Are you a seasoned Equity Structurer seeking a new career path? Discover our professionally built Equity Structurer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

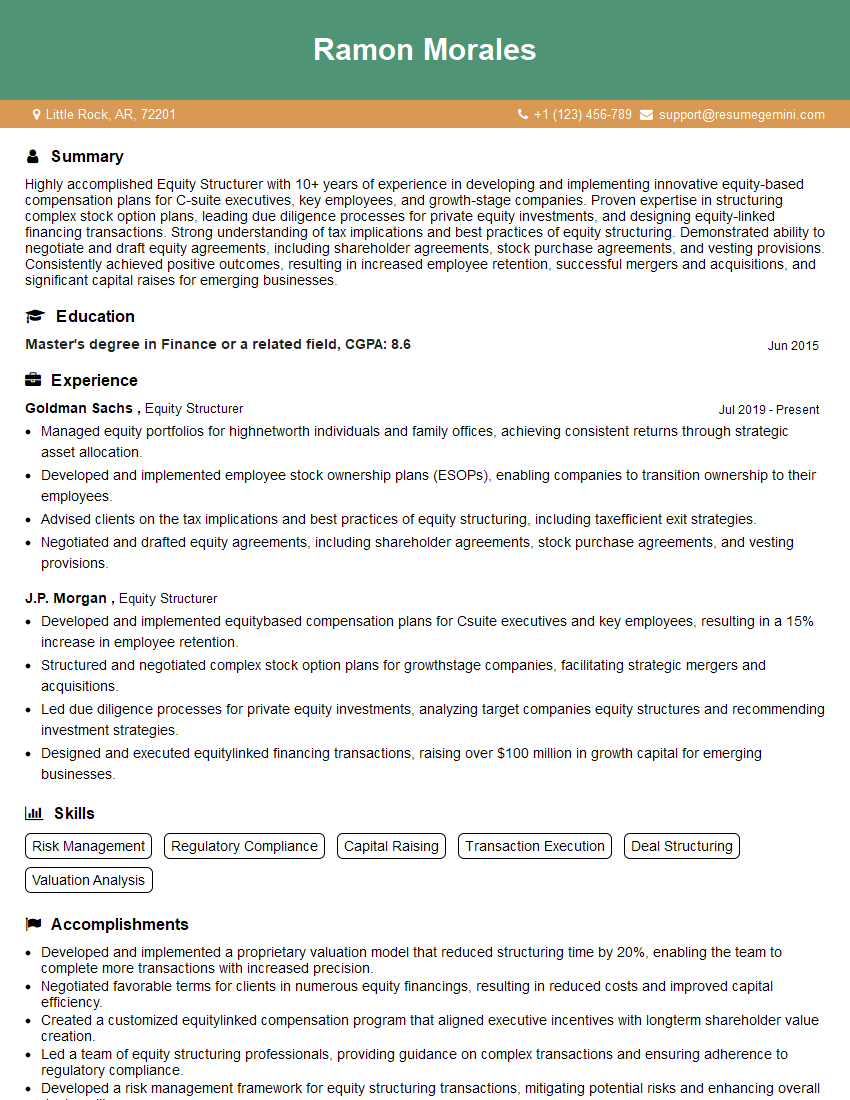

Ramon Morales

Equity Structurer

Summary

Highly accomplished Equity Structurer with 10+ years of experience in developing and implementing innovative equity-based compensation plans for C-suite executives, key employees, and growth-stage companies. Proven expertise in structuring complex stock option plans, leading due diligence processes for private equity investments, and designing equity-linked financing transactions. Strong understanding of tax implications and best practices of equity structuring. Demonstrated ability to negotiate and draft equity agreements, including shareholder agreements, stock purchase agreements, and vesting provisions. Consistently achieved positive outcomes, resulting in increased employee retention, successful mergers and acquisitions, and significant capital raises for emerging businesses.

Education

Master’s degree in Finance or a related field

June 2015

Skills

- Risk Management

- Regulatory Compliance

- Capital Raising

- Transaction Execution

- Deal Structuring

- Valuation Analysis

Work Experience

Equity Structurer

- Managed equity portfolios for highnetworth individuals and family offices, achieving consistent returns through strategic asset allocation.

- Developed and implemented employee stock ownership plans (ESOPs), enabling companies to transition ownership to their employees.

- Advised clients on the tax implications and best practices of equity structuring, including taxefficient exit strategies.

