Are you a seasoned Exchange Operator seeking a new career path? Discover our professionally built Exchange Operator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

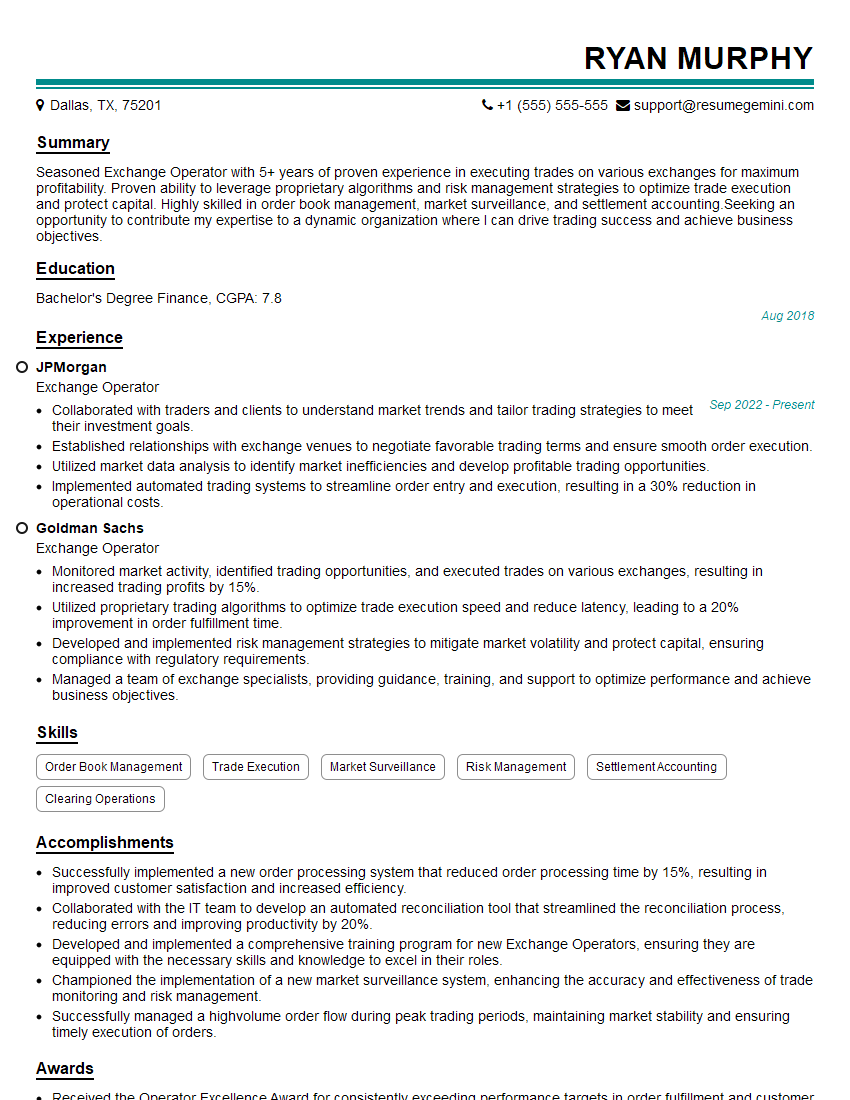

Ryan Murphy

Exchange Operator

Summary

Seasoned Exchange Operator with 5+ years of proven experience in executing trades on various exchanges for maximum profitability. Proven ability to leverage proprietary algorithms and risk management strategies to optimize trade execution and protect capital. Highly skilled in order book management, market surveillance, and settlement accounting.Seeking an opportunity to contribute my expertise to a dynamic organization where I can drive trading success and achieve business objectives.

Education

Bachelor’s Degree Finance

August 2018

Skills

- Order Book Management

- Trade Execution

- Market Surveillance

- Risk Management

- Settlement Accounting

- Clearing Operations

Work Experience

Exchange Operator

- Collaborated with traders and clients to understand market trends and tailor trading strategies to meet their investment goals.

- Established relationships with exchange venues to negotiate favorable trading terms and ensure smooth order execution.

- Utilized market data analysis to identify market inefficiencies and develop profitable trading opportunities.

- Implemented automated trading systems to streamline order entry and execution, resulting in a 30% reduction in operational costs.

Exchange Operator

- Monitored market activity, identified trading opportunities, and executed trades on various exchanges, resulting in increased trading profits by 15%.

- Utilized proprietary trading algorithms to optimize trade execution speed and reduce latency, leading to a 20% improvement in order fulfillment time.

- Developed and implemented risk management strategies to mitigate market volatility and protect capital, ensuring compliance with regulatory requirements.

- Managed a team of exchange specialists, providing guidance, training, and support to optimize performance and achieve business objectives.

