Are you a seasoned Enrolled Agent seeking a new career path? Discover our professionally built Enrolled Agent Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

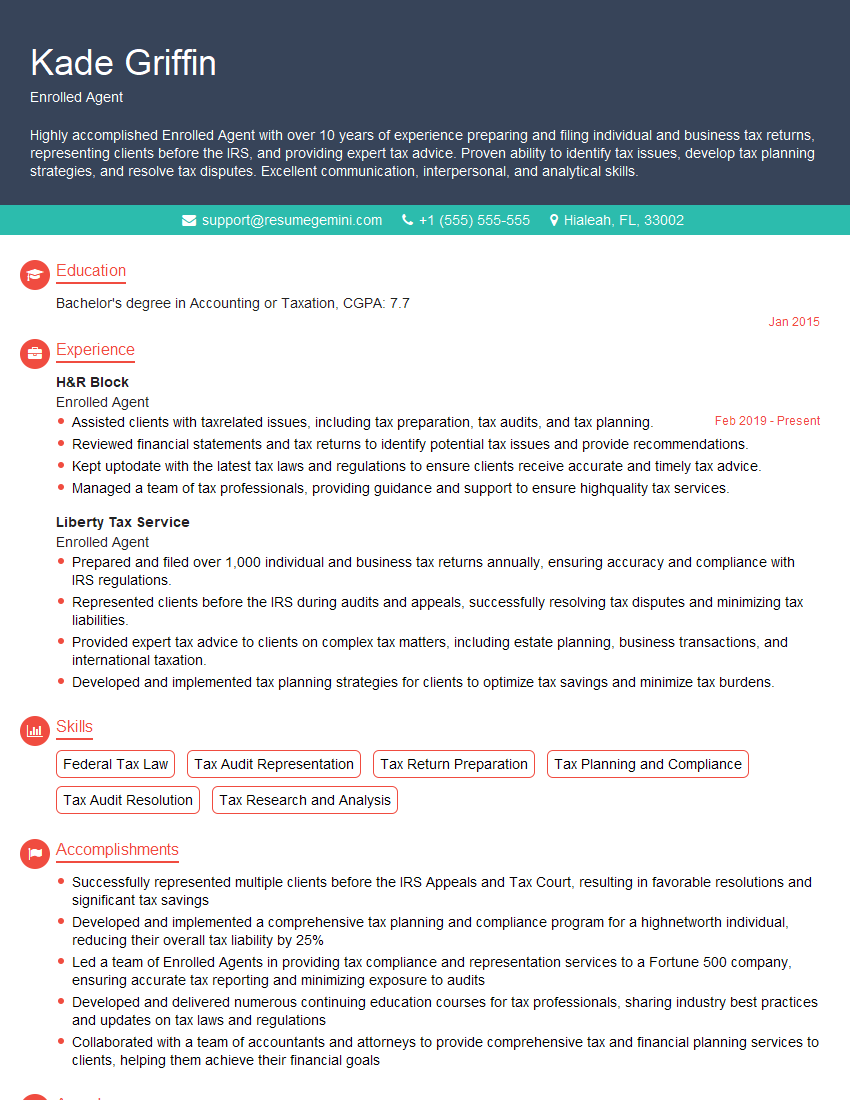

Kade Griffin

Enrolled Agent

Summary

Highly accomplished Enrolled Agent with over 10 years of experience preparing and filing individual and business tax returns, representing clients before the IRS, and providing expert tax advice. Proven ability to identify tax issues, develop tax planning strategies, and resolve tax disputes. Excellent communication, interpersonal, and analytical skills.

Education

Bachelor’s degree in Accounting or Taxation

January 2015

Skills

- Federal Tax Law

- Tax Audit Representation

- Tax Return Preparation

- Tax Planning and Compliance

- Tax Audit Resolution

- Tax Research and Analysis

Work Experience

Enrolled Agent

- Assisted clients with taxrelated issues, including tax preparation, tax audits, and tax planning.

- Reviewed financial statements and tax returns to identify potential tax issues and provide recommendations.

- Kept uptodate with the latest tax laws and regulations to ensure clients receive accurate and timely tax advice.

- Managed a team of tax professionals, providing guidance and support to ensure highquality tax services.

Enrolled Agent

- Prepared and filed over 1,000 individual and business tax returns annually, ensuring accuracy and compliance with IRS regulations.

