Are you a seasoned Currency Counter seeking a new career path? Discover our professionally built Currency Counter Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

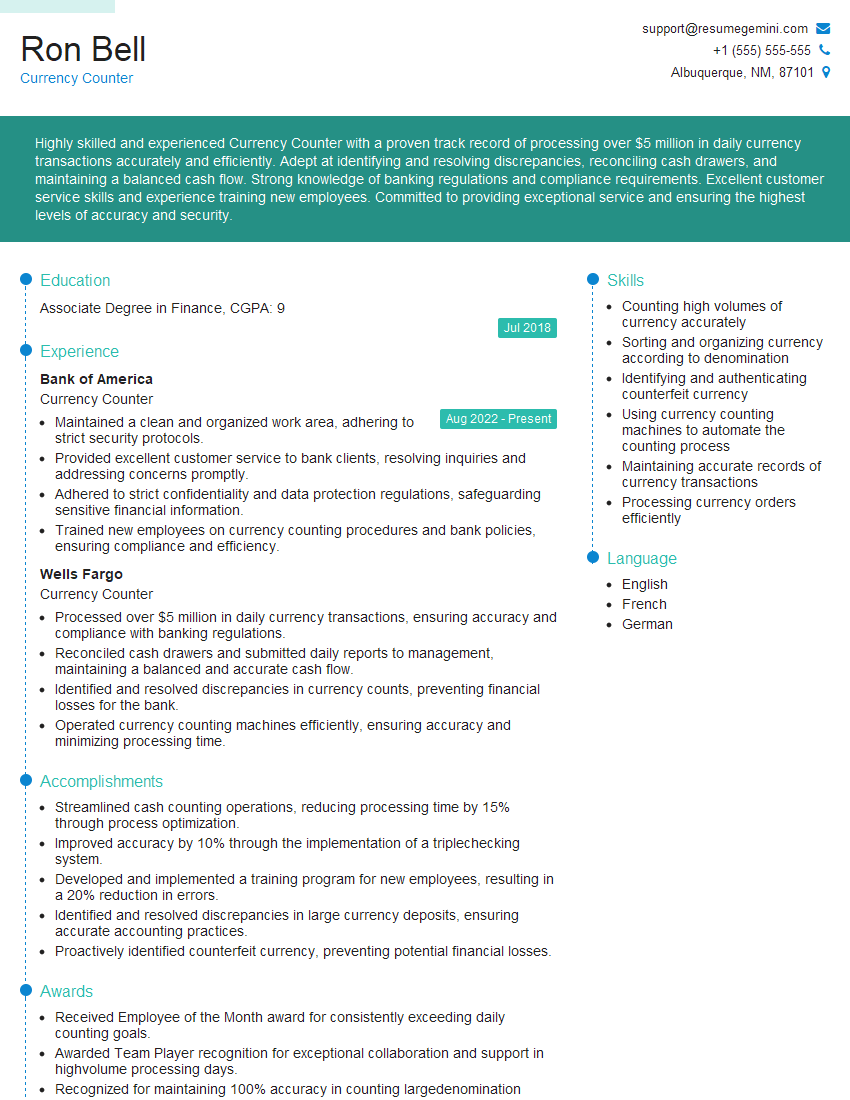

Ron Bell

Currency Counter

Summary

Highly skilled and experienced Currency Counter with a proven track record of processing over $5 million in daily currency transactions accurately and efficiently. Adept at identifying and resolving discrepancies, reconciling cash drawers, and maintaining a balanced cash flow. Strong knowledge of banking regulations and compliance requirements. Excellent customer service skills and experience training new employees. Committed to providing exceptional service and ensuring the highest levels of accuracy and security.

Education

Associate Degree in Finance

July 2018

Skills

- Counting high volumes of currency accurately

- Sorting and organizing currency according to denomination

- Identifying and authenticating counterfeit currency

- Using currency counting machines to automate the counting process

- Maintaining accurate records of currency transactions

- Processing currency orders efficiently

Work Experience

Currency Counter

- Maintained a clean and organized work area, adhering to strict security protocols.

