Are you a seasoned Estate Planner seeking a new career path? Discover our professionally built Estate Planner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

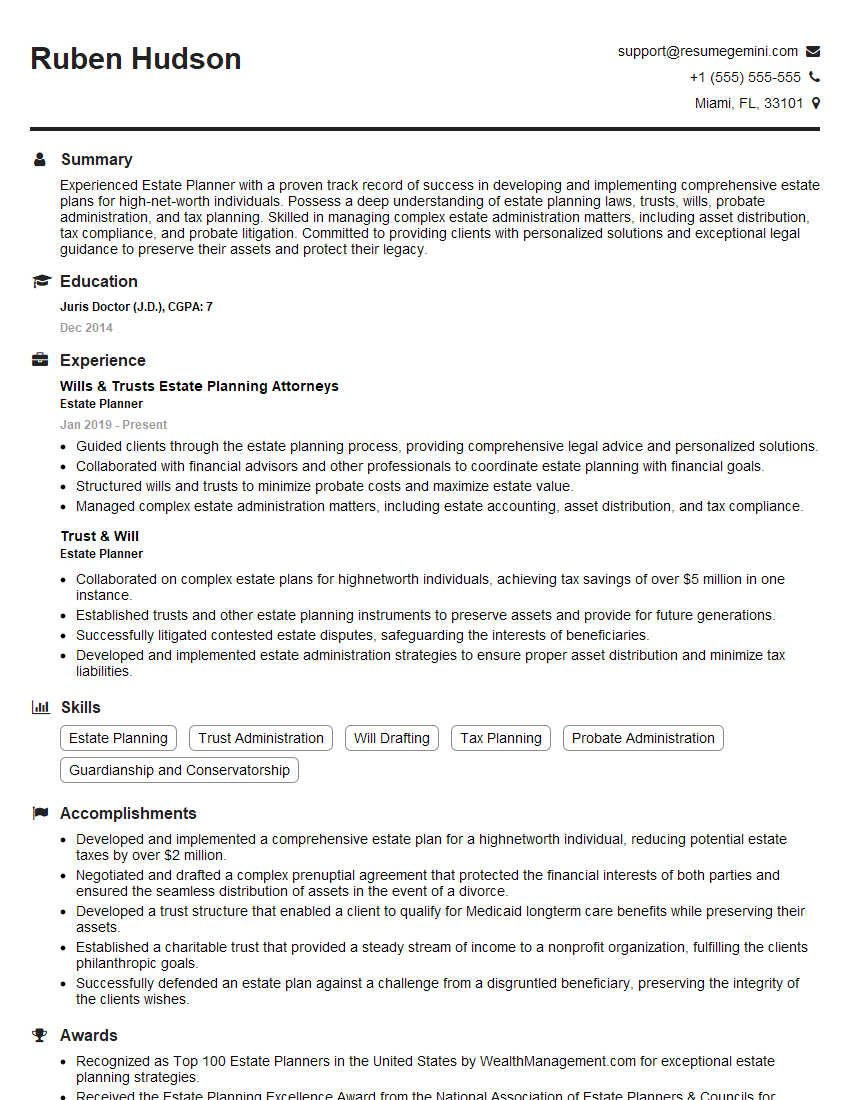

Ruben Hudson

Estate Planner

Summary

Experienced Estate Planner with a proven track record of success in developing and implementing comprehensive estate plans for high-net-worth individuals. Possess a deep understanding of estate planning laws, trusts, wills, probate administration, and tax planning. Skilled in managing complex estate administration matters, including asset distribution, tax compliance, and probate litigation. Committed to providing clients with personalized solutions and exceptional legal guidance to preserve their assets and protect their legacy.

Education

Juris Doctor (J.D.)

December 2014

Skills

- Estate Planning

- Trust Administration

- Will Drafting

- Tax Planning

- Probate Administration

- Guardianship and Conservatorship

Work Experience

Estate Planner

- Guided clients through the estate planning process, providing comprehensive legal advice and personalized solutions.

- Collaborated with financial advisors and other professionals to coordinate estate planning with financial goals.

- Structured wills and trusts to minimize probate costs and maximize estate value.