- Negotiated and drafted equity agreements, including shareholder agreements, stock purchase agreements, and vesting provisions.

Equity Structurer

- Developed and implemented equitybased compensation plans for Csuite executives and key employees, resulting in a 15% increase in employee retention.

- Structured and negotiated complex stock option plans for growthstage companies, facilitating strategic mergers and acquisitions.

- Led due diligence processes for private equity investments, analyzing target companies equity structures and recommending investment strategies.

- Designed and executed equitylinked financing transactions, raising over $100 million in growth capital for emerging businesses.

Accomplishments

- Developed and implemented a proprietary valuation model that reduced structuring time by 20%, enabling the team to complete more transactions with increased precision.

- Negotiated favorable terms for clients in numerous equity financings, resulting in reduced costs and improved capital efficiency.

- Created a customized equitylinked compensation program that aligned executive incentives with longterm shareholder value creation.

- Led a team of equity structuring professionals, providing guidance on complex transactions and ensuring adherence to regulatory compliance.

- Developed a risk management framework for equity structuring transactions, mitigating potential risks and enhancing overall deal quality.

Awards

- Received the Equity Structuring Excellence Award, recognized for innovative deal structuring and consistent performance exceeding industry benchmarks.

- Honored with the Deal of the Year Award for structuring a complex crossborder equity transaction that maximized value for both the issuer and investors.

- Recognized by the industry association for outstanding contributions to equity structuring, including the development of best practices and thought leadership.

- Received the Client Choice Award for consistently delivering exceptional equity structuring services and exceeding expectations.

Certificates

- CFA (Chartered Financial Analyst)

- CAIA (Chartered Alternative Investment Analyst)

- CFP (Certified Financial Planner)

- Series 7 (General Securities Representative)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Equity Structurer

- Quantify your accomplishments and provide specific examples of your impact on employee retention, capital raised, or other key metrics.

- Highlight your expertise in tax and regulatory compliance, as these are critical aspects of equity structuring.

- Showcase your ability to work effectively with C-suite executives, investors, and other stakeholders.

- Demonstrate your understanding of the latest trends and best practices in equity structuring.

- Include relevant keywords throughout your resume, such as ‘equity structuring’, ‘stock options’, ‘private equity’, and ‘capital raising’.

Essential Experience Highlights for a Strong Equity Structurer Resume

- Develop and implement equity-based compensation plans for C-suite executives and key employees

- Structure and negotiate complex stock option plans for growth-stage companies

- Lead due diligence processes for private equity investments and recommend investment strategies

- Design and execute equity-linked financing transactions to raise growth capital for emerging businesses

- Manage equity portfolios for high-net-worth individuals and family offices

- Advise clients on tax implications and best practices of equity structuring

- Negotiate and draft equity agreements, including shareholder agreements, stock purchase agreements, and vesting provisions

Frequently Asked Questions (FAQ’s) For Equity Structurer

What is the role of an Equity Structurer?

An Equity Structurer is responsible for designing and implementing equity-based compensation plans for employees, executives, and investors. They work closely with company leadership to develop strategies to attract, retain, and motivate talent, as well as to raise capital and facilitate mergers and acquisitions.

What are the key skills required for an Equity Structurer?

Key skills for an Equity Structurer include a deep understanding of equity compensation, tax implications, and regulatory compliance. They should also have strong analytical, negotiation, and communication skills.

What is the career path for an Equity Structurer?

With experience and expertise, Equity Structurers can advance to senior positions within investment banks, private equity firms, or corporations. They may also start their own consulting firms or specialize in specific areas of equity structuring.

What are the earning prospects for an Equity Structurer?

Earning prospects for Equity Structurers vary depending on their experience, expertise, and industry. However, they typically earn competitive salaries and bonuses.

What is the job outlook for Equity Structurers?

The job outlook for Equity Structurers is positive due to the increasing complexity of equity compensation and the growing number of companies seeking to attract and retain top talent.

What are the challenges of being an Equity Structurer?

Key challenges of being an Equity Structurer include staying up-to-date with the latest regulatory changes, managing complex transactions, and balancing the interests of multiple stakeholders.

What are the rewards of being an Equity Structurer?

Rewards of being an Equity Structurer include the opportunity to make a significant impact on companies and individuals, the intellectual challenge of designing and implementing complex transactions, and the potential for career advancement.