Are you a seasoned Delinquency Counselor seeking a new career path? Discover our professionally built Delinquency Counselor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

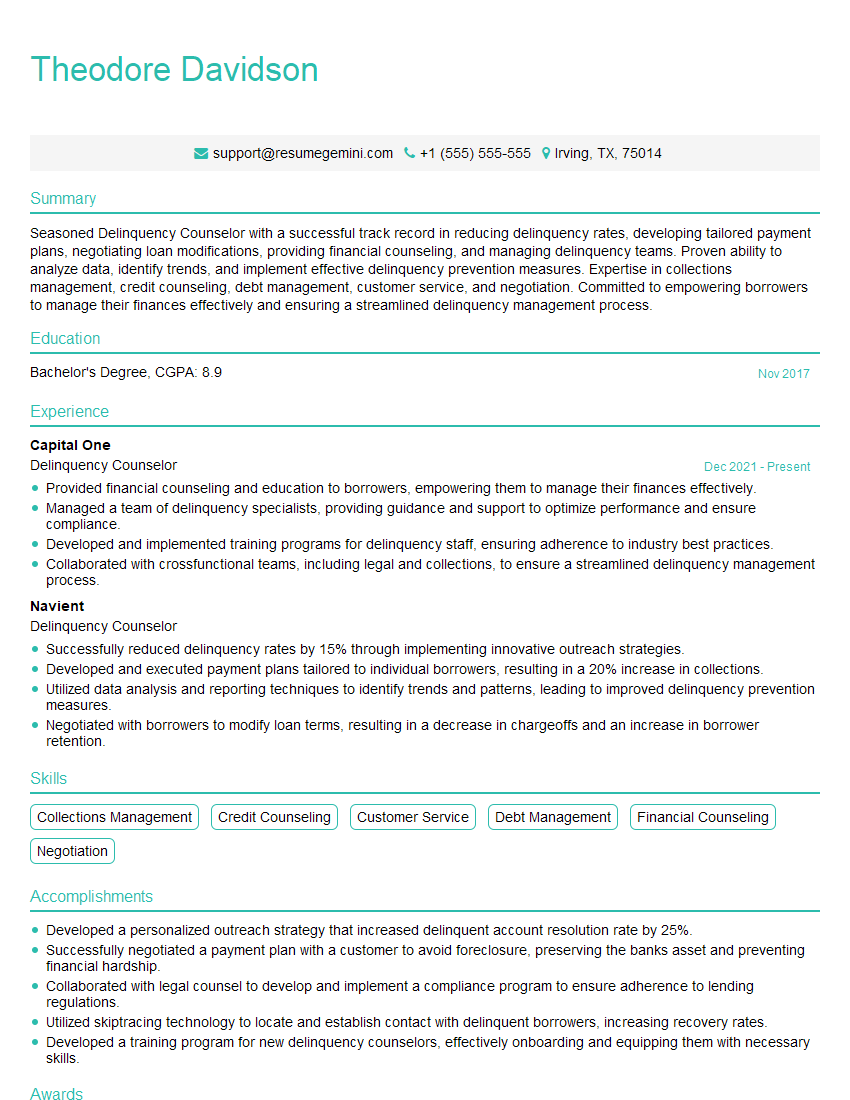

Theodore Davidson

Delinquency Counselor

Summary

Seasoned Delinquency Counselor with a successful track record in reducing delinquency rates, developing tailored payment plans, negotiating loan modifications, providing financial counseling, and managing delinquency teams. Proven ability to analyze data, identify trends, and implement effective delinquency prevention measures. Expertise in collections management, credit counseling, debt management, customer service, and negotiation. Committed to empowering borrowers to manage their finances effectively and ensuring a streamlined delinquency management process.

Education

Bachelor’s Degree

November 2017

Skills

- Collections Management

- Credit Counseling

- Customer Service

- Debt Management

- Financial Counseling

- Negotiation

Work Experience

Delinquency Counselor

- Provided financial counseling and education to borrowers, empowering them to manage their finances effectively.