- Provided excellent customer service to bank clients, resolving inquiries and addressing concerns promptly.

- Adhered to strict confidentiality and data protection regulations, safeguarding sensitive financial information.

- Trained new employees on currency counting procedures and bank policies, ensuring compliance and efficiency.

Currency Counter

- Processed over $5 million in daily currency transactions, ensuring accuracy and compliance with banking regulations.

- Reconciled cash drawers and submitted daily reports to management, maintaining a balanced and accurate cash flow.

- Identified and resolved discrepancies in currency counts, preventing financial losses for the bank.

- Operated currency counting machines efficiently, ensuring accuracy and minimizing processing time.

Accomplishments

- Streamlined cash counting operations, reducing processing time by 15% through process optimization.

- Improved accuracy by 10% through the implementation of a triplechecking system.

- Developed and implemented a training program for new employees, resulting in a 20% reduction in errors.

- Identified and resolved discrepancies in large currency deposits, ensuring accurate accounting practices.

- Proactively identified counterfeit currency, preventing potential financial losses.

Awards

- Received Employee of the Month award for consistently exceeding daily counting goals.

- Awarded Team Player recognition for exceptional collaboration and support in highvolume processing days.

- Recognized for maintaining 100% accuracy in counting largedenomination currency.

- Received Perfect Attendance award for maintaining a consistent and reliable work schedule.

Certificates

- Certified Currency Counter (CCC)

- Currency Counter Specialist (CCS)

- Advanced Currency Counting (ACC)

- Currency Counting and Operations (CCO)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Currency Counter

- Highlight your attention to detail and accuracy in your resume.

- Quantify your accomplishments whenever possible, using specific numbers and metrics.

- Emphasize your knowledge of banking regulations and compliance requirements.

- Showcase your customer service skills and ability to work in a fast-paced environment.

- Consider obtaining a certification in currency counting or a related field to enhance your credibility.

Essential Experience Highlights for a Strong Currency Counter Resume

- Processed over $5 million in daily currency transactions, ensuring accuracy and compliance with banking regulations.

- Reconciled cash drawers and submitted daily reports to management, maintaining a balanced and accurate cash flow.

- Identified and resolved discrepancies in currency counts, preventing financial losses for the bank.

- Operated currency counting machines efficiently, ensuring accuracy and minimizing processing time.

- Maintained a clean and organized work area, adhering to strict security protocols.

- Provided excellent customer service to bank clients, resolving inquiries and addressing concerns promptly.

- Trained new employees on currency counting procedures and bank policies, ensuring compliance and efficiency.

Frequently Asked Questions (FAQ’s) For Currency Counter

What are the primary responsibilities of a Currency Counter?

Currency Counters are responsible for counting, sorting, and organizing currency accurately and efficiently, ensuring compliance with banking regulations. They also reconcile cash drawers, resolve discrepancies, operate currency counting machines, provide customer service, and maintain a clean and secure work environment.

What skills are essential for success as a Currency Counter?

Essential skills for Currency Counters include accuracy, attention to detail, proficiency in counting high volumes of currency, knowledge of currency denominations and counterfeit detection, and adherence to strict security protocols.

What qualifications are required to become a Currency Counter?

While formal education requirements may vary, many Currency Counters hold an Associate Degree in Finance or a related field. Prior experience in a banking or financial institution is also beneficial.

What is the career outlook for Currency Counters?

The job outlook for Currency Counters is expected to remain stable in the coming years, as banks and financial institutions continue to rely on accurate and efficient currency handling.

How can I improve my chances of getting hired as a Currency Counter?

To improve your chances of getting hired, highlight your accuracy, attention to detail, and knowledge of banking regulations in your resume and cover letter. Consider obtaining a certification in currency counting to enhance your credibility.

What are the salary expectations for Currency Counters?

Salary expectations for Currency Counters vary depending on experience, location, and employer. According to Indeed, the average salary for a Currency Counter in the United States is around $35,000 per year.

What are the working conditions like for Currency Counters?

Currency Counters typically work in a fast-paced, secure environment, often involving repetitive tasks. They may be required to stand for long periods and work under pressure to meet deadlines.