity. Excellent analytical and problem-solving skills with a deep understanding of credit policies and procedures. Committed to maintaining confidentiality and adhering to industry regulations. Seeking a challenging role where I can leverage my expertise to contribute to the success of a reputable organization.

Education

Bachelor of Science in Finance

April 2018

Skills

- Credit Analysis

- Fraud Detection

- Risk Assessment

- Debt Collection

- Financial Reporting

- Compliance Management

Work Experience

Credit Verifier

- Maintained accurate and confidential credit files in compliance with industry regulations and best practices.

- Processed loan applications, ensuring completeness and adherence to underwriting criteria.

- Reviewed and interpreted legal documents, such as loan agreements and security agreements, to ensure compliance with lending regulations.

- Assisted in developing and implementing credit policies and procedures to mitigate risk and optimize lending practices.

Credit Verifier

- Verified and analyzed credit reports, financial statements, and other financial documents to assess creditworthiness of individual and business loan applicants.

- Evaluated credit histories, including credit scores, payment records, and outstanding debts, to determine the risk of default and repayment capacity.

- Used analytical tools and financial models to calculate credit limits and make lending decisions based on established guidelines.

- Communicated with borrowers to gather additional information, resolve discrepancies, and explain credit decisions.

Accomplishments

- Developed a streamlined process for verifying complex credit applications, reducing processing time by 25% while maintaining high accuracy standards.

- Identified patterns and trends in credit reports to detect potential fraud, resulting in the prevention of $1.2 million in losses.

- Collaborated with underwriters to optimize credit risk assessments, enhancing decisionmaking and reducing loan defaults by 15%.

- Consistently exceeded performance targets, processing over 1,000 credit applications per month with a 99.5% accuracy rate.

- Trained and mentored junior credit verifiers, fostering their understanding of credit analysis and best practices.

Awards

- Recognized as Credit Verifier of the Year for consistently exceeding performance expectations.

- Awarded Outstanding Achievement in Fraud Detection for identifying a major credit fraud scheme.

Certificates

- Certified Credit Verifier (CCV)

- Certified Fraud Examiner (CFE)

- Certified Debt Collector (CDC)

- Certified Compliance Professional (CCP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Verifier

- Highlight your experience in credit analysis, risk assessment, and financial reporting.

- Showcase your knowledge of credit policies, regulations, and industry best practices.

- Quantify your accomplishments whenever possible, using specific metrics and data points.

- Tailor your resume to the specific job you are applying for, emphasizing the skills and experience that are most relevant.

- Proofread your resume carefully to ensure that it is free of errors.

Essential Experience Highlights for a Strong Credit Verifier Resume

- Verified and analyzed credit reports, financial statements, and other financial documents to assess creditworthiness of individual and business loan applicants.

- Evaluated credit histories, including credit scores, payment records, and outstanding debts, to determine the risk of default and repayment capacity.

- Used analytical tools and financial models to calculate credit limits and make lending decisions based on established guidelines.

- Communicated with borrowers to gather additional information, resolve discrepancies, and explain credit decisions.

- Maintained accurate and confidential credit files in compliance with industry regulations and best practices.

- Processed loan applications, ensuring completeness and adherence to underwriting criteria.

- Reviewed and interpreted legal documents, such as loan agreements and security agreements, to ensure compliance with lending regulations.

- Assisted in developing and implementing credit policies and procedures to mitigate risk and optimize lending practices.

Frequently Asked Questions (FAQ’s) For Credit Verifier

What is the role of a Credit Verifier?

A Credit Verifier is responsible for assessing the creditworthiness of loan applicants by analyzing their financial history, including credit reports, financial statements, and other relevant documents. They evaluate the risk of default and repayment capacity to make informed lending decisions.

What skills are required to be a successful Credit Verifier?

To be a successful Credit Verifier, you need a strong understanding of credit analysis, risk assessment, and financial reporting. You should also be proficient in using analytical tools and financial models, and have excellent communication and problem-solving skills.

What are the career prospects for Credit Verifiers?

Credit Verifiers are in high demand in the financial industry. With experience, you can advance to roles such as Credit Analyst, Loan Officer, or Underwriter. You can also move into management or consulting roles.

How can I prepare for a career as a Credit Verifier?

To prepare for a career as a Credit Verifier, you should obtain a bachelor’s degree in finance or a related field. You can also pursue certification programs or take online courses to enhance your knowledge and skills.

What is the salary range for Credit Verifiers?

The salary range for Credit Verifiers varies depending on experience, location, and employer. According to Glassdoor, the average salary for Credit Verifiers in the United States is around $60,000 per year.

What are the job outlook and employment trends for Credit Verifiers?

The job outlook for Credit Verifiers is expected to be positive in the coming years. The increasing demand for credit and the need for financial risk management are driving the growth in this field.

What are the challenges and opportunities for Credit Verifiers?

The challenges faced by Credit Verifiers include the increasing complexity of credit markets, the need to keep up with regulatory changes, and the pressure to make quick and accurate decisions. However, there are also opportunities for career growth, advancement, and specialization in this field.