Are you a seasoned Financial Consultant seeking a new career path? Discover our professionally built Financial Consultant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

