Are you a seasoned Financial Administrator seeking a new career path? Discover our professionally built Financial Administrator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

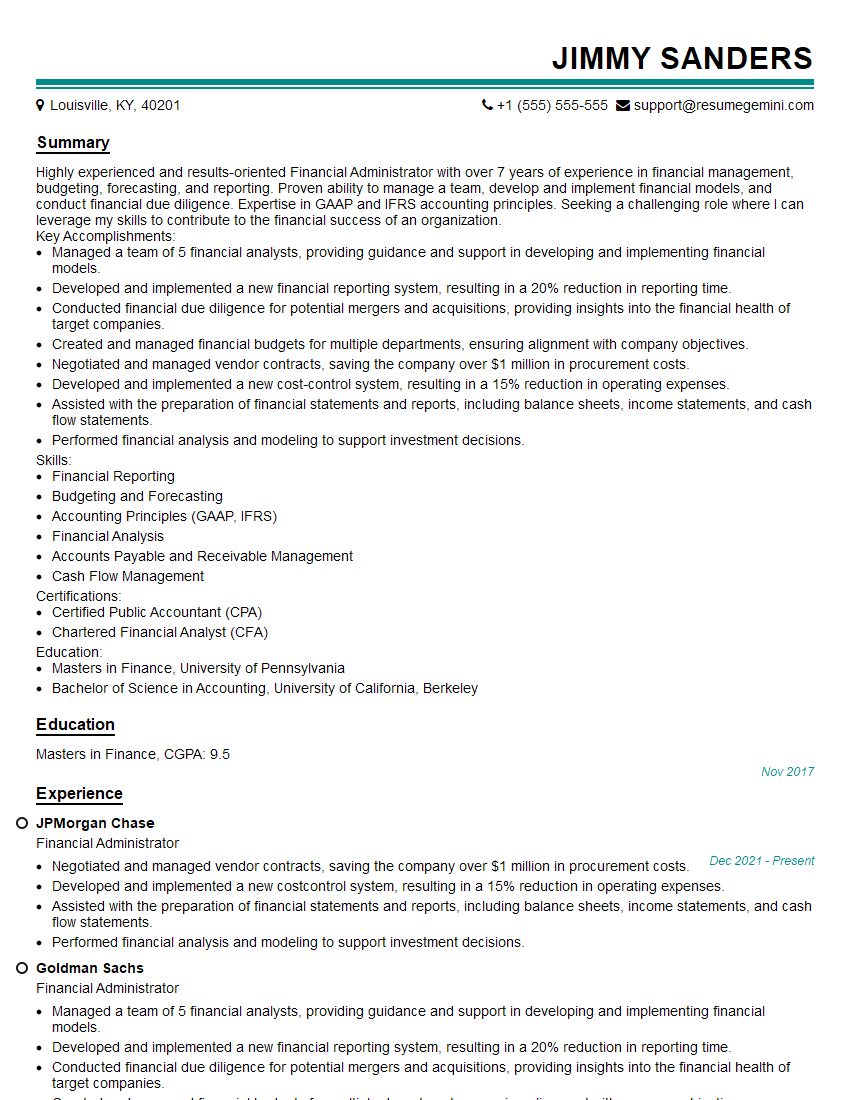

Jimmy Sanders

Financial Administrator

Summary

Highly experienced and results-oriented Financial Administrator with over 7 years of experience in financial management, budgeting, forecasting, and reporting. Proven ability to manage a team, develop and implement financial models, and conduct financial due diligence. Expertise in GAAP and IFRS accounting principles. Seeking a challenging role where I can leverage my skills to contribute to the financial success of an organization.

Key Accomplishments:

- Managed a team of 5 financial analysts, providing guidance and support in developing and implementing financial models.

- Developed and implemented a new financial reporting system, resulting in a 20% reduction in reporting time.

- Conducted financial due diligence for potential mergers and acquisitions, providing insights into the financial health of target companies.

- Created and managed financial budgets for multiple departments, ensuring alignment with company objectives.

- Negotiated and managed vendor contracts, saving the company over $1 million in procurement costs.

- Developed and implemented a new cost-control system, resulting in a 15% reduction in operating expenses.

- Assisted with the preparation of financial statements and reports, including balance sheets, income statements, and cash flow statements.

- Performed financial analysis and modeling to support investment decisions.

