Are you a seasoned Energy Derivatives Trader seeking a new career path? Discover our professionally built Energy Derivatives Trader Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

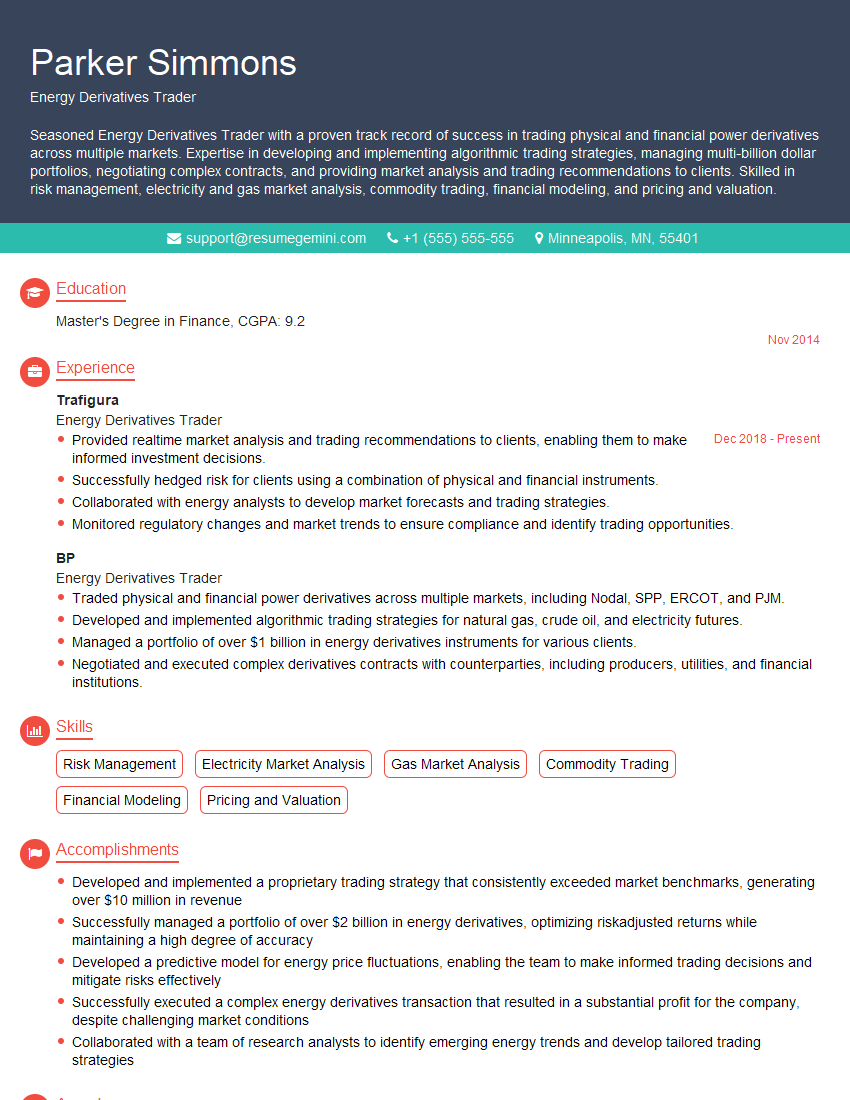

Parker Simmons

Energy Derivatives Trader

Summary

Seasoned Energy Derivatives Trader with a proven track record of success in trading physical and financial power derivatives across multiple markets. Expertise in developing and implementing algorithmic trading strategies, managing multi-billion dollar portfolios, negotiating complex contracts, and providing market analysis and trading recommendations to clients. Skilled in risk management, electricity and gas market analysis, commodity trading, financial modeling, and pricing and valuation.

Education

Master’s Degree in Finance

November 2014

Skills

- Risk Management

- Electricity Market Analysis

- Gas Market Analysis

- Commodity Trading

- Financial Modeling

- Pricing and Valuation

Work Experience

Energy Derivatives Trader

- Provided realtime market analysis and trading recommendations to clients, enabling them to make informed investment decisions.

- Successfully hedged risk for clients using a combination of physical and financial instruments.

- Collaborated with energy analysts to develop market forecasts and trading strategies.

- Monitored regulatory changes and market trends to ensure compliance and identify trading opportunities.