- Managed complex estate administration matters, including estate accounting, asset distribution, and tax compliance.

Estate Planner

- Collaborated on complex estate plans for highnetworth individuals, achieving tax savings of over $5 million in one instance.

- Established trusts and other estate planning instruments to preserve assets and provide for future generations.

- Successfully litigated contested estate disputes, safeguarding the interests of beneficiaries.

- Developed and implemented estate administration strategies to ensure proper asset distribution and minimize tax liabilities.

Accomplishments

- Developed and implemented a comprehensive estate plan for a highnetworth individual, reducing potential estate taxes by over $2 million.

- Negotiated and drafted a complex prenuptial agreement that protected the financial interests of both parties and ensured the seamless distribution of assets in the event of a divorce.

- Developed a trust structure that enabled a client to qualify for Medicaid longterm care benefits while preserving their assets.

- Established a charitable trust that provided a steady stream of income to a nonprofit organization, fulfilling the clients philanthropic goals.

- Successfully defended an estate plan against a challenge from a disgruntled beneficiary, preserving the integrity of the clients wishes.

Awards

- Recognized as Top 100 Estate Planners in the United States by WealthManagement.com for exceptional estate planning strategies.

- Received the Estate Planning Excellence Award from the National Association of Estate Planners & Councils for innovative approaches to estate planning.

- Recognized as a Fellow of the American College of Trust and Estate Counsel for outstanding contributions to the field of estate planning.

- Received the Estate Planning Leadership Award from the American Bar Association for mentorship and guidance to young estate planning professionals.

Certificates

- Certified Public Accountant (CPA)

- Certified Financial Planner (CFP)

- Accredited Estate Planner (AEP)

- Certified Trust and Financial Advisor (CTFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Estate Planner

- Quantify your accomplishments with specific numbers and metrics whenever possible.

- Highlight your knowledge of estate planning laws and regulations.

- Showcase your ability to communicate complex legal concepts clearly and effectively.

- Emphasize your commitment to providing personalized and compassionate client service.

Essential Experience Highlights for a Strong Estate Planner Resume

- Collaborate with clients to understand their estate planning goals and objectives.

- Develop and implement tailored estate plans that minimize tax liabilities and preserve assets.

- Draft and review wills, trusts, and other estate planning documents.

- Guide clients through the probate process, ensuring proper asset distribution and minimizing delays.

- Represent clients in estate litigation matters, protecting their interests and resolving disputes.

- Stay abreast of changes in estate planning laws and regulations to provide clients with up-to-date advice.

- Collaborate with financial advisors and other professionals to coordinate estate planning with financial goals.

Frequently Asked Questions (FAQ’s) For Estate Planner

What is the role of an Estate Planner?

An Estate Planner helps individuals and families create plans to manage and distribute their assets after death. They work with clients to understand their goals and objectives, and develop tailored plans that minimize tax liabilities and preserve assets.

What are the benefits of estate planning?

Estate planning can provide numerous benefits, including reducing estate taxes, probate costs, and family disputes. It can also ensure that your assets are distributed according to your wishes and that your loved ones are provided for after your death.

What are the different types of estate planning documents?

Common estate planning documents include wills, trusts, powers of attorney, and health care directives. Each document serves a specific purpose and can be tailored to meet your individual needs.

How do I choose an Estate Planner?

When choosing an Estate Planner, it is important to consider their experience, qualifications, and fees. You should also look for someone you feel comfortable with and who you can trust to provide sound advice.

What are the common estate planning mistakes?

Some common estate planning mistakes include failing to create a will, not updating your estate plan regularly, and not considering the tax implications of your estate plan.

How can I get started with estate planning?

To get started with estate planning, you should first consider your goals and objectives. Then, you can consult with an Estate Planner to discuss your options and develop a plan that meets your needs.

What are the key considerations when drafting a will?

When drafting a will, it is important to consider who you want to inherit your assets, who you want to appoint as your executor, and how you want your assets to be distributed. You should also consider any special circumstances, such as if you have minor children or if you own a business.

What are the benefits of a trust?

Trusts can provide a number of benefits, including avoiding probate, reducing estate taxes, and protecting your assets from creditors. Trusts can also be used to manage assets for minors or individuals with disabilities.