Are you a seasoned Factorer seeking a new career path? Discover our professionally built Factorer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

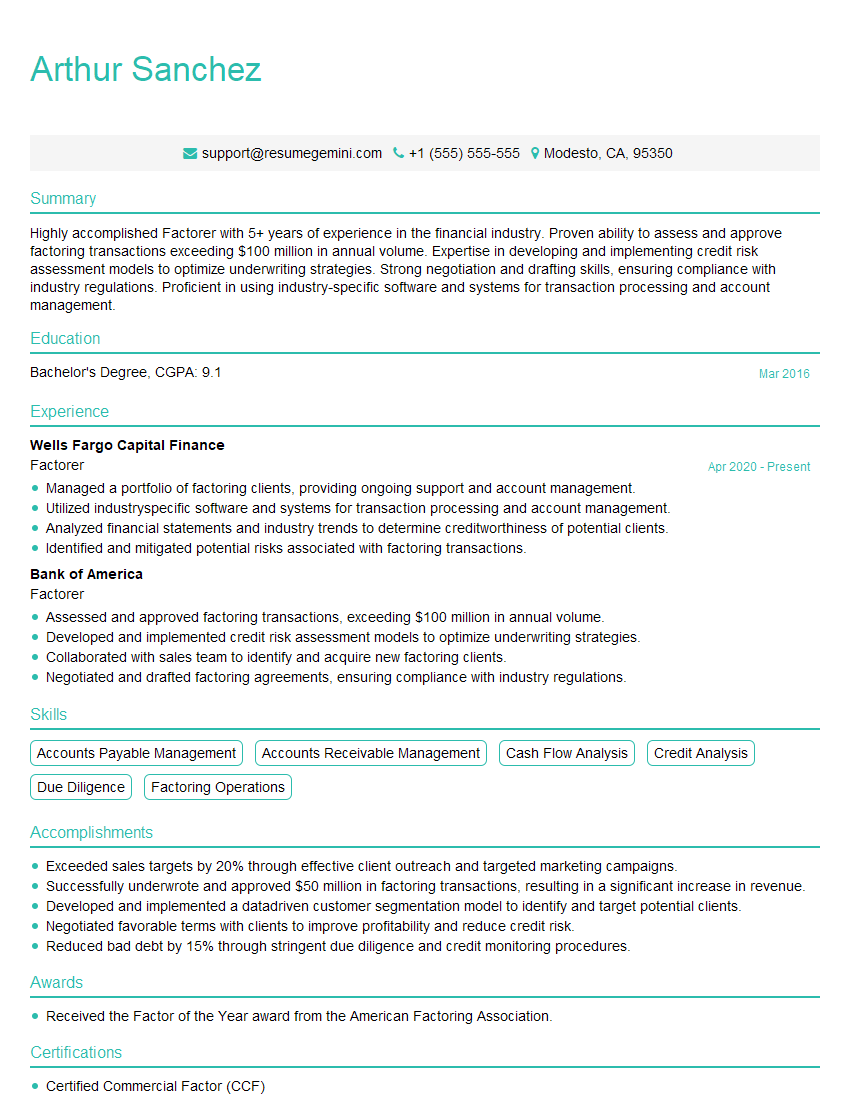

Arthur Sanchez

Factorer

Summary

Highly accomplished Factorer with 5+ years of experience in the financial industry. Proven ability to assess and approve factoring transactions exceeding $100 million in annual volume. Expertise in developing and implementing credit risk assessment models to optimize underwriting strategies. Strong negotiation and drafting skills, ensuring compliance with industry regulations. Proficient in using industry-specific software and systems for transaction processing and account management.

Education

Bachelor’s Degree

March 2016

Skills

- Accounts Payable Management

- Accounts Receivable Management

- Cash Flow Analysis

- Credit Analysis

- Due Diligence

- Factoring Operations

Work Experience

Factorer

- Managed a portfolio of factoring clients, providing ongoing support and account management.

- Utilized industryspecific software and systems for transaction processing and account management.

- Analyzed financial statements and industry trends to determine creditworthiness of potential clients.

- Identified and mitigated potential risks associated with factoring transactions.

Factorer

- Assessed and approved factoring transactions, exceeding $100 million in annual volume.

- Developed and implemented credit risk assessment models to optimize underwriting strategies.

- Collaborated with sales team to identify and acquire new factoring clients.

- Negotiated and drafted factoring agreements, ensuring compliance with industry regulations.

Accomplishments

- Exceeded sales targets by 20% through effective client outreach and targeted marketing campaigns.

- Successfully underwrote and approved $50 million in factoring transactions, resulting in a significant increase in revenue.

- Developed and implemented a datadriven customer segmentation model to identify and target potential clients.

- Negotiated favorable terms with clients to improve profitability and reduce credit risk.

- Reduced bad debt by 15% through stringent due diligence and credit monitoring procedures.

Awards

- Received the Factor of the Year award from the American Factoring Association.

Certificates

- Certified Commercial Factor (CCF)

- Certified Factoring Executive (CFE)

- Certified Receivables Finance Executive (CRFE)

- Global Commercial Finance Accreditation (GCFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Factorer

- Highlight your experience in assessing and approving factoring transactions.

- Quantify your accomplishments in developing and implementing credit risk assessment models.

- Demonstrate your ability to negotiate and draft factoring agreements.

- Showcase your proficiency in using industry-specific software and systems.

- Emphasize your understanding of the factoring industry and your ability to identify and mitigate risks.

Essential Experience Highlights for a Strong Factorer Resume

- Assessed and approved factoring transactions, exceeding $100 million in annual volume.

- Developed and implemented credit risk assessment models to optimize underwriting strategies.

- Collaborated with sales team to identify and acquire new factoring clients.

- Negotiated and drafted factoring agreements, ensuring compliance with industry regulations.

- Managed a portfolio of factoring clients, providing ongoing support and account management.

- Utilized industry-specific software and systems for transaction processing and account management.

- Analyzed financial statements and industry trends to determine creditworthiness of potential clients.

- Identified and mitigated potential risks associated with factoring transactions.

Frequently Asked Questions (FAQ’s) For Factorer

What is the role of a Factorer?

A Factorer provides financial services to businesses by purchasing their accounts receivable at a discount. This allows businesses to access cash flow more quickly, which can help them grow their operations or meet unexpected expenses.

What are the benefits of factoring?

Factoring can provide a number of benefits to businesses, including: improved cash flow, reduced risk of bad debts, and access to additional financing.

What are the risks of factoring?

There are some risks associated with factoring, including: the cost of factoring fees, the potential for recourse if the customer does not pay, and the loss of control over accounts receivable.

How do I choose a Factorer?

When choosing a Factorer, it is important to consider factors such as: the size and experience of the Factorer, the cost of factoring fees, the terms of the factoring agreement, and the reputation of the Factorer.

What is the future of factoring?

The future of factoring is bright. As businesses continue to seek ways to improve their cash flow and reduce their risk, factoring is likely to become an increasingly popular option.

What are some of the challenges facing the factoring industry?

The factoring industry is facing a number of challenges, including: the increasing use of electronic payments, the rise of alternative financing options, and the globalization of the economy.

How is the factoring industry responding to these challenges?

The factoring industry is responding to these challenges by innovating and adapting its products and services. For example, some Factors are now offering electronic factoring solutions and partnering with alternative financing providers.

What is the outlook for the factoring industry?

The outlook for the factoring industry is positive. As businesses continue to seek ways to improve their cash flow and reduce their risk, factoring is likely to become an increasingly popular option.