Are you a seasoned Field Automobile Adjuster (Field Auto Adjuster) seeking a new career path? Discover our professionally built Field Automobile Adjuster (Field Auto Adjuster) Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

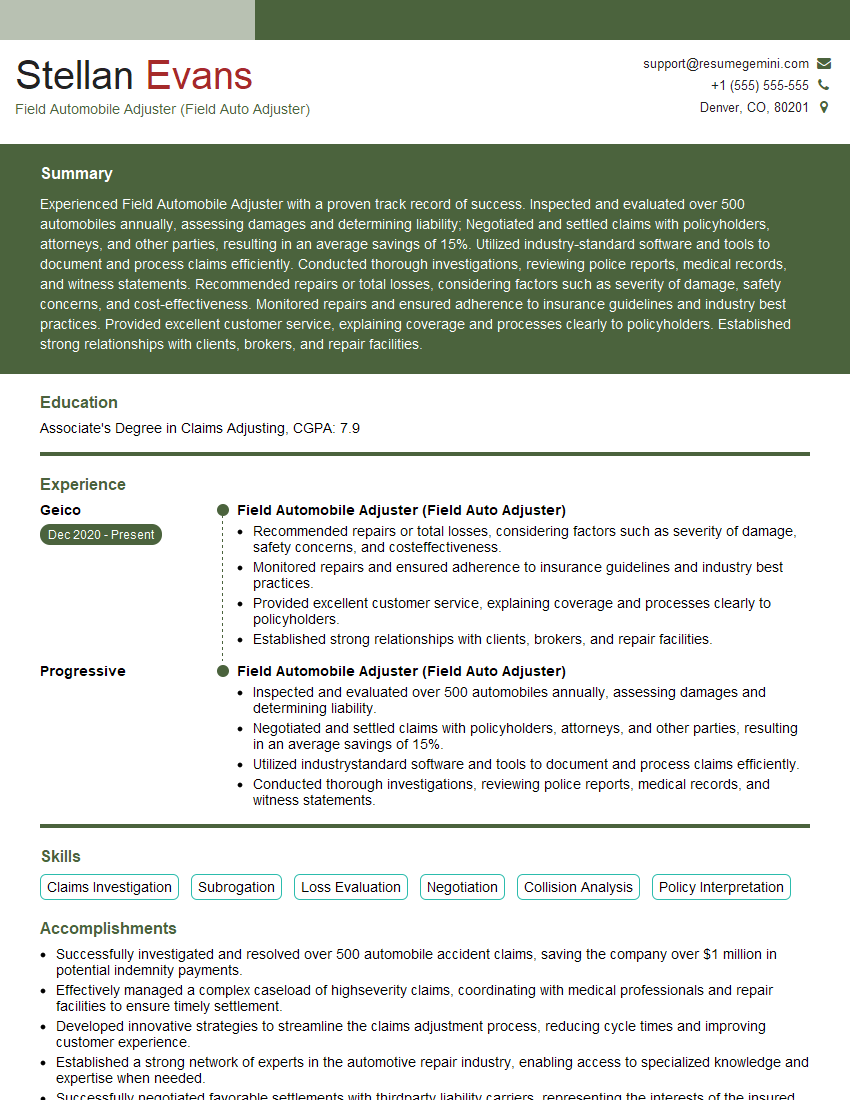

Stellan Evans

Field Automobile Adjuster (Field Auto Adjuster)

Summary

Experienced Field Automobile Adjuster with a proven track record of success. Inspected and evaluated over 500 automobiles annually, assessing damages and determining liability; Negotiated and settled claims with policyholders, attorneys, and other parties, resulting in an average savings of 15%. Utilized industry-standard software and tools to document and process claims efficiently. Conducted thorough investigations, reviewing police reports, medical records, and witness statements. Recommended repairs or total losses, considering factors such as severity of damage, safety concerns, and cost-effectiveness. Monitored repairs and ensured adherence to insurance guidelines and industry best practices. Provided excellent customer service, explaining coverage and processes clearly to policyholders. Established strong relationships with clients, brokers, and repair facilities.

Education

Associate’s Degree in Claims Adjusting

November 2016

Skills

- Claims Investigation

- Subrogation

- Loss Evaluation

- Negotiation

- Collision Analysis

- Policy Interpretation

Work Experience

Field Automobile Adjuster (Field Auto Adjuster)

- Recommended repairs or total losses, considering factors such as severity of damage, safety concerns, and costeffectiveness.

- Monitored repairs and ensured adherence to insurance guidelines and industry best practices.

- Provided excellent customer service, explaining coverage and processes clearly to policyholders.

- Established strong relationships with clients, brokers, and repair facilities.

