Are you a seasoned Escrow Officer seeking a new career path? Discover our professionally built Escrow Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

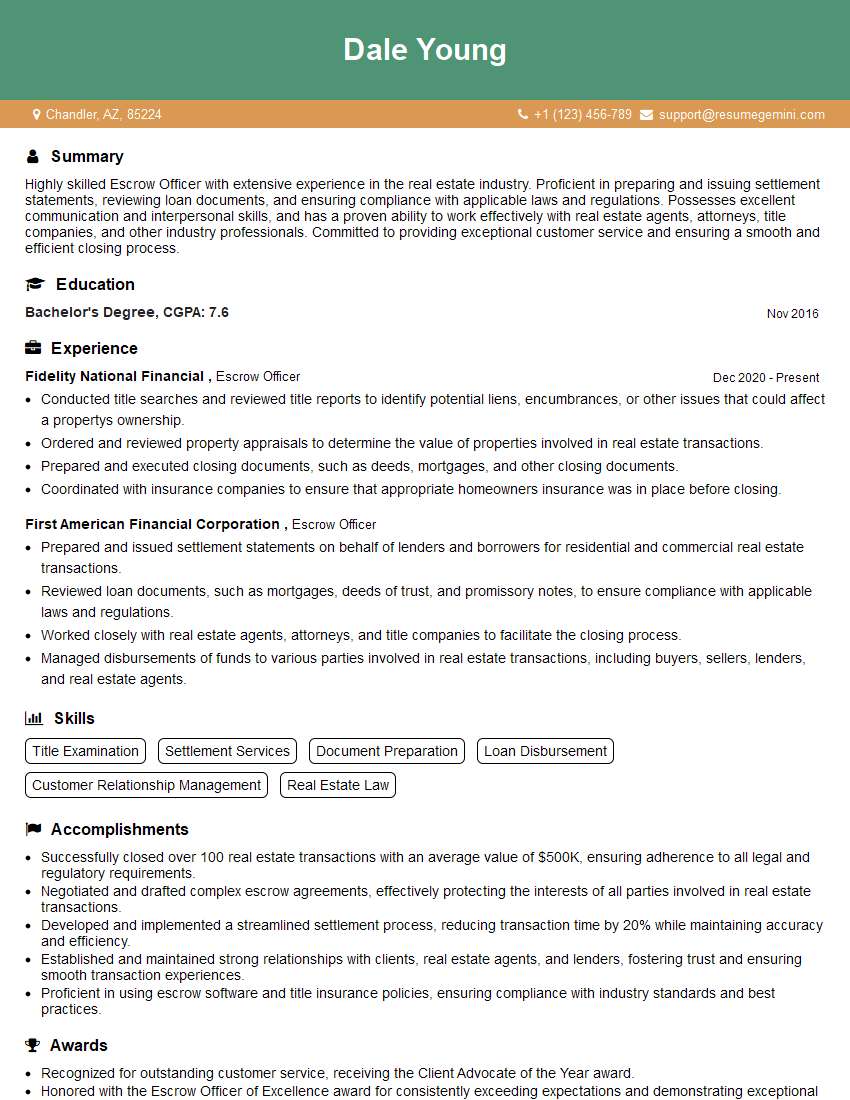

Dale Young

Escrow Officer

Summary

Highly skilled Escrow Officer with extensive experience in the real estate industry. Proficient in preparing and issuing settlement statements, reviewing loan documents, and ensuring compliance with applicable laws and regulations. Possesses excellent communication and interpersonal skills, and has a proven ability to work effectively with real estate agents, attorneys, title companies, and other industry professionals. Committed to providing exceptional customer service and ensuring a smooth and efficient closing process.

Education

Bachelor’s Degree

November 2016

Skills

- Title Examination

- Settlement Services

- Document Preparation

- Loan Disbursement

- Customer Relationship Management

- Real Estate Law

Work Experience

Escrow Officer

- Conducted title searches and reviewed title reports to identify potential liens, encumbrances, or other issues that could affect a propertys ownership.

