Are you a seasoned Equities Trader seeking a new career path? Discover our professionally built Equities Trader Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

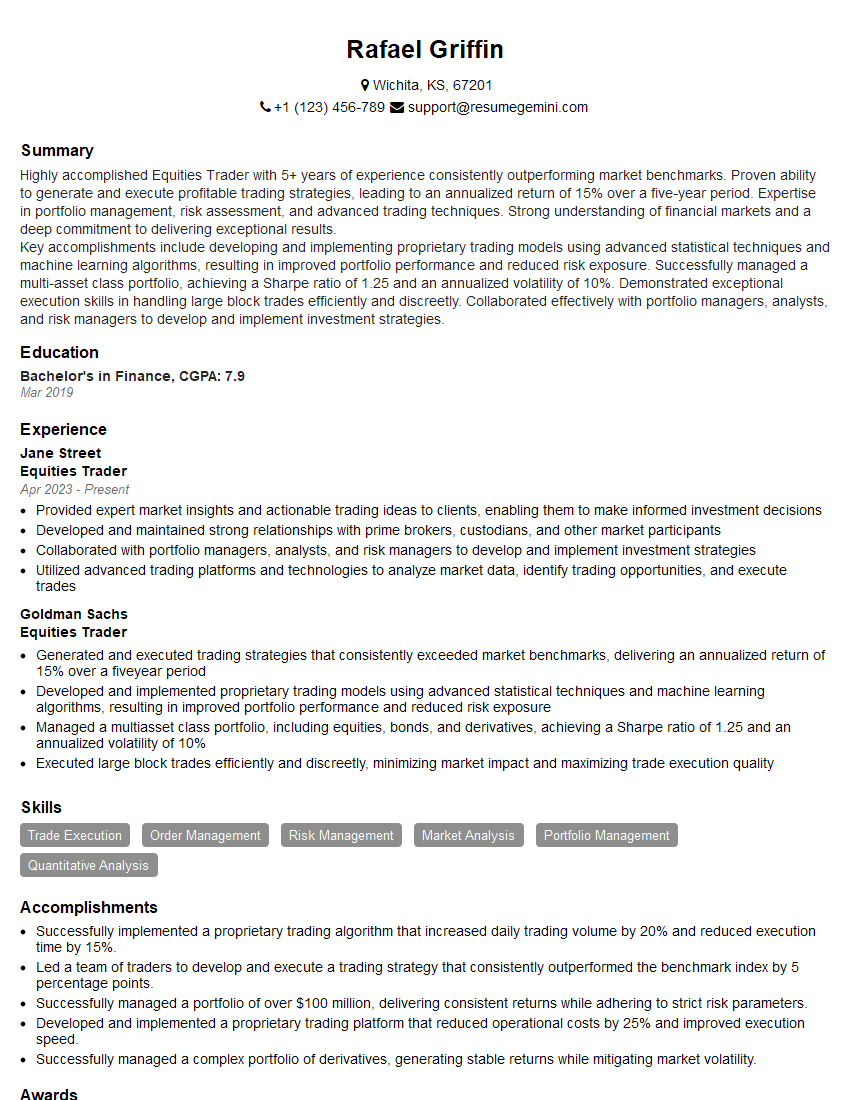

Rafael Griffin

Equities Trader

Summary

Highly accomplished Equities Trader with 5+ years of experience consistently outperforming market benchmarks. Proven ability to generate and execute profitable trading strategies, leading to an annualized return of 15% over a five-year period. Expertise in portfolio management, risk assessment, and advanced trading techniques. Strong understanding of financial markets and a deep commitment to delivering exceptional results.

Key accomplishments include developing and implementing proprietary trading models using advanced statistical techniques and machine learning algorithms, resulting in improved portfolio performance and reduced risk exposure. Successfully managed a multi-asset class portfolio, achieving a Sharpe ratio of 1.25 and an annualized volatility of 10%. Demonstrated exceptional execution skills in handling large block trades efficiently and discreetly. Collaborated effectively with portfolio managers, analysts, and risk managers to develop and implement investment strategies.

