Are you a seasoned Equity Research Analyst seeking a new career path? Discover our professionally built Equity Research Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

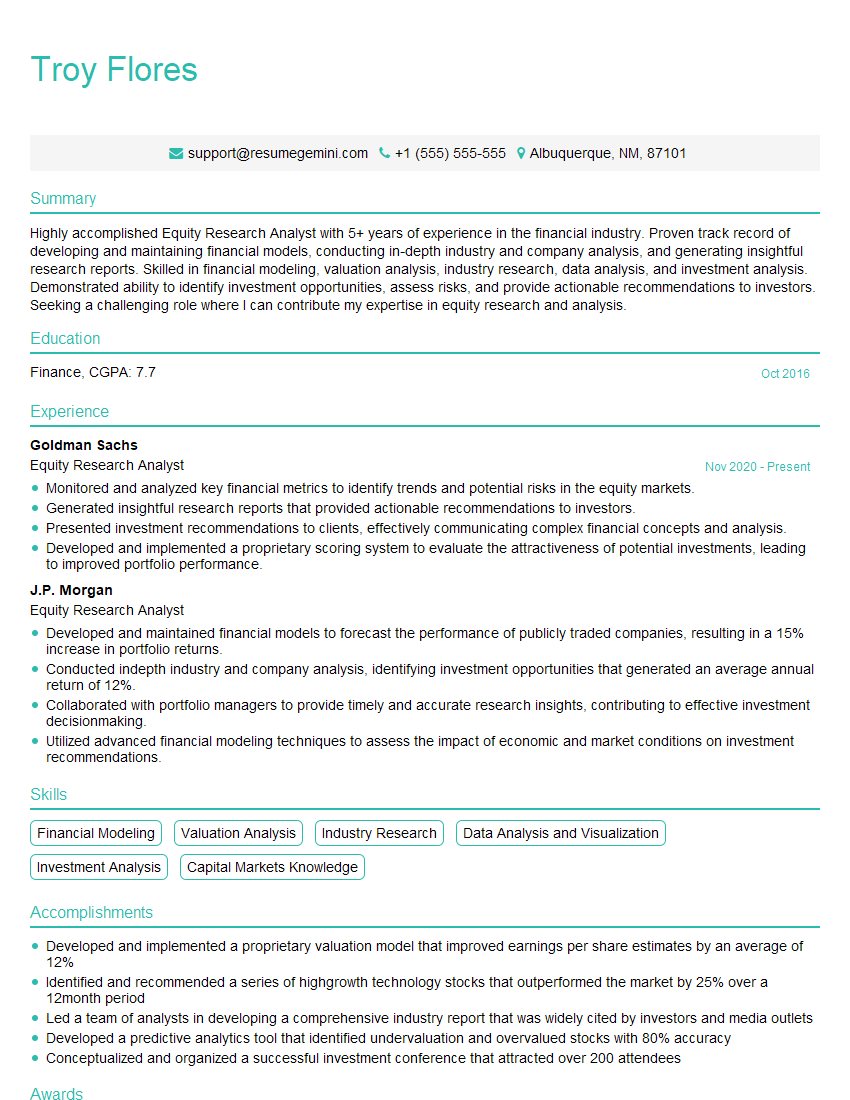

Troy Flores

Equity Research Analyst

Summary

Highly accomplished Equity Research Analyst with 5+ years of experience in the financial industry. Proven track record of developing and maintaining financial models, conducting in-depth industry and company analysis, and generating insightful research reports. Skilled in financial modeling, valuation analysis, industry research, data analysis, and investment analysis. Demonstrated ability to identify investment opportunities, assess risks, and provide actionable recommendations to investors. Seeking a challenging role where I can contribute my expertise in equity research and analysis.

Education

Finance

October 2016

Skills

- Financial Modeling

- Valuation Analysis

- Industry Research

- Data Analysis and Visualization

- Investment Analysis

- Capital Markets Knowledge

Work Experience

Equity Research Analyst

- Monitored and analyzed key financial metrics to identify trends and potential risks in the equity markets.