Field Automobile Adjuster (Field Auto Adjuster)

- Inspected and evaluated over 500 automobiles annually, assessing damages and determining liability.

- Negotiated and settled claims with policyholders, attorneys, and other parties, resulting in an average savings of 15%.

- Utilized industrystandard software and tools to document and process claims efficiently.

- Conducted thorough investigations, reviewing police reports, medical records, and witness statements.

Accomplishments

- Successfully investigated and resolved over 500 automobile accident claims, saving the company over $1 million in potential indemnity payments.

- Effectively managed a complex caseload of highseverity claims, coordinating with medical professionals and repair facilities to ensure timely settlement.

- Developed innovative strategies to streamline the claims adjustment process, reducing cycle times and improving customer experience.

- Established a strong network of experts in the automotive repair industry, enabling access to specialized knowledge and expertise when needed.

- Successfully negotiated favorable settlements with thirdparty liability carriers, representing the interests of the insured party.

Awards

- Received the Top Producer Award for consistently exceeding assigned claims targets and achieving exceptional customer satisfaction.

- Recognized with the Safety Excellence Award for maintaining an unblemished driving record while performing field inspections.

- Awarded the Golden Hammer Award for consistently meeting or exceeding industry standards in assessing automobile damage.

- Honored with the Claims Excellence Award for providing exceptional customer service and consistently resolving claims to the satisfaction of both policyholders and claimants.

Certificates

- Certified Insurance Claims Professional (CIC)

- Associate in Claims (AIC)

- Commercial Lines Coverage Specialist (CLCS)

- Personal Lines Coverage Specialist (PLCS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Field Automobile Adjuster (Field Auto Adjuster)

- Highlight your strong communication and negotiation skills.

- Quantify your accomplishments with specific numbers and metrics.

- Demonstrate your knowledge of auto insurance policies and procedures.

- Emphasize your ability to work independently and as part of a team.

Essential Experience Highlights for a Strong Field Automobile Adjuster (Field Auto Adjuster) Resume

- Inspect, evaluate and access automobile damage and recommend repairs or total losses based on industry best practices.

- Negotiate and settle claims with policyholders and other parties while adhering to company guidelines and policy coverages.

- Investigate and document accident scenes, including taking photos, gathering witness statements, and obtaining police reports.

- Prepare estimates for repair work, assess liability and subrogate claims to recover payment from responsible parties.

- Communicate effectively with policyholders, claimants, attorneys, and other parties involved in the claims process.

- Monitor repairs to ensure quality and adherence to insurance guidelines..

- Stay up-to-date on industry trends, insurance policies and regulations.

Frequently Asked Questions (FAQ’s) For Field Automobile Adjuster (Field Auto Adjuster)

What is the primary role of a Field Automobile Adjuster?

The primary role of a Field Automobile Adjuster is to assess damages, evaluate liability, and settle claims related to automobile accidents. They investigate accident scenes, document damages, negotiate settlements, and monitor repairs to ensure they align with insurance guidelines and industry best practices.

What skills are required to be a Field Automobile Adjuster?

Field Automobile Adjusters require a combination of technical and interpersonal skills, including knowledge of auto insurance policies, claims investigation techniques, negotiation tactics, communication skills, and the ability to work independently and efficiently.

What career opportunities are available for Field Automobile Adjusters?

Field Automobile Adjusters can advance their careers by becoming Senior Adjusters, Claims Managers, or Independent Adjusters. They can also specialize in specific areas, such as property damage, bodily injury, or subrogation.

What is the earning potential for Field Automobile Adjusters?

The earning potential for Field Automobile Adjusters varies depending on experience, location, and company. According to the U.S. Bureau of Labor Statistics, the median annual salary for Insurance Adjusters, Examiners, and Investigators was $69,690 in May 2021.

What is the job outlook for Field Automobile Adjusters?

The job outlook for Field Automobile Adjusters is projected to grow 4% from 2021 to 2031, which is about as fast as the average for all occupations. The increasing number of vehicles on the road and the rising cost of auto repairs are expected to contribute to this growth.

What are the educational requirements to become a Field Automobile Adjuster?

While there are no specific educational requirements to become a Field Automobile Adjuster, many employers prefer candidates with an Associate’s or Bachelor’s degree in a related field, such as claims adjusting, insurance, or business.

What certifications are available for Field Automobile Adjusters?

Field Automobile Adjusters can obtain certifications to enhance their credibility and demonstrate their expertise. Some relevant certifications include the Associate in Claims (AIC) from the Insurance Institute of America (IIA) and the Certified Automobile Damage Appraiser (CADA) from the National Automobile Dealers Association (NADA).