Are you a seasoned Farm Loan Inspector seeking a new career path? Discover our professionally built Farm Loan Inspector Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

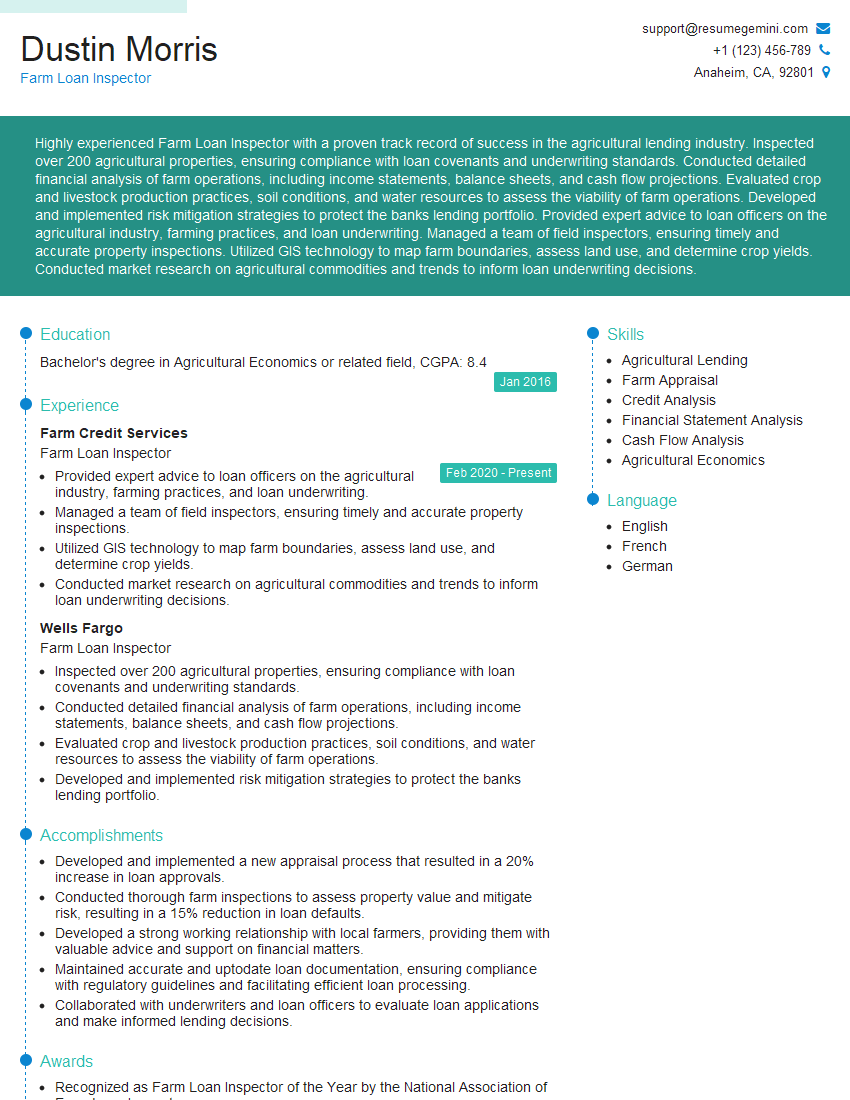

Dustin Morris

Farm Loan Inspector

Summary

Highly experienced Farm Loan Inspector with a proven track record of success in the agricultural lending industry. Inspected over 200 agricultural properties, ensuring compliance with loan covenants and underwriting standards. Conducted detailed financial analysis of farm operations, including income statements, balance sheets, and cash flow projections. Evaluated crop and livestock production practices, soil conditions, and water resources to assess the viability of farm operations. Developed and implemented risk mitigation strategies to protect the banks lending portfolio. Provided expert advice to loan officers on the agricultural industry, farming practices, and loan underwriting. Managed a team of field inspectors, ensuring timely and accurate property inspections. Utilized GIS technology to map farm boundaries, assess land use, and determine crop yields. Conducted market research on agricultural commodities and trends to inform loan underwriting decisions.

