Are you a seasoned Debt Counselor seeking a new career path? Discover our professionally built Debt Counselor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

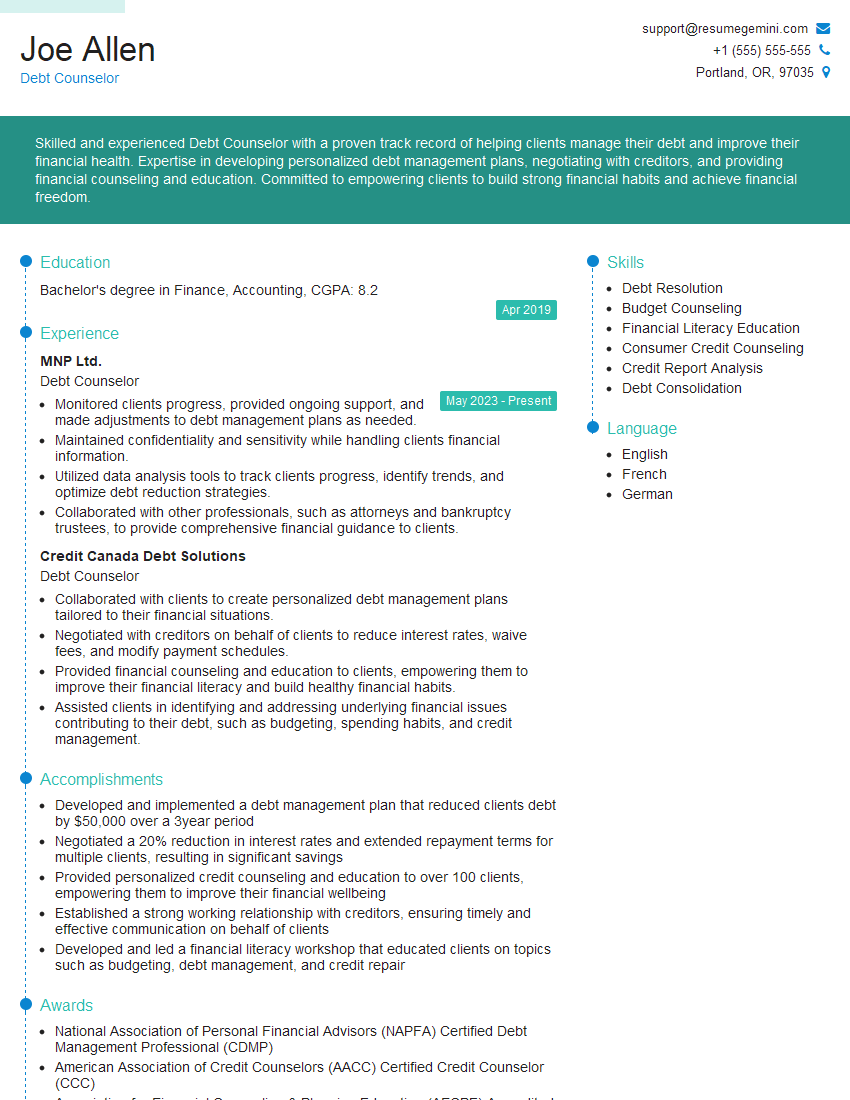

Joe Allen

Debt Counselor

Summary

Skilled and experienced Debt Counselor with a proven track record of helping clients manage their debt and improve their financial health. Expertise in developing personalized debt management plans, negotiating with creditors, and providing financial counseling and education. Committed to empowering clients to build strong financial habits and achieve financial freedom.

Education

Bachelor’s degree in Finance, Accounting

April 2019

Skills

- Debt Resolution

- Budget Counseling

- Financial Literacy Education

- Consumer Credit Counseling

- Credit Report Analysis

- Debt Consolidation

Work Experience

Debt Counselor

- Monitored clients progress, provided ongoing support, and made adjustments to debt management plans as needed.

- Maintained confidentiality and sensitivity while handling clients financial information.

- Utilized data analysis tools to track clients progress, identify trends, and optimize debt reduction strategies.

- Collaborated with other professionals, such as attorneys and bankruptcy trustees, to provide comprehensive financial guidance to clients.

Debt Counselor

- Collaborated with clients to create personalized debt management plans tailored to their financial situations.

- Negotiated with creditors on behalf of clients to reduce interest rates, waive fees, and modify payment schedules.

- Provided financial counseling and education to clients, empowering them to improve their financial literacy and build healthy financial habits.

- Assisted clients in identifying and addressing underlying financial issues contributing to their debt, such as budgeting, spending habits, and credit management.

Accomplishments

- Developed and implemented a debt management plan that reduced clients debt by $50,000 over a 3year period

- Negotiated a 20% reduction in interest rates and extended repayment terms for multiple clients, resulting in significant savings

- Provided personalized credit counseling and education to over 100 clients, empowering them to improve their financial wellbeing

- Established a strong working relationship with creditors, ensuring timely and effective communication on behalf of clients

- Developed and led a financial literacy workshop that educated clients on topics such as budgeting, debt management, and credit repair

Awards

- National Association of Personal Financial Advisors (NAPFA) Certified Debt Management Professional (CDMP)

- American Association of Credit Counselors (AACC) Certified Credit Counselor (CCC)

- Association for Financial Counseling & Planning Education (AFCPE) Accredited Financial Counselor (AFC)

Certificates

- Certified Credit Counselor (CCC)

- Certified Student Loan Counselor (CSLC)

- Certified Bankruptcy Counselor (CBC)

- Certified Financial Counselor (CFC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Debt Counselor

- Highlight your expertise in debt resolution and financial counseling.

- Showcase your ability to build strong relationships with clients and creditors.

- Emphasize your commitment to helping clients achieve financial freedom.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Tailor your resume to each job description, highlighting the skills and experience that are most relevant to the position.

Essential Experience Highlights for a Strong Debt Counselor Resume

- Collaborated with clients to create personalized debt management plans tailored to their financial situations.

- Negotiated with creditors on behalf of clients to reduce interest rates, waive fees, and modify payment schedules.

- Provided financial counseling and education to clients, empowering them to improve their financial literacy and build healthy financial habits.

- Assisted clients in identifying and addressing underlying financial issues contributing to their debt, such as budgeting, spending habits, and credit management.

- Monitored clients’ progress, provided ongoing support, and made adjustments to debt management plans as needed.

Frequently Asked Questions (FAQ’s) For Debt Counselor

What is the role of a Debt Counselor?

A Debt Counselor assists individuals and families in managing their debt and improving their financial well-being. They work closely with clients to assess their financial situation, create personalized debt management plans, and negotiate with creditors on their behalf.

What are the key skills required for a Debt Counselor?

Effective Debt Counselors possess strong analytical, communication, and negotiation skills. They are also proficient in financial management, budgeting, and credit counseling. Additionally, they must be compassionate and empathetic, as they work with clients who are often facing financial challenges.

What are the benefits of working as a Debt Counselor?

Debt Counselors play a vital role in helping individuals and families overcome financial difficulties and achieve financial stability. The job offers the opportunity to make a positive impact on people’s lives and contribute to their financial well-being.

How can I become a Debt Counselor?

To become a Debt Counselor, individuals typically need a bachelor’s degree in finance, accounting, or a related field. They may also need to obtain specific certifications or licenses, depending on the state or country in which they practice.

What is the job outlook for Debt Counselors?

The job outlook for Debt Counselors is expected to be positive in the coming years. As more and more individuals and families face financial challenges, the demand for qualified Debt Counselors is likely to increase.