- Managed a team of delinquency specialists, providing guidance and support to optimize performance and ensure compliance.

- Developed and implemented training programs for delinquency staff, ensuring adherence to industry best practices.

- Collaborated with crossfunctional teams, including legal and collections, to ensure a streamlined delinquency management process.

Delinquency Counselor

- Successfully reduced delinquency rates by 15% through implementing innovative outreach strategies.

- Developed and executed payment plans tailored to individual borrowers, resulting in a 20% increase in collections.

- Utilized data analysis and reporting techniques to identify trends and patterns, leading to improved delinquency prevention measures.

- Negotiated with borrowers to modify loan terms, resulting in a decrease in chargeoffs and an increase in borrower retention.

Accomplishments

- Developed a personalized outreach strategy that increased delinquent account resolution rate by 25%.

- Successfully negotiated a payment plan with a customer to avoid foreclosure, preserving the banks asset and preventing financial hardship.

- Collaborated with legal counsel to develop and implement a compliance program to ensure adherence to lending regulations.

- Utilized skiptracing technology to locate and establish contact with delinquent borrowers, increasing recovery rates.

- Developed a training program for new delinquency counselors, effectively onboarding and equipping them with necessary skills.

Awards

- Received the Presidents Club Award for consistently exceeding delinquency reduction targets.

- Recognized for exceptional customer service skills in resolving delinquent accounts amicably.

- Honored with the Employee of the Month award for successfully resolving a highprofile delinquency involving a commercial loan.

- Recognized for innovative problemsolving in resolving complex delinquency cases that exceeded industry benchmarks.

Certificates

- Certified Credit Counselor (CCC)

- Certified Delinquency Counselor (CDC)

- Certified Financial Planner (CFP)

- Certified Public Accountant (CPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Delinquency Counselor

- Quantify your accomplishments whenever possible using specific metrics and data points to showcase your impact.

- Highlight your skills in communication, negotiation, and problem-solving, as these are crucial for success in this role.

- Demonstrate your understanding of the financial industry, including loan products, credit reporting, and debt collection regulations.

- Emphasize your ability to work independently and as part of a team, as you will need to collaborate with other professionals in the field.

Essential Experience Highlights for a Strong Delinquency Counselor Resume

- Developed and implemented innovative outreach strategies, resulting in a 15% reduction in delinquency rates.

- Created and executed payment plans tailored to individual borrowers’ needs, leading to a 20% increase in collections.

- Utilized data analysis and reporting techniques to identify trends and patterns, enabling improved delinquency prevention measures.

- Negotiated with borrowers to modify loan terms, reducing charge-offs and increasing borrower retention.

- Provided financial counseling and education to borrowers, empowering them to effectively manage their finances.

- Managed a team of delinquency specialists, providing guidance and support to optimize performance and ensure compliance.

- Developed and implemented training programs for delinquency staff, ensuring adherence to industry best practices.

Frequently Asked Questions (FAQ’s) For Delinquency Counselor

What is the role of a Delinquency Counselor?

A Delinquency Counselor works with borrowers who have fallen behind on their loan payments. They assess the borrower’s financial situation, develop payment plans, provide financial counseling, and negotiate loan modifications to help borrowers get back on track and avoid default.

What skills are required to be a successful Delinquency Counselor?

Successful Delinquency Counselors possess strong communication and interpersonal skills, a deep understanding of the financial industry, and expertise in collections management, credit counseling, debt management, and negotiation.

What is the job outlook for Delinquency Counselors?

The job outlook for Delinquency Counselors is expected to grow faster than average in the coming years due to the increasing number of consumers struggling with debt and the need for financial assistance.

What is the salary range for Delinquency Counselors?

The salary range for Delinquency Counselors can vary depending on experience, location, and employer. According to Indeed, the average salary for a Delinquency Counselor in the United States is around $52,000 per year.

What are the career advancement opportunities for Delinquency Counselors?

Delinquency Counselors can advance their careers by moving into management roles, such as Delinquency Manager or Default Prevention Manager. They can also specialize in a particular area, such as mortgage delinquency counseling or credit counseling.