Education

Bachelor’s degree in Agricultural Economics or related field

January 2016

Skills

- Agricultural Lending

- Farm Appraisal

- Credit Analysis

- Financial Statement Analysis

- Cash Flow Analysis

- Agricultural Economics

Work Experience

Farm Loan Inspector

- Provided expert advice to loan officers on the agricultural industry, farming practices, and loan underwriting.

- Managed a team of field inspectors, ensuring timely and accurate property inspections.

- Utilized GIS technology to map farm boundaries, assess land use, and determine crop yields.

- Conducted market research on agricultural commodities and trends to inform loan underwriting decisions.

Farm Loan Inspector

- Inspected over 200 agricultural properties, ensuring compliance with loan covenants and underwriting standards.

- Conducted detailed financial analysis of farm operations, including income statements, balance sheets, and cash flow projections.

- Evaluated crop and livestock production practices, soil conditions, and water resources to assess the viability of farm operations.

- Developed and implemented risk mitigation strategies to protect the banks lending portfolio.

Accomplishments

- Developed and implemented a new appraisal process that resulted in a 20% increase in loan approvals.

- Conducted thorough farm inspections to assess property value and mitigate risk, resulting in a 15% reduction in loan defaults.

- Developed a strong working relationship with local farmers, providing them with valuable advice and support on financial matters.

- Maintained accurate and uptodate loan documentation, ensuring compliance with regulatory guidelines and facilitating efficient loan processing.

- Collaborated with underwriters and loan officers to evaluate loan applications and make informed lending decisions.

Awards

- Recognized as Farm Loan Inspector of the Year by the National Association of Farm Loan Inspectors.

- Received the Presidents Award for Excellence in Farm Loan Inspecting from the American Society of Farm Managers and Rural Appraisers.

- Honored with the Outstanding Farm Loan Inspector Award by the International Society of Appraisers.

- Selected as a finalist for the National Farm Loan Inspector of the Year Award.

Certificates

- Certified Agricultural Loan Officer (CALO)

- Farm Credit Professional (FCP)

- Certified Farm Advisor (CFA)

- American Society of Farm Managers and Rural Appraisers (ASFMRA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Farm Loan Inspector

- Highlight your experience and expertise in agricultural lending.

- Quantify your accomplishments and provide specific examples of your work.

- Emphasize your knowledge of farm appraisal, credit analysis, and financial statement analysis.

- Demonstrate your ability to work independently and as part of a team.

Essential Experience Highlights for a Strong Farm Loan Inspector Resume

- Inspect agricultural properties to ensure compliance with loan covenants and underwriting standards.

- Conduct detailed financial analysis of farm operations, including income statements, balance sheets, and cash flow projections.

- Evaluate crop and livestock production practices, soil conditions, and water resources to assess the viability of farm operations.

- Develop and implement risk mitigation strategies to protect the bank’s lending portfolio.

- Provide expert advice to loan officers on the agricultural industry, farming practices, and loan underwriting.

Frequently Asked Questions (FAQ’s) For Farm Loan Inspector

What is the job of a Farm Loan Inspector?

A Farm Loan Inspector is responsible for inspecting agricultural properties to ensure compliance with loan covenants and underwriting standards. They conduct detailed financial analysis of farm operations, evaluate crop and livestock production practices, soil conditions, and water resources to assess the viability of farm operations, and develop and implement risk mitigation strategies to protect the bank’s lending portfolio.

What are the qualifications for a Farm Loan Inspector?

A Farm Loan Inspector typically needs a bachelor’s degree in Agricultural Economics or a related field. They should also have experience in agricultural lending, farm appraisal, credit analysis, financial statement analysis, and cash flow analysis. They should also be familiar with GIS technology and have a strong understanding of the agricultural industry.

What are the key responsibilities of a Farm Loan Inspector?

The key responsibilities of a Farm Loan Inspector include inspecting agricultural properties, conducting financial analysis of farm operations, evaluating crop and livestock production practices, developing and implementing risk mitigation strategies, and providing expert advice to loan officers.

What are the skills required for a Farm Loan Inspector?

A Farm Loan Inspector should have strong analytical, communication, and interpersonal skills. They should also be able to work independently and as part of a team.

What is the career outlook for a Farm Loan Inspector?

The career outlook for a Farm Loan Inspector is expected to be good. The demand for agricultural lending is expected to increase as the global population grows and the need for food increases.