Are you a seasoned Deputy Insurance Commissioner seeking a new career path? Discover our professionally built Deputy Insurance Commissioner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

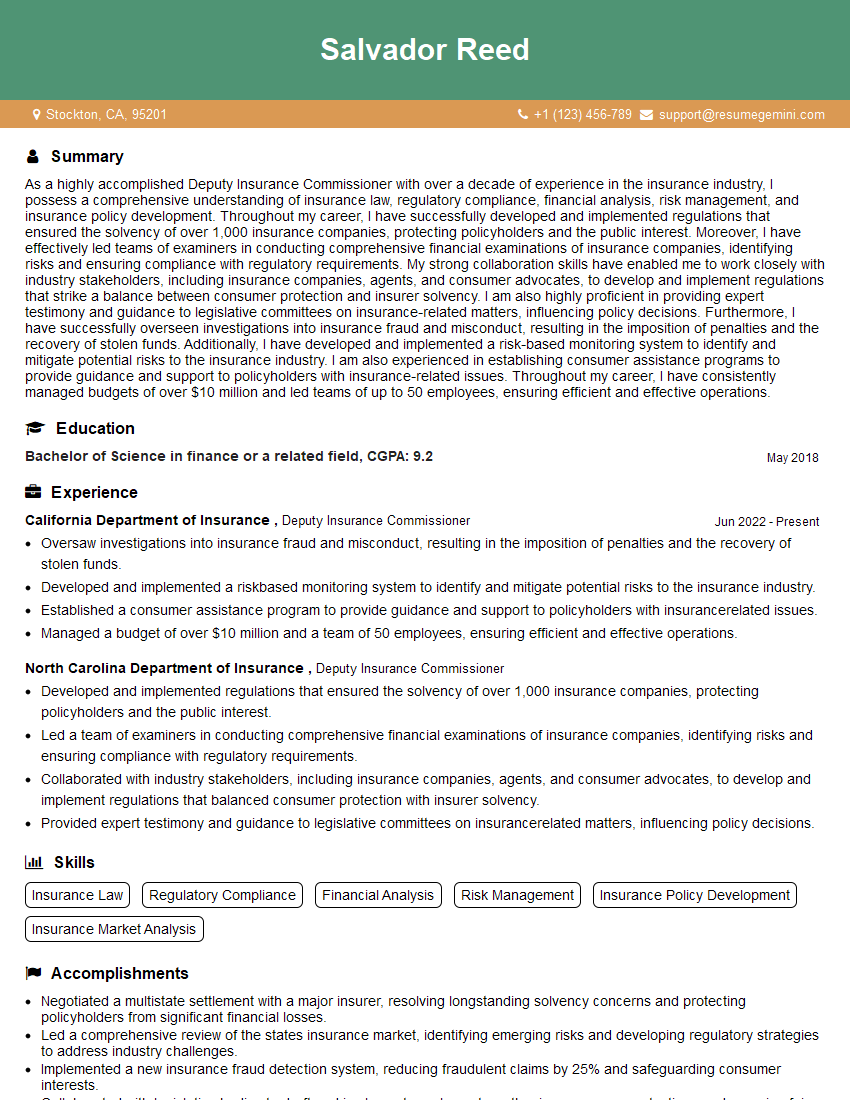

Salvador Reed

Deputy Insurance Commissioner

Summary

As a highly accomplished Deputy Insurance Commissioner with over a decade of experience in the insurance industry, I possess a comprehensive understanding of insurance law, regulatory compliance, financial analysis, risk management, and insurance policy development. Throughout my career, I have successfully developed and implemented regulations that ensured the solvency of over 1,000 insurance companies, protecting policyholders and the public interest. Moreover, I have effectively led teams of examiners in conducting comprehensive financial examinations of insurance companies, identifying risks and ensuring compliance with regulatory requirements. My strong collaboration skills have enabled me to work closely with industry stakeholders, including insurance companies, agents, and consumer advocates, to develop and implement regulations that strike a balance between consumer protection and insurer solvency. I am also highly proficient in providing expert testimony and guidance to legislative committees on insurance-related matters, influencing policy decisions. Furthermore, I have successfully overseen investigations into insurance fraud and misconduct, resulting in the imposition of penalties and the recovery of stolen funds. Additionally, I have developed and implemented a risk-based monitoring system to identify and mitigate potential risks to the insurance industry. I am also experienced in establishing consumer assistance programs to provide guidance and support to policyholders with insurance-related issues. Throughout my career, I have consistently managed budgets of over $10 million and led teams of up to 50 employees, ensuring efficient and effective operations.

Education

Bachelor of Science in finance or a related field

May 2018

Skills

- Insurance Law

- Regulatory Compliance

- Financial Analysis

- Risk Management

- Insurance Policy Development

- Insurance Market Analysis

Work Experience

Deputy Insurance Commissioner

- Oversaw investigations into insurance fraud and misconduct, resulting in the imposition of penalties and the recovery of stolen funds.