- Represented clients before the IRS during audits and appeals, successfully resolving tax disputes and minimizing tax liabilities.

- Provided expert tax advice to clients on complex tax matters, including estate planning, business transactions, and international taxation.

- Developed and implemented tax planning strategies for clients to optimize tax savings and minimize tax burdens.

Accomplishments

- Successfully represented multiple clients before the IRS Appeals and Tax Court, resulting in favorable resolutions and significant tax savings

- Developed and implemented a comprehensive tax planning and compliance program for a highnetworth individual, reducing their overall tax liability by 25%

- Led a team of Enrolled Agents in providing tax compliance and representation services to a Fortune 500 company, ensuring accurate tax reporting and minimizing exposure to audits

- Developed and delivered numerous continuing education courses for tax professionals, sharing industry best practices and updates on tax laws and regulations

- Collaborated with a team of accountants and attorneys to provide comprehensive tax and financial planning services to clients, helping them achieve their financial goals

Awards

- Received the National Association of Enrolled Agents (NAEA) Award of Merit for outstanding contributions to the profession

- Recognized as an IRS Enrolled Agent with Emerald Circle distinction, signifying exceptional tax knowledge and expertise

- Awarded the NAEA William L. Raby Continuing Education Award for completing over 100 hours of continuing professional education

Certificates

- Enrolled Agent (EA)

- Certified Public Accountant (CPA)

- Master of Science in Taxation (MST)

- Juris Doctor (JD) with a focus on Taxation

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Enrolled Agent

- Highlight your Enrolled Agent credential prominently on your resume.

- Quantify your accomplishments whenever possible, using specific numbers and metrics.

- Showcase your expertise in tax laws and regulations by mentioning any relevant certifications or continuing education courses you have completed.

- Emphasize your ability to resolve tax disputes and minimize tax liabilities for your clients.

- Proofread your resume carefully before submitting it, as any errors could reflect poorly on your professionalism.

Essential Experience Highlights for a Strong Enrolled Agent Resume

- Prepare and file individual and business tax returns, ensuring accuracy and compliance with IRS regulations

- Represent clients before the IRS during audits and appeals, successfully resolving tax disputes and minimizing tax liabilities

- Provide expert tax advice to clients on complex tax matters, including estate planning, business transactions, and international taxation

- Develop and implement tax planning strategies for clients to optimize tax savings and minimize tax burdens

- Review financial statements and tax returns to identify potential tax issues and provide recommendations

- Keep uptodate with the latest tax laws and regulations to ensure clients receive accurate and timely tax advice

- Manage a team of tax professionals, providing guidance and support to ensure highquality tax services

Frequently Asked Questions (FAQ’s) For Enrolled Agent

What is an Enrolled Agent?

An Enrolled Agent (EA) is a federally authorized tax practitioner who is empowered by the U.S. Department of the Treasury to represent taxpayers before the Internal Revenue Service (IRS). EAs are the only tax professionals who are licensed to practice before the IRS in all 50 states.

What are the benefits of hiring an Enrolled Agent?

There are several benefits to hiring an Enrolled Agent, including their expertise in tax laws and regulations, their ability to represent you before the IRS, and their commitment to ethical and professional conduct.

How do I become an Enrolled Agent?

To become an Enrolled Agent, you must pass a rigorous three-part examination administered by the IRS and meet certain experience requirements. You must also meet continuing education requirements to maintain your EA status.

What is the difference between an Enrolled Agent and a Certified Public Accountant (CPA)?

Enrolled Agents and CPAs are both tax professionals, but they have different areas of expertise. EAs are focused on taxation, while CPAs have a broader focus that includes accounting, auditing, and financial planning.

How much does it cost to hire an Enrolled Agent?

The cost of hiring an Enrolled Agent can vary depending on the complexity of your tax situation and the location of the EA. However, most EAs charge hourly rates ranging from $100 to $250.

What are the key qualities of a good Enrolled Agent?

Good Enrolled Agents are knowledgeable, experienced, and ethical. They are also able to communicate complex tax issues in a clear and concise manner.

How can I find a reputable Enrolled Agent?

You can find a reputable Enrolled Agent by asking for referrals from friends, family, or other professionals. You can also search for EAs in your area on the IRS website.