Are you a seasoned Field Adjuster seeking a new career path? Discover our professionally built Field Adjuster Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

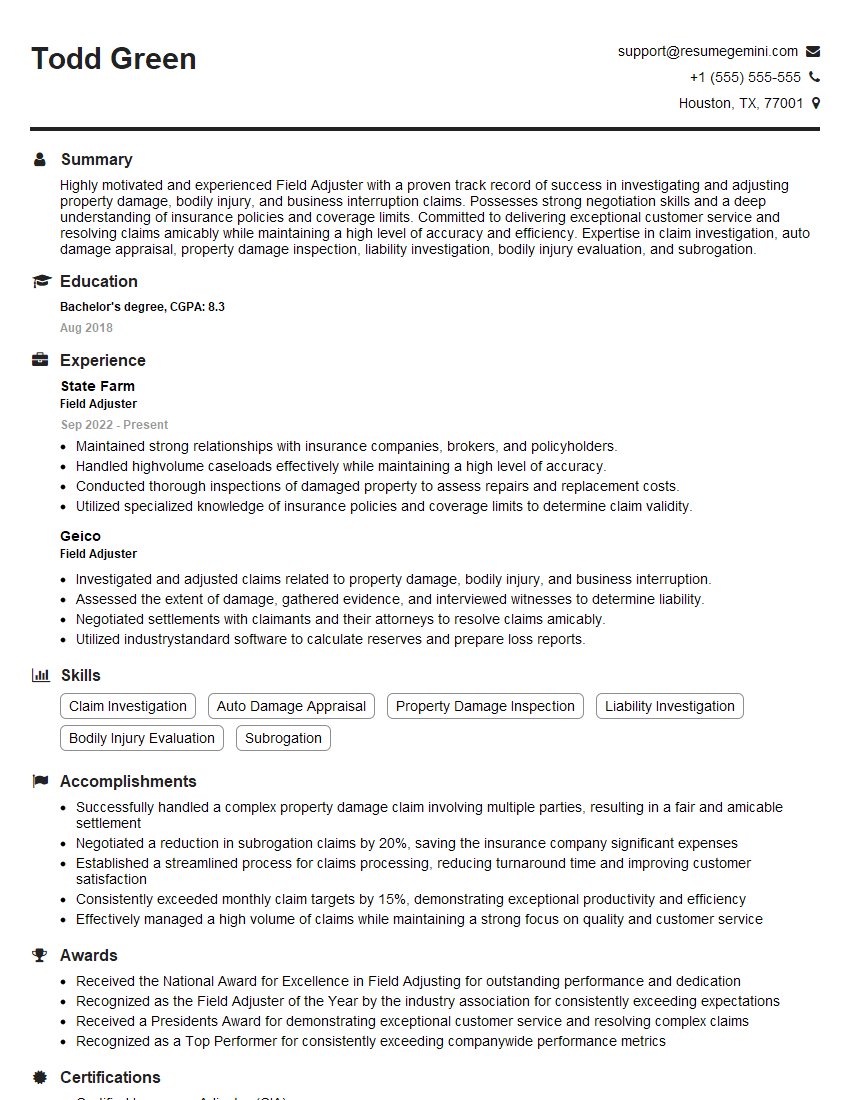

Todd Green

Field Adjuster

Summary

Highly motivated and experienced Field Adjuster with a proven track record of success in investigating and adjusting property damage, bodily injury, and business interruption claims. Possesses strong negotiation skills and a deep understanding of insurance policies and coverage limits. Committed to delivering exceptional customer service and resolving claims amicably while maintaining a high level of accuracy and efficiency. Expertise in claim investigation, auto damage appraisal, property damage inspection, liability investigation, bodily injury evaluation, and subrogation.

Education

Bachelor’s degree

August 2018

Skills

- Claim Investigation

- Auto Damage Appraisal

- Property Damage Inspection

- Liability Investigation

- Bodily Injury Evaluation

- Subrogation

Work Experience

Field Adjuster

- Maintained strong relationships with insurance companies, brokers, and policyholders.

