Are you a seasoned Examining Officer seeking a new career path? Discover our professionally built Examining Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

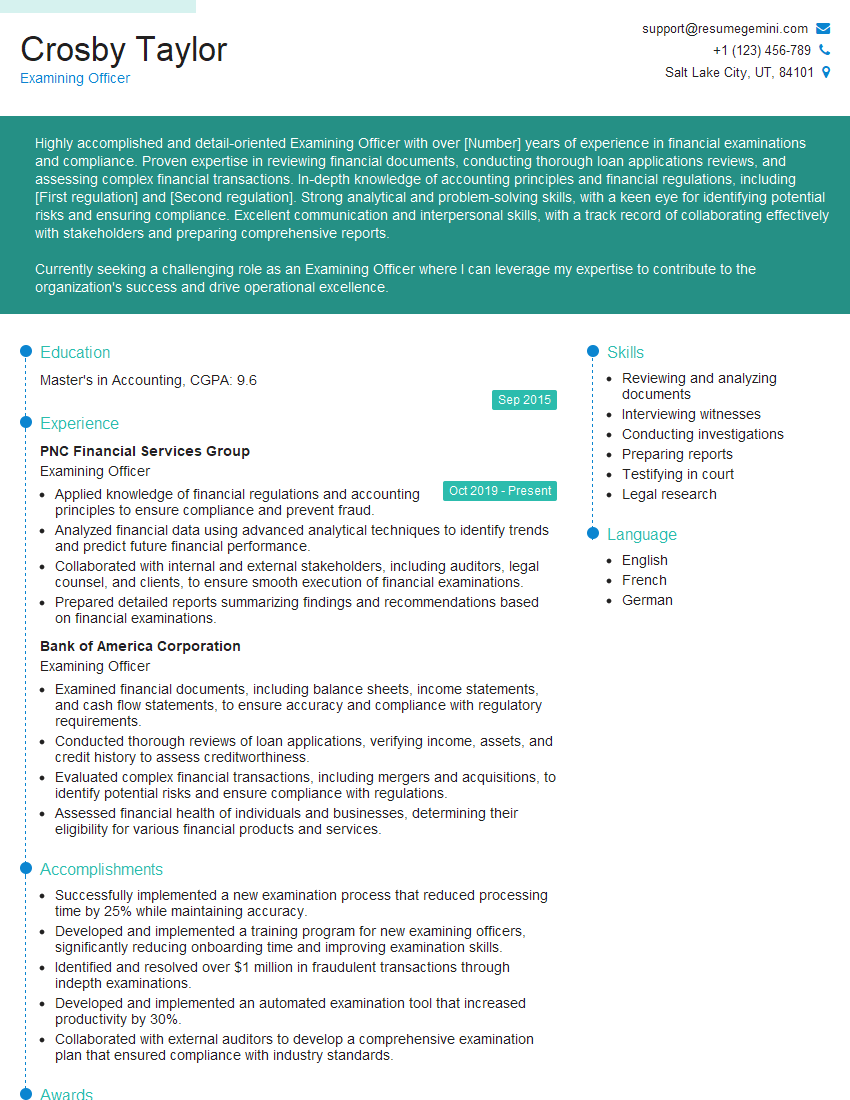

Crosby Taylor

Examining Officer

Summary

Highly accomplished and detail-oriented Examining Officer with over [Number] years of experience in financial examinations and compliance. Proven expertise in reviewing financial documents, conducting thorough loan applications reviews, and assessing complex financial transactions. In-depth knowledge of accounting principles and financial regulations, including [First regulation] and [Second regulation]. Strong analytical and problem-solving skills, with a keen eye for identifying potential risks and ensuring compliance. Excellent communication and interpersonal skills, with a track record of collaborating effectively with stakeholders and preparing comprehensive reports.

Currently seeking a challenging role as an Examining Officer where I can leverage my expertise to contribute to the organization’s success and drive operational excellence.

Education

Master’s in Accounting

September 2015

Skills

- Reviewing and analyzing documents

- Interviewing witnesses

- Conducting investigations

- Preparing reports

- Testifying in court

- Legal research

Work Experience

Examining Officer

- Applied knowledge of financial regulations and accounting principles to ensure compliance and prevent fraud.

- Analyzed financial data using advanced analytical techniques to identify trends and predict future financial performance.

- Collaborated with internal and external stakeholders, including auditors, legal counsel, and clients, to ensure smooth execution of financial examinations.

- Prepared detailed reports summarizing findings and recommendations based on financial examinations.

