Are you a seasoned Examiner of Currency seeking a new career path? Discover our professionally built Examiner of Currency Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

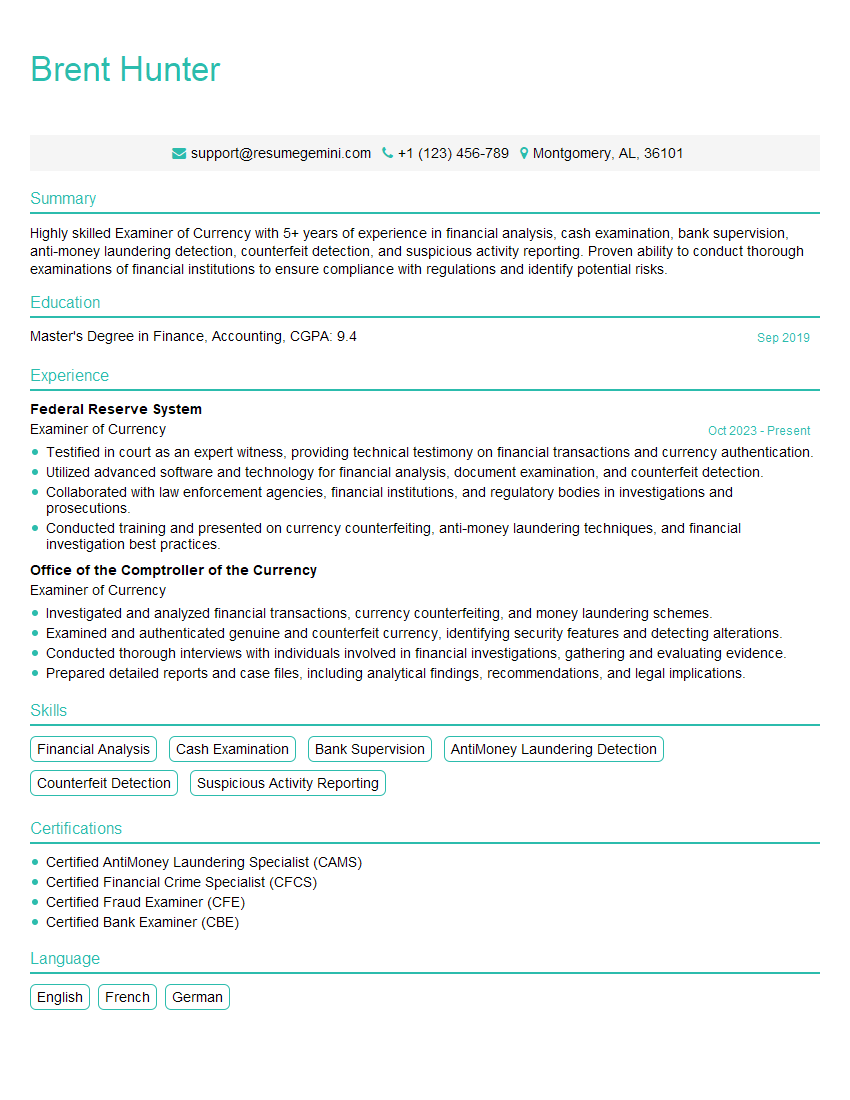

Brent Hunter

Examiner of Currency

Summary

Highly skilled Examiner of Currency with 5+ years of experience in financial analysis, cash examination, bank supervision, anti-money laundering detection, counterfeit detection, and suspicious activity reporting. Proven ability to conduct thorough examinations of financial institutions to ensure compliance with regulations and identify potential risks.

Education

Master’s Degree in Finance, Accounting

September 2019

Skills

- Financial Analysis

- Cash Examination

- Bank Supervision

- AntiMoney Laundering Detection

- Counterfeit Detection

- Suspicious Activity Reporting

Work Experience

Examiner of Currency

- Testified in court as an expert witness, providing technical testimony on financial transactions and currency authentication.

- Utilized advanced software and technology for financial analysis, document examination, and counterfeit detection.

- Collaborated with law enforcement agencies, financial institutions, and regulatory bodies in investigations and prosecutions.

- Conducted training and presented on currency counterfeiting, anti-money laundering techniques, and financial investigation best practices.

Examiner of Currency

- Investigated and analyzed financial transactions, currency counterfeiting, and money laundering schemes.

- Examined and authenticated genuine and counterfeit currency, identifying security features and detecting alterations.

- Conducted thorough interviews with individuals involved in financial investigations, gathering and evaluating evidence.

- Prepared detailed reports and case files, including analytical findings, recommendations, and legal implications.

Certificates

- Certified AntiMoney Laundering Specialist (CAMS)

- Certified Financial Crime Specialist (CFCS)

- Certified Fraud Examiner (CFE)

- Certified Bank Examiner (CBE)

Languages

- English

- French

- German

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Examiner of Currency

- Highlight your experience in financial analysis, bank supervision, and anti-money laundering detection.

- Showcase your knowledge of regulatory compliance and best practices in the banking industry.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Proofread your resume carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Examiner of Currency Resume

- Examine financial institutions to ensure compliance with regulatory requirements

- Evaluate the safety and soundness of financial institutions through financial analysis and cash examination

- Identify and mitigate risks associated with money laundering and other illegal activities

- Detect and investigate counterfeit currency and other fraudulent instruments

- Prepare and present findings to senior management and law enforcement agencies

- Stay up-to-date on the latest regulatory changes and best practices in banking and financial regulation

Frequently Asked Questions (FAQ’s) For Examiner of Currency

What is the role of an Examiner of Currency?

An Examiner of Currency is responsible for examining financial institutions to ensure compliance with regulatory requirements, identifying and mitigating risks, detecting and investigating counterfeit currency, and preparing and presenting findings to senior management and law enforcement agencies.

What are the qualifications for becoming an Examiner of Currency?

A Master’s Degree in Finance, Accounting, or a related field, along with experience in financial analysis, bank supervision, and anti-money laundering detection.

What are the key skills required for an Examiner of Currency?

Financial analysis, cash examination, bank supervision, anti-money laundering detection, counterfeit detection, and suspicious activity reporting.

What is the job outlook for Examiners of Currency?

The job outlook for Examiners of Currency is expected to be good over the next few years, as financial institutions continue to face increasing regulatory scrutiny.

What is the average salary for an Examiner of Currency?

The average salary for an Examiner of Currency is around $75,000 per year, depending on experience and location.

What are the benefits of being an Examiner of Currency?

Examiners of Currency enjoy a competitive salary and benefits package, opportunities for career advancement, and the satisfaction of knowing that they are making a difference in the financial system.