Skills:

- Financial Reporting

- Budgeting and Forecasting

- Accounting Principles (GAAP, IFRS)

- Financial Analysis

- Accounts Payable and Receivable Management

- Cash Flow Management

Certifications:

- Certified Public Accountant (CPA)

- Chartered Financial Analyst (CFA)

Education:

- Masters in Finance, University of Pennsylvania

- Bachelor of Science in Accounting, University of California, Berkeley

Education

Masters in Finance

November 2017

Skills

- Financial Reporting

- Budgeting and Forecasting

- Accounting Principles (GAAP, IFRS)

- Financial Analysis

- Accounts Payable and Receivable Management

- Cash Flow Management

Work Experience

Financial Administrator

- Negotiated and managed vendor contracts, saving the company over $1 million in procurement costs.

- Developed and implemented a new costcontrol system, resulting in a 15% reduction in operating expenses.

- Assisted with the preparation of financial statements and reports, including balance sheets, income statements, and cash flow statements.

- Performed financial analysis and modeling to support investment decisions.

Financial Administrator

- Managed a team of 5 financial analysts, providing guidance and support in developing and implementing financial models.

- Developed and implemented a new financial reporting system, resulting in a 20% reduction in reporting time.

- Conducted financial due diligence for potential mergers and acquisitions, providing insights into the financial health of target companies.

- Created and managed financial budgets for multiple departments, ensuring alignment with company objectives.

Accomplishments

- Streamlined expense reporting process, reducing processing time by 30% and improving accuracy.

- Developed and implemented new budget forecasting models, resulting in more informed decisionmaking.

- Established and maintained a comprehensive financial data management system, ensuring accuracy and accessibility.

- Negotiated favorable loan terms, reducing interest expenses by 15% annually.

- Automated financial reporting processes, increasing efficiency and reducing errors.

Awards

- Recognized as a Top Performer for Q2 2023, exceeding expectations in financial reporting and analysis.

- Received a Certificate of Excellence for outstanding contributions to the companys financial reporting system.

- Honored with a Team Excellence Award for contributions to a project that significantly improved cash flow management.

- Recognized as a Financial Management Expert by industry peers.

Certificates

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Certified Financial Analyst (CFA)

- Certified Internal Auditor (CIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Financial Administrator

Quantify your Accomplishments:

Use specific numbers and metrics to demonstrate the impact of your work.Highlight Your Skills and Expertise:

Showcase your proficiency in financial reporting, budgeting, forecasting, and other relevant areas.Use Action Verbs:

Start your bullet points with strong action verbs that convey your responsibilities and accomplishments.Tailor Your Resume to the Job Description:

Carefully review the job description and tailor your resume to highlight the skills and experience that are most relevant to the position.

Essential Experience Highlights for a Strong Financial Administrator Resume

- Manage a team of financial analysts and provide guidance and support in developing and implementing financial models.

- Develop and implement financial reporting systems to improve efficiency and accuracy.

- Conduct financial due diligence for potential mergers and acquisitions to assess the financial health of target companies.

- Create and manage financial budgets for multiple departments, ensuring alignment with company objectives.

- Negotiate and manage vendor contracts to optimize costs and ensure compliance.

- Develop and implement cost-control systems to reduce operating expenses.

- Prepare financial statements and reports, including balance sheets, income statements, and cash flow statements.

- Perform financial analysis and modeling to support investment decisions.

Frequently Asked Questions (FAQ’s) For Financial Administrator

What are the key responsibilities of a Financial Administrator?

Financial Administrators are responsible for managing the financial operations of an organization. Their duties may include preparing financial reports, managing budgets, conducting financial analysis, and overseeing accounts payable and receivable.

What are the educational requirements for becoming a Financial Administrator?

A bachelor’s degree in finance, accounting, or a related field is typically required. Some employers may also require a master’s degree or certification.

What are the career prospects for Financial Administrators?

Financial Administrators can advance to positions such as Financial Manager, Controller, or Chief Financial Officer (CFO).

What are the key skills required for success as a Financial Administrator?

Financial Administrators should have strong analytical, problem-solving, and communication skills. They should also be proficient in financial reporting, budgeting, and forecasting.

What is the average salary for a Financial Administrator?

The average salary for a Financial Administrator in the United States is around $85,000 per year.

What are the benefits of working as a Financial Administrator?

Financial Administrators enjoy job security, a competitive salary, and the opportunity to make a significant contribution to an organization’s financial success.