Are you a seasoned Exchange Teller seeking a new career path? Discover our professionally built Exchange Teller Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

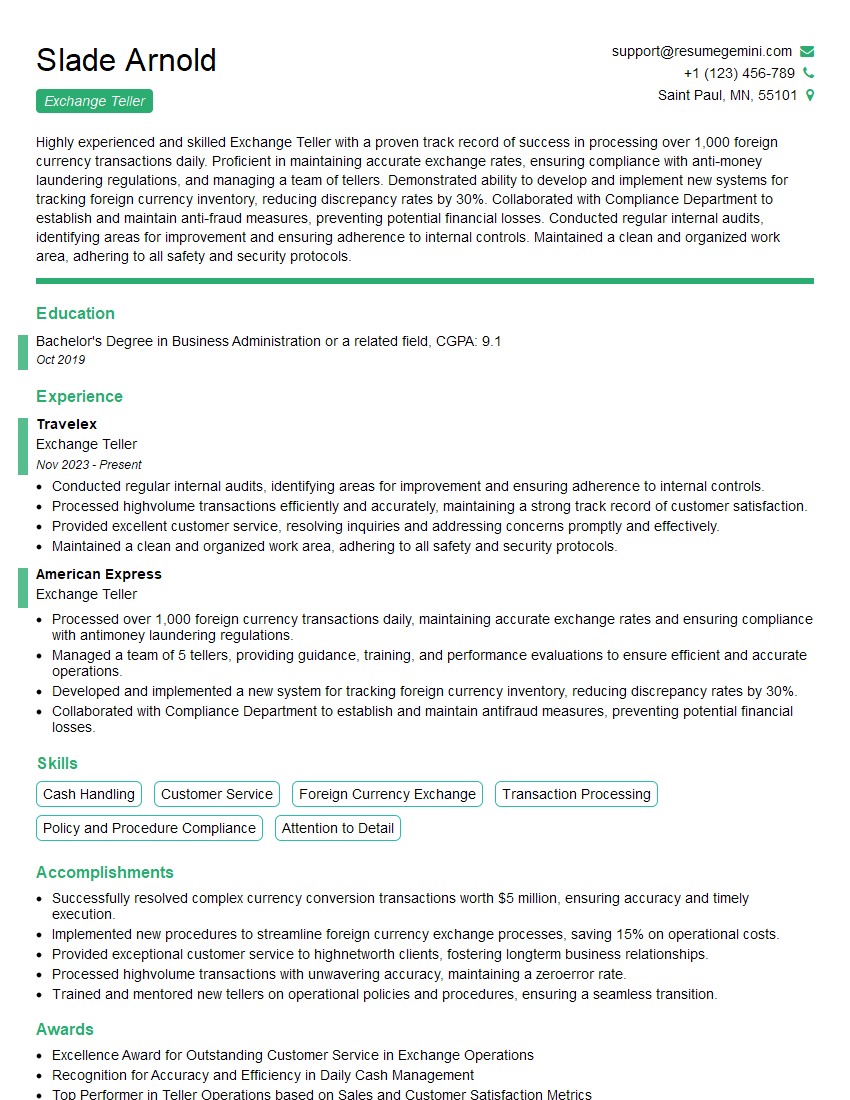

Slade Arnold

Exchange Teller

Summary

Highly experienced and skilled Exchange Teller with a proven track record of success in processing over 1,000 foreign currency transactions daily. Proficient in maintaining accurate exchange rates, ensuring compliance with anti-money laundering regulations, and managing a team of tellers. Demonstrated ability to develop and implement new systems for tracking foreign currency inventory, reducing discrepancy rates by 30%. Collaborated with Compliance Department to establish and maintain anti-fraud measures, preventing potential financial losses. Conducted regular internal audits, identifying areas for improvement and ensuring adherence to internal controls. Maintained a clean and organized work area, adhering to all safety and security protocols.