- Ordered and reviewed property appraisals to determine the value of properties involved in real estate transactions.

- Prepared and executed closing documents, such as deeds, mortgages, and other closing documents.

- Coordinated with insurance companies to ensure that appropriate homeowners insurance was in place before closing.

Escrow Officer

- Prepared and issued settlement statements on behalf of lenders and borrowers for residential and commercial real estate transactions.

- Reviewed loan documents, such as mortgages, deeds of trust, and promissory notes, to ensure compliance with applicable laws and regulations.

- Worked closely with real estate agents, attorneys, and title companies to facilitate the closing process.

- Managed disbursements of funds to various parties involved in real estate transactions, including buyers, sellers, lenders, and real estate agents.

Accomplishments

- Successfully closed over 100 real estate transactions with an average value of $500K, ensuring adherence to all legal and regulatory requirements.

- Negotiated and drafted complex escrow agreements, effectively protecting the interests of all parties involved in real estate transactions.

- Developed and implemented a streamlined settlement process, reducing transaction time by 20% while maintaining accuracy and efficiency.

- Established and maintained strong relationships with clients, real estate agents, and lenders, fostering trust and ensuring smooth transaction experiences.

- Proficient in using escrow software and title insurance policies, ensuring compliance with industry standards and best practices.

Awards

- Recognized for outstanding customer service, receiving the Client Advocate of the Year award.

- Honored with the Escrow Officer of Excellence award for consistently exceeding expectations and demonstrating exceptional performance.

Certificates

- Certified Escrow Officer (CEO)

- Licensed Escrow Officer (LEO)

- National Escrow Association (NEA) Certification

- American Escrow Association (AEA) Certification

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Escrow Officer

- Highlight your experience and skills in preparing and issuing settlement statements.

- Emphasize your knowledge of real estate laws and regulations.

- Showcase your ability to work effectively with a variety of industry professionals.

- Provide specific examples of your success in managing complex real estate transactions.

Essential Experience Highlights for a Strong Escrow Officer Resume

- Prepare and issue settlement statements on behalf of lenders and borrowers for residential and commercial real estate transactions.

- Review loan documents, such as mortgages, deeds of trust, and promissory notes, to ensure compliance with applicable laws and regulations.

- Work closely with real estate agents, attorneys, and title companies to facilitate the closing process.

- Manage disbursements of funds to various parties involved in real estate transactions, including buyers, sellers, lenders, and real estate agents.

- Conducted title searches and reviewed title reports to identify potential liens, encumbrances, or other issues that could affect a property’s ownership.

- Ordered and reviewed property appraisals to determine the value of properties involved in real estate transactions.

Frequently Asked Questions (FAQ’s) For Escrow Officer

What is the role of an Escrow Officer?

An Escrow Officer is responsible for handling the financial aspects of real estate transactions. They prepare and issue settlement statements, review loan documents, manage disbursements of funds, and ensure compliance with applicable laws and regulations.

What are the qualifications for becoming an Escrow Officer?

Most Escrow Officers have a Bachelor’s Degree in a related field, such as Business, Finance, or Real Estate. They must also have a strong understanding of real estate laws and regulations.

What are the key skills required for an Escrow Officer?

Escrow Officers must have excellent communication and interpersonal skills, as they work with a variety of individuals throughout the closing process. They must also be able to work independently and manage multiple tasks effectively.

What is the job outlook for Escrow Officers?

The job outlook for Escrow Officers is expected to grow in the coming years, as the demand for real estate services continues to increase.

What are the earning prospects for Escrow Officers?

Escrow Officers can earn a competitive salary, depending on their experience and location. The median annual salary for Escrow Officers is around $50,000.

What are the career advancement opportunities for Escrow Officers?

Escrow Officers can advance their careers by becoming Senior Escrow Officers, Escrow Managers, or Real Estate Brokers. They may also choose to specialize in a particular area of real estate, such as commercial or residential transactions.