- Developed and implemented a riskbased monitoring system to identify and mitigate potential risks to the insurance industry.

- Established a consumer assistance program to provide guidance and support to policyholders with insurancerelated issues.

- Managed a budget of over $10 million and a team of 50 employees, ensuring efficient and effective operations.

Deputy Insurance Commissioner

- Developed and implemented regulations that ensured the solvency of over 1,000 insurance companies, protecting policyholders and the public interest.

- Led a team of examiners in conducting comprehensive financial examinations of insurance companies, identifying risks and ensuring compliance with regulatory requirements.

- Collaborated with industry stakeholders, including insurance companies, agents, and consumer advocates, to develop and implement regulations that balanced consumer protection with insurer solvency.

- Provided expert testimony and guidance to legislative committees on insurancerelated matters, influencing policy decisions.

Accomplishments

- Negotiated a multistate settlement with a major insurer, resolving longstanding solvency concerns and protecting policyholders from significant financial losses.

- Led a comprehensive review of the states insurance market, identifying emerging risks and developing regulatory strategies to address industry challenges.

- Implemented a new insurance fraud detection system, reducing fraudulent claims by 25% and safeguarding consumer interests.

- Collaborated with legislative bodies to draft and implement new laws strengthening consumer protections and ensuring fair insurance practices.

- Testified before congressional committees on insurance industry issues, providing expert insights and advocating for balanced regulatory policies.

Awards

- Recognized for outstanding performance in insurance regulatory enforcement with the National Association of Insurance Commissioners (NAIC) Award for Excellence in Enforcement.

- Presented with the Distinguished Service Award from the International Association of Insurance Supervisors (IAIS) for contributions to global insurance regulation and supervision.

- Honored with the Insurance Commissioner of the Year Award from the Council of Insurance Commissioners International (CICI) for leadership in insurance policy and regulatory innovation.

- Received the Insurance Risk Manager of the Year Award from the Risk and Insurance Management Society (RIMS) for exceptional contributions to the field of insurance risk management.

Certificates

- Certified Insurance Counselor (CIC)

- Associate in Risk Management (ARM)

- Fellow of the Casualty Actuarial Society (FCAS)

- Chartered Property Casualty Underwriter (CPCU)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Deputy Insurance Commissioner

- Highlight your experience in insurance law, regulatory compliance, financial analysis, risk management, and insurance policy development.

- Showcase your leadership skills by emphasizing your ability to lead teams of examiners and manage large budgets.

- Provide specific examples of your accomplishments, such as developing regulations that ensured the solvency of insurance companies or overseeing investigations into insurance fraud.

- Quantify your results whenever possible, using numbers and metrics to demonstrate the impact of your work.

- Proofread your resume carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Deputy Insurance Commissioner Resume

- Developing and implementing regulations that ensure the solvency of insurance companies

- Leading teams of examiners in conducting comprehensive financial examinations of insurance companies

- Collaborating with industry stakeholders to develop and implement regulations

- Providing expert testimony and guidance to legislative committees on insurance-related matters

- Overseeing investigations into insurance fraud and misconduct

- Developing and implementing a risk-based monitoring system to identify and mitigate potential risks to the insurance industry

- Establishing a consumer assistance program to provide guidance and support to policyholders

Frequently Asked Questions (FAQ’s) For Deputy Insurance Commissioner

What is the role of a Deputy Insurance Commissioner?

A Deputy Insurance Commissioner is responsible for assisting the Insurance Commissioner in regulating the insurance industry within a state. They may develop and implement regulations, conduct examinations of insurance companies, investigate complaints, and represent the department in legal proceedings.

What are the qualifications for becoming a Deputy Insurance Commissioner?

Most Deputy Insurance Commissioners have a bachelor’s degree in finance, accounting, or a related field, along with several years of experience in the insurance industry. They must also have a strong understanding of insurance law and regulations.

What are the key responsibilities of a Deputy Insurance Commissioner?

The key responsibilities of a Deputy Insurance Commissioner include developing and implementing regulations, conducting examinations of insurance companies, investigating complaints, and representing the department in legal proceedings.

What are the career prospects for a Deputy Insurance Commissioner?

Deputy Insurance Commissioners can advance to become Insurance Commissioners or take on other leadership roles within the insurance industry. They may also choose to move into academia or consulting.

What are the challenges faced by Deputy Insurance Commissioners?

Deputy Insurance Commissioners face a number of challenges, including the need to stay up-to-date on the latest insurance laws and regulations, the need to balance the interests of consumers and insurers, and the need to deal with complex financial issues.

What are the rewards of being a Deputy Insurance Commissioner?

Deputy Insurance Commissioners can make a real difference in the lives of consumers by ensuring that the insurance industry is fair and competitive. They can also enjoy a high level of job satisfaction and a competitive salary.