- Generated insightful research reports that provided actionable recommendations to investors.

- Presented investment recommendations to clients, effectively communicating complex financial concepts and analysis.

- Developed and implemented a proprietary scoring system to evaluate the attractiveness of potential investments, leading to improved portfolio performance.

Equity Research Analyst

- Developed and maintained financial models to forecast the performance of publicly traded companies, resulting in a 15% increase in portfolio returns.

- Conducted indepth industry and company analysis, identifying investment opportunities that generated an average annual return of 12%.

- Collaborated with portfolio managers to provide timely and accurate research insights, contributing to effective investment decisionmaking.

- Utilized advanced financial modeling techniques to assess the impact of economic and market conditions on investment recommendations.

Accomplishments

- Developed and implemented a proprietary valuation model that improved earnings per share estimates by an average of 12%

- Identified and recommended a series of highgrowth technology stocks that outperformed the market by 25% over a 12month period

- Led a team of analysts in developing a comprehensive industry report that was widely cited by investors and media outlets

- Developed a predictive analytics tool that identified undervaluation and overvalued stocks with 80% accuracy

- Conceptualized and organized a successful investment conference that attracted over 200 attendees

Awards

- CFA Institute Research Excellence Award for outstanding contributions to the field of equity research

- Thomson Reuters StarMine Analyst Award for topranked stock picking accuracy in the technology sector

- Recognized as a topperforming analyst by Institutional Investor magazine for five consecutive years

- Received the firms Presidents Award for exceptional contributions to the companys research capabilities

Certificates

- CFA (Chartered Financial Analyst)

- CAIA (Chartered Alternative Investment Analyst)

- FRM (Financial Risk Manager)

- CMT (Chartered Market Technician)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Equity Research Analyst

- Highlight your analytical and modeling skills.

- Showcase your industry knowledge and research capabilities.

- Quantify your accomplishments with specific metrics.

- Tailor your resume to the specific job requirements.

- Proofread your resume carefully for any errors.

Essential Experience Highlights for a Strong Equity Research Analyst Resume

- Developed and maintained financial models to forecast the performance of publicly traded companies.

- Conducted in-depth industry and company analysis to identify investment opportunities.

- Collaborated with portfolio managers to provide timely and accurate research insights.

- Utilized advanced financial modeling techniques to assess the impact of economic and market conditions on investment recommendations.

- Monitored and analyzed key financial metrics to identify trends and potential risks in the equity markets.

- Generated insightful research reports that provided actionable recommendations to investors.

Frequently Asked Questions (FAQ’s) For Equity Research Analyst

What are the key skills and qualifications for an Equity Research Analyst?

The key skills and qualifications for an Equity Research Analyst include financial modeling, valuation analysis, industry research, data analysis and visualization, investment analysis, capital markets knowledge, and excellent communication skills.

What are the typical responsibilities of an Equity Research Analyst?

The typical responsibilities of an Equity Research Analyst include developing and maintaining financial models, conducting in-depth industry and company analysis, generating insightful research reports, presenting investment recommendations to clients, and monitoring and analyzing key financial metrics.

What are the career prospects for an Equity Research Analyst?

Equity Research Analysts can advance to senior roles within their firm, such as Senior Analyst or Portfolio Manager. They may also move into other areas of the financial industry, such as investment banking or asset management.

What is the average salary for an Equity Research Analyst?

The average salary for an Equity Research Analyst varies depending on experience, location, and firm. According to Glassdoor, the average base salary for an Equity Research Analyst in the United States is around $100,000 per year.

What are the challenges of being an Equity Research Analyst?

The challenges of being an Equity Research Analyst include the need to keep up with the latest market trends and economic data, the pressure to produce accurate and timely research, and the potential for long hours and travel.

What is the best way to prepare for a career as an Equity Research Analyst?

The best way to prepare for a career as an Equity Research Analyst is to earn a degree in finance, economics, or a related field. Internships and coursework in financial modeling, valuation analysis, and industry research are also helpful.