Energy Derivatives Trader

- Traded physical and financial power derivatives across multiple markets, including Nodal, SPP, ERCOT, and PJM.

- Developed and implemented algorithmic trading strategies for natural gas, crude oil, and electricity futures.

- Managed a portfolio of over $1 billion in energy derivatives instruments for various clients.

- Negotiated and executed complex derivatives contracts with counterparties, including producers, utilities, and financial institutions.

Accomplishments

- Developed and implemented a proprietary trading strategy that consistently exceeded market benchmarks, generating over $10 million in revenue

- Successfully managed a portfolio of over $2 billion in energy derivatives, optimizing riskadjusted returns while maintaining a high degree of accuracy

- Developed a predictive model for energy price fluctuations, enabling the team to make informed trading decisions and mitigate risks effectively

- Successfully executed a complex energy derivatives transaction that resulted in a substantial profit for the company, despite challenging market conditions

- Collaborated with a team of research analysts to identify emerging energy trends and develop tailored trading strategies

Awards

- Recognized as Top Energy Derivatives Trader by Energy Risk Magazine for consecutive years

- Awarded the Energy Risk Derivative Trader of the Year award for exceptional performance in the global energy derivatives market

- Received the Platts Energy Trading Excellence Award for innovative trading strategies and exceptional market knowledge

- Named as one of the Top 10 Energy Derivatives Traders under 40 by the International Energy Traders Association

Certificates

- Certified Energy Risk Analyst (CERA)

- Energy Trading Certificate (ETC)

- Financial Risk Management (FRM)

- Chartered Financial Analyst (CFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Energy Derivatives Trader

- Quantify your accomplishments using specific metrics whenever possible.

- Highlight your experience in developing and implementing trading strategies that have generated positive returns for clients.

- Showcase your ability to manage risk and navigate complex energy markets.

- Demonstrate your understanding of the regulatory landscape and your commitment to compliance.

- Consider obtaining industry certifications, such as the Certified Energy Risk Analyst (CERA) or the Energy Risk Professional (ERP), to enhance your credibility.

Essential Experience Highlights for a Strong Energy Derivatives Trader Resume

- Traded physical and financial power derivatives across multiple markets, including Nodal, SPP, ERCOT, and PJM.

- Developed and implemented algorithmic trading strategies for natural gas, crude oil, and electricity futures.

- Managed a portfolio of over $1 billion in energy derivatives instruments for various clients.

- Negotiated and executed complex derivatives contracts with counterparties, including producers, utilities, and financial institutions.

- Provided realtime market analysis and trading recommendations to clients, enabling them to make informed investment decisions.

- Successfully hedged risk for clients using a combination of physical and financial instruments.

- Collaborated with energy analysts to develop market forecasts and trading strategies.

- Monitored regulatory changes and market trends to ensure compliance and identify trading opportunities.

Frequently Asked Questions (FAQ’s) For Energy Derivatives Trader

What is the job outlook for Energy Derivatives Traders?

The job outlook for Energy Derivatives Traders is expected to be good over the next few years. The growing demand for energy and the increasing complexity of energy markets are expected to drive demand for qualified traders.

What are the key skills required to be a successful Energy Derivatives Trader?

Key skills required to be a successful Energy Derivatives Trader include strong analytical skills, knowledge of energy markets, experience in trading derivatives, and risk management skills.

What are the earning prospects for Energy Derivatives Traders?

The earning prospects for Energy Derivatives Traders vary depending on experience, skills, and the size of the firm. Experienced traders with strong track records can earn high salaries and bonuses.

What is the work environment for Energy Derivatives Traders like?

Energy Derivatives Traders typically work in fast-paced, demanding environments. They may work long hours, including evenings and weekends, to keep up with market developments.

What are the career advancement opportunities for Energy Derivatives Traders?

Energy Derivatives Traders with strong performance records can advance to senior trading roles, portfolio management positions, or other leadership roles within the energy industry.

How can I prepare for a career as an Energy Derivatives Trader?

To prepare for a career as an Energy Derivatives Trader, you should develop a strong foundation in finance, economics, and energy markets. You should also gain experience in trading and risk management.

What resources are available to help me learn more about Energy Derivatives Trading?

There are a number of resources available to help you learn more about Energy Derivatives Trading, including books, articles, and online courses. You can also attend industry conferences and workshops to network with other professionals in the field.