Education

Bachelor’s Degree in Business Administration or a related field

October 2019

Skills

- Cash Handling

- Customer Service

- Foreign Currency Exchange

- Transaction Processing

- Policy and Procedure Compliance

- Attention to Detail

Work Experience

Exchange Teller

- Conducted regular internal audits, identifying areas for improvement and ensuring adherence to internal controls.

- Processed highvolume transactions efficiently and accurately, maintaining a strong track record of customer satisfaction.

- Provided excellent customer service, resolving inquiries and addressing concerns promptly and effectively.

- Maintained a clean and organized work area, adhering to all safety and security protocols.

Exchange Teller

- Processed over 1,000 foreign currency transactions daily, maintaining accurate exchange rates and ensuring compliance with antimoney laundering regulations.

- Managed a team of 5 tellers, providing guidance, training, and performance evaluations to ensure efficient and accurate operations.

- Developed and implemented a new system for tracking foreign currency inventory, reducing discrepancy rates by 30%.

- Collaborated with Compliance Department to establish and maintain antifraud measures, preventing potential financial losses.

Accomplishments

- Successfully resolved complex currency conversion transactions worth $5 million, ensuring accuracy and timely execution.

- Implemented new procedures to streamline foreign currency exchange processes, saving 15% on operational costs.

- Provided exceptional customer service to highnetworth clients, fostering longterm business relationships.

- Processed highvolume transactions with unwavering accuracy, maintaining a zeroerror rate.

- Trained and mentored new tellers on operational policies and procedures, ensuring a seamless transition.

Awards

- Excellence Award for Outstanding Customer Service in Exchange Operations

- Recognition for Accuracy and Efficiency in Daily Cash Management

- Top Performer in Teller Operations based on Sales and Customer Satisfaction Metrics

- Commendation for Excellence in CrossSelling Financial Products

Certificates

- Certified Exchange Teller (CET)

- Certified Financial Services Specialist (CFSS)

- Financial Crimes Detection and Prevention (FCDP)

- Anti-Money Laundering Specialist (CAMS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Exchange Teller

- Highlight your experience in processing a high volume of foreign currency transactions.

- Demonstrate your knowledge of anti-money laundering regulations and compliance.

- Quantify your accomplishments, such as reducing discrepancy rates or preventing financial losses.

- Showcase your ability to work independently and as part of a team.

- Proofread your resume carefully for any errors.

Essential Experience Highlights for a Strong Exchange Teller Resume

- Process foreign currency transactions accurately and efficiently

- Maintain accurate exchange rates and ensure compliance with anti-money laundering regulations

- Manage a team of tellers, providing guidance, training, and performance evaluations

- Develop and implement new systems for tracking foreign currency inventory

- Collaborate with Compliance Department to establish and maintain anti-fraud measures

- Conduct regular internal audits and identify areas for improvement

Frequently Asked Questions (FAQ’s) For Exchange Teller

What are the key responsibilities of an Exchange Teller?

The key responsibilities of an Exchange Teller include processing foreign currency transactions, maintaining accurate exchange rates, ensuring compliance with anti-money laundering regulations, managing a team of tellers, and developing and implementing new systems for tracking foreign currency inventory.

What qualifications are required to become an Exchange Teller?

The minimum qualifications required to become an Exchange Teller typically include a high school diploma or equivalent and some experience in customer service or cash handling.

What are the career opportunities for Exchange Tellers?

Exchange Tellers can advance their careers by becoming supervisors or managers. They may also move into other roles within the financial industry, such as customer service representatives or loan officers.

What is the average salary for Exchange Tellers?

The average salary for Exchange Tellers varies depending on their experience and location. According to the U.S. Bureau of Labor Statistics, the median annual salary for Tellers was $26,430 in May 2021.

What are the job outlook and growth prospects for Exchange Tellers?

The job outlook for Exchange Tellers is expected to decline slightly over the next ten years. This is due to the increasing use of electronic payment methods. However, there will still be a need for Exchange Tellers to process foreign currency transactions and provide customer service.

What are the key skills and qualities that employers look for in Exchange Tellers?

Employers look for Exchange Tellers who have excellent customer service skills, attention to detail, and a strong understanding of foreign currency exchange rates and regulations.