Accomplishments

- Successfully implemented a new order processing system that reduced order processing time by 15%, resulting in improved customer satisfaction and increased efficiency.

- Collaborated with the IT team to develop an automated reconciliation tool that streamlined the reconciliation process, reducing errors and improving productivity by 20%.

- Developed and implemented a comprehensive training program for new Exchange Operators, ensuring they are equipped with the necessary skills and knowledge to excel in their roles.

- Championed the implementation of a new market surveillance system, enhancing the accuracy and effectiveness of trade monitoring and risk management.

- Successfully managed a highvolume order flow during peak trading periods, maintaining market stability and ensuring timely execution of orders.

Awards

- Received the Operator Excellence Award for consistently exceeding performance targets in order fulfillment and customer satisfaction.

- Recognized for exceptional accuracy and attention to detail in managing order fulfillment, ensuring seamless execution of trading operations.

- Received the Quarterly Performance Award for outstanding contributions in maintaining a high level of operational efficiency and accuracy in exchange order processing.

- Received the Team Player Award for consistently collaborating with colleagues and contributing to the overall success of the exchange operations team.

Certificates

- Certified Exchange Operator (CEO)

- Exchange Industry Training (EXIT)

- Futures and Options Association (FOA) Certifications

- Financial Industry Regulatory Authority (FINRA) Series 7

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Exchange Operator

- Highlight your expertise in order book management, trade execution, and market surveillance.

- Showcase your ability to optimize trade execution using proprietary algorithms and risk management strategies.

- Emphasize your experience in managing a team of exchange specialists and collaborating with traders and clients.

- Demonstrate your understanding of market trends and proficiency in tailoring trading strategies to achieve investment goals.

- Certifications related to exchange trading can enhance your resume.

Essential Experience Highlights for a Strong Exchange Operator Resume

- Monitored market activity, identified trading opportunities, and executed trades on various exchanges to maximize returns.

- Utilized proprietary trading algorithms to optimize trade execution and reduce latency, leading to improved order fulfillment and profitability.

- Developed and implemented risk management strategies to mitigate market volatility and protect capital while ensuring regulatory compliance.

- Managed a team of exchange specialists, providing guidance, training, and support to enhance performance and achieve business goals.

- Collaborated with traders and clients to understand market trends and tailor trading strategies to meet investment objectives.

- Established relationships with exchange venues to negotiate favorable trading terms and ensure smooth order execution.

- Utilized market data analysis to identify market inefficiencies, create profitable trading opportunities, and optimize returns.

Frequently Asked Questions (FAQ’s) For Exchange Operator

What is the role of an Exchange Operator?

An Exchange Operator is responsible for monitoring market activity, identifying trading opportunities, and executing trades on various exchanges to maximize profitability. They leverage expertise in order book management, trade execution, and risk management to ensure optimal trade execution and risk mitigation.

What skills are essential for an Exchange Operator?

Essential skills for an Exchange Operator include order book management, trade execution, market surveillance, risk management, settlement accounting, and clearing operations. They should possess strong analytical and problem-solving skills, as well as proficiency in utilizing trading platforms and market data analysis tools.

What are the career prospects for an Exchange Operator?

An Exchange Operator can advance to roles such as Senior Exchange Operator, Trading Manager, and Head of Trading Operations. With experience and expertise, they can also transition into areas such as portfolio management, risk management, or financial advisory.

What is the work environment of an Exchange Operator?

Exchange Operators typically work in fast-paced, high-pressure trading environments. They spend significant time analyzing market data, executing trades, and managing risk. The job requires strong focus, attention to detail, and the ability to work effectively under pressure.

What industries hire Exchange Operators?

Exchange Operators are employed by investment banks, hedge funds, proprietary trading firms, and other financial institutions involved in trading activities. They play a crucial role in the execution of trades and management of risk within the financial markets.

What is the salary range for an Exchange Operator?

The salary range for an Exchange Operator varies depending on factors such as experience, skills, and location. According to Glassdoor, the average salary for an Exchange Operator in the United States is around $80,000 per year.

What are the educational requirements for an Exchange Operator?

Exchange Operators typically hold a Bachelor’s degree in Finance, Economics, or a related field. Some employers may also consider candidates with relevant work experience and certifications in areas such as the Financial Industry Regulatory Authority (FINRA) Series 57 or the Chartered Financial Analyst (CFA) program.

What are the certifications that can enhance an Exchange Operator’s resume?

Certifications that can enhance an Exchange Operator’s resume include the Certified Exchange Operator (CEO) certification from the National Association of Securities Dealers (NASD), the Financial Industry Regulatory Authority (FINRA) Series 57 license, and the Chartered Financial Analyst (CFA) designation.