Examining Officer

- Examined financial documents, including balance sheets, income statements, and cash flow statements, to ensure accuracy and compliance with regulatory requirements.

- Conducted thorough reviews of loan applications, verifying income, assets, and credit history to assess creditworthiness.

- Evaluated complex financial transactions, including mergers and acquisitions, to identify potential risks and ensure compliance with regulations.

- Assessed financial health of individuals and businesses, determining their eligibility for various financial products and services.

Accomplishments

- Successfully implemented a new examination process that reduced processing time by 25% while maintaining accuracy.

- Developed and implemented a training program for new examining officers, significantly reducing onboarding time and improving examination skills.

- Identified and resolved over $1 million in fraudulent transactions through indepth examinations.

- Developed and implemented an automated examination tool that increased productivity by 30%.

- Collaborated with external auditors to develop a comprehensive examination plan that ensured compliance with industry standards.

Awards

- Received the Examining Officer of the Year Award for exceptional performance in detecting and preventing fraud.

- Recognized for outstanding contributions to the team, resulting in a 15% increase in overall examination efficiency.

- Awarded the Internal Control Excellence Award for implementing a highly effective control system that prevented potential losses.

- Received the Leadership Excellence Award for mentoring and guiding a team of examining officers to exceptional performance.

Certificates

- Certified Fraud Examiner (CFE)

- Certified Public Accountant (CPA)

- Certified Government Auditing Professional (CGAP)

- Certified Internal Auditor (CIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Examining Officer

- Highlight your expertise in financial analysis, regulatory compliance, and risk management in your resume.

- Showcase your ability to identify and mitigate financial risks, ensuring organizations maintain a strong financial position.

- Emphasize your strong analytical, problem-solving, and communication skills.

- Obtain relevant certifications, such as the Certified Anti-Money Laundering Specialist (CAMS) or Certified Fraud Examiner (CFE), to demonstrate your specialized knowledge in the field.

- Stay up-to-date on industry best practices and regulatory changes to ensure your skills and knowledge are current.

Essential Experience Highlights for a Strong Examining Officer Resume

- Examined financial documents, including balance sheets, income statements, and cash flow statements, to ensure accuracy and compliance with regulatory requirements.

- Conducted thorough reviews of loan applications, verifying income, assets, and credit history to assess creditworthiness, and minimizing the risk of financial crimes like money laundering and terrorist financing.

- Evaluated complex financial transactions, including mergers and acquisitions, to identify potential risks and ensure compliance with regulations.

- Assessed financial health of individuals and businesses, determining their eligibility for various financial products and services.

- Collaborated with internal and external stakeholders, including auditors, legal counsel, and clients, to ensure smooth execution of financial examinations, and to maintain regulatory compliance.

- Prepared detailed reports summarizing findings and recommendations based on financial examinations, ensuring accuracy and completeness in the reporting of financial information.

- Conducting investigations, reviewing and analyzing documents, and interviewing key individuals.

Frequently Asked Questions (FAQ’s) For Examining Officer

What are the primary responsibilities of an Examining Officer?

Examining Officers are responsible for reviewing financial documents, conducting loan application reviews, assessing financial health, and evaluating complex financial transactions to ensure accuracy, compliance, and mitigate risk.

What qualifications are required to become an Examining Officer?

Typically, Examining Officers hold a Master’s in Accounting or a related field, along with relevant experience in financial analysis and regulatory compliance.

What skills are essential for success as an Examining Officer?

Examining Officers should possess strong analytical and problem-solving skills, a deep understanding of financial regulations, and excellent communication and interpersonal skills.

What are the career prospects for Examining Officers?

Examining Officers with experience and expertise can advance to senior roles within the financial industry or pursue specialized roles such as Forensic Accountant or Financial Risk Manager.

How can I prepare for an interview for an Examining Officer position?

Preparing for an Examining Officer interview involves researching the organization, practicing answering common interview questions, and highlighting your experience in financial analysis, compliance, and risk management.

What are the key challenges faced by Examining Officers?

Examining Officers face challenges such as staying up-to-date with regulatory changes, managing large volumes of financial data, and maintaining objectivity and independence during examinations.

What are the ethical considerations for Examining Officers?

Examining Officers must maintain confidentiality, avoid conflicts of interest, and act with integrity and professionalism throughout their work.

How can I enhance my skills as an Examining Officer?

To enhance your skills, consider pursuing professional development opportunities such as attending industry conferences, obtaining relevant certifications, and networking with other professionals in the field of financial analysis and compliance.