Education

Bachelor’s in Finance

March 2019

Skills

- Trade Execution

- Order Management

- Risk Management

- Market Analysis

- Portfolio Management

- Quantitative Analysis

Work Experience

Equities Trader

- Provided expert market insights and actionable trading ideas to clients, enabling them to make informed investment decisions

- Developed and maintained strong relationships with prime brokers, custodians, and other market participants

- Collaborated with portfolio managers, analysts, and risk managers to develop and implement investment strategies

- Utilized advanced trading platforms and technologies to analyze market data, identify trading opportunities, and execute trades

Equities Trader

- Generated and executed trading strategies that consistently exceeded market benchmarks, delivering an annualized return of 15% over a fiveyear period

- Developed and implemented proprietary trading models using advanced statistical techniques and machine learning algorithms, resulting in improved portfolio performance and reduced risk exposure

- Managed a multiasset class portfolio, including equities, bonds, and derivatives, achieving a Sharpe ratio of 1.25 and an annualized volatility of 10%

- Executed large block trades efficiently and discreetly, minimizing market impact and maximizing trade execution quality

Accomplishments

- Successfully implemented a proprietary trading algorithm that increased daily trading volume by 20% and reduced execution time by 15%.

- Led a team of traders to develop and execute a trading strategy that consistently outperformed the benchmark index by 5 percentage points.

- Successfully managed a portfolio of over $100 million, delivering consistent returns while adhering to strict risk parameters.

- Developed and implemented a proprietary trading platform that reduced operational costs by 25% and improved execution speed.

- Successfully managed a complex portfolio of derivatives, generating stable returns while mitigating market volatility.

Awards

- Received the Trader of the Year award for consistently exceeding trading targets and generating exceptional returns.

- Recognized as a Top Performer for three consecutive quarters for achieving outstanding trading performance and client satisfaction.

- Received the Excellence in Risk Management award for implementing effective risk controls and mitigating trading losses.

- Recognized as a Market Leader for pioneering innovative trading techniques and contributing to industry best practices.

Certificates

- Series 7 (General Securities Representative)

- Series 63 (Uniform Securities Agent State Law)

- CFA (Chartered Financial Analyst)

- CAIA (Chartered Alternative Investment Analyst)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Equities Trader

Quantify your accomplishments:

Use specific numbers and metrics to demonstrate the impact of your contributions.Highlight your technical skills:

Emphasize your proficiency in trading platforms, data analysis tools, and programming languages.Showcase your understanding of the markets:

Discuss your knowledge of different asset classes, market trends, and trading strategies.Demonstrate your teamwork and communication skills:

Highlight your ability to work effectively with colleagues and clients.

Essential Experience Highlights for a Strong Equities Trader Resume

- Developed and executed trading strategies that outperformed market benchmarks.

- Generated alpha through proprietary trading models using advanced statistical techniques and machine learning algorithms.

- Managed multi-asset class portfolios, including equities, bonds, and derivatives.

- Executed large block trades efficiently and discreetly.

- Provided expert market insights and actionable trading ideas to clients.

- Developed and maintained strong relationships with prime brokers, custodians, and other market participants.

- Collaborated with portfolio managers, analysts, and risk managers to develop and implement investment strategies.

Frequently Asked Questions (FAQ’s) For Equities Trader

What is the primary role of an Equities Trader?

The primary role of an Equities Trader is to buy and sell stocks or exchange-traded funds (ETFs) to achieve specific investment objectives, such as capital appreciation or income generation.

What skills and qualifications are typically required to become an Equities Trader?

Equities Traders typically need a bachelor’s degree in finance, accounting, economics, or a related field. They should also have strong analytical, problem-solving, and communication skills, as well as a deep understanding of financial markets and trading strategies.

What is the career path for an Equities Trader?

Equities Traders can advance to positions such as Portfolio Manager, Hedge Fund Manager, or Chief Investment Officer. They may also move into research or sales roles within the financial industry.

What are the challenges faced by Equities Traders?

Equities Traders face the challenge of constantly monitoring market conditions and making quick decisions in a fast-paced environment. They must also manage risk effectively and adhere to regulatory requirements.

What are the rewards for working as an Equities Trader?

Equities Traders can earn high salaries and bonuses based on their performance. They also have the opportunity to work in a dynamic and challenging environment.

How can I prepare for a career as an Equities Trader?

To prepare for a career as an Equities Trader, you should develop a solid understanding of financial markets, trading strategies, and risk management. You should also practice using trading platforms and data analysis tools.

What are the top companies that hire Equities Traders?

Top companies that hire Equities Traders include Goldman Sachs, Jane Street, Citadel, and Renaissance Technologies.

What are the key responsibilities of an Equities Trader?

Key responsibilities of an Equities Trader include executing trades, managing portfolios, conducting research, and providing investment advice. They must also stay up-to-date on market trends and regulatory changes.