- Handled highvolume caseloads effectively while maintaining a high level of accuracy.

- Conducted thorough inspections of damaged property to assess repairs and replacement costs.

- Utilized specialized knowledge of insurance policies and coverage limits to determine claim validity.

Field Adjuster

- Investigated and adjusted claims related to property damage, bodily injury, and business interruption.

- Assessed the extent of damage, gathered evidence, and interviewed witnesses to determine liability.

- Negotiated settlements with claimants and their attorneys to resolve claims amicably.

- Utilized industrystandard software to calculate reserves and prepare loss reports.

Accomplishments

- Successfully handled a complex property damage claim involving multiple parties, resulting in a fair and amicable settlement

- Negotiated a reduction in subrogation claims by 20%, saving the insurance company significant expenses

- Established a streamlined process for claims processing, reducing turnaround time and improving customer satisfaction

- Consistently exceeded monthly claim targets by 15%, demonstrating exceptional productivity and efficiency

- Effectively managed a high volume of claims while maintaining a strong focus on quality and customer service

Awards

- Received the National Award for Excellence in Field Adjusting for outstanding performance and dedication

- Recognized as the Field Adjuster of the Year by the industry association for consistently exceeding expectations

- Received a Presidents Award for demonstrating exceptional customer service and resolving complex claims

- Recognized as a Top Performer for consistently exceeding companywide performance metrics

Certificates

- Certified Insurance Adjuster (CIA)

- Associate in Claims (AIC)

- Certified Field Adjuster (CFA)

- Registered Property Adjuster (RPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Field Adjuster

- Highlight your experience and expertise in claims investigation and adjustment.

- Showcase your negotiation skills and ability to resolve claims amicably.

- Emphasize your knowledge of insurance policies and coverage limits.

- Demonstrate your proficiency in utilizing industry-standard software and tools.

Essential Experience Highlights for a Strong Field Adjuster Resume

- Investigate and adjust claims related to property damage, bodily injury, and business interruption.

- Assess the extent of damage, gather evidence, and interview witnesses to determine liability.

- Negotiate settlements with claimants and their attorneys to resolve claims amicably.

- Utilize industry-standard software to calculate reserves and prepare loss reports.

- Maintain strong relationships with insurance companies, brokers, and policyholders.

- Handle high-volume caseloads effectively while maintaining a high level of accuracy.

- Conduct thorough inspections of damaged property to assess repairs and replacement costs.

Frequently Asked Questions (FAQ’s) For Field Adjuster

What is the role of a Field Adjuster?

A Field Adjuster investigates and adjusts claims related to property damage, bodily injury, and business interruption, assessing the extent of damage, gathering evidence, and determining liability.

What are the essential skills for a successful Field Adjuster?

Excellent communication, interpersonal, and negotiation skills, as well as a strong understanding of insurance policies and coverage limits, and proficiency in claims investigation techniques.

What is the career path for a Field Adjuster?

With experience and additional qualifications, Field Adjusters can advance to roles such as Claims Manager, Underwriter, or Risk Manager.

What industries employ Field Adjusters?

Field Adjusters are primarily employed by insurance companies, but they may also work for independent adjusting firms or self-employed.

What is the job outlook for Field Adjusters?

The job outlook for Field Adjusters is expected to grow in the coming years due to the increasing frequency and severity of natural disasters and other events that result in property damage.

What are the challenges faced by Field Adjusters?

Field Adjusters often work in challenging conditions, such as disaster zones, and may face difficult interactions with claimants who are emotionally distressed.

What are the rewards of being a Field Adjuster?

Field Adjusters have the opportunity to make a positive impact on the lives of those affected by property damage and other events, and they can enjoy a rewarding career with opportunities for advancement.

How can I become a Field Adjuster?

To become a Field Adjuster, you typically need a bachelor’s degree, relevant experience in the insurance industry, and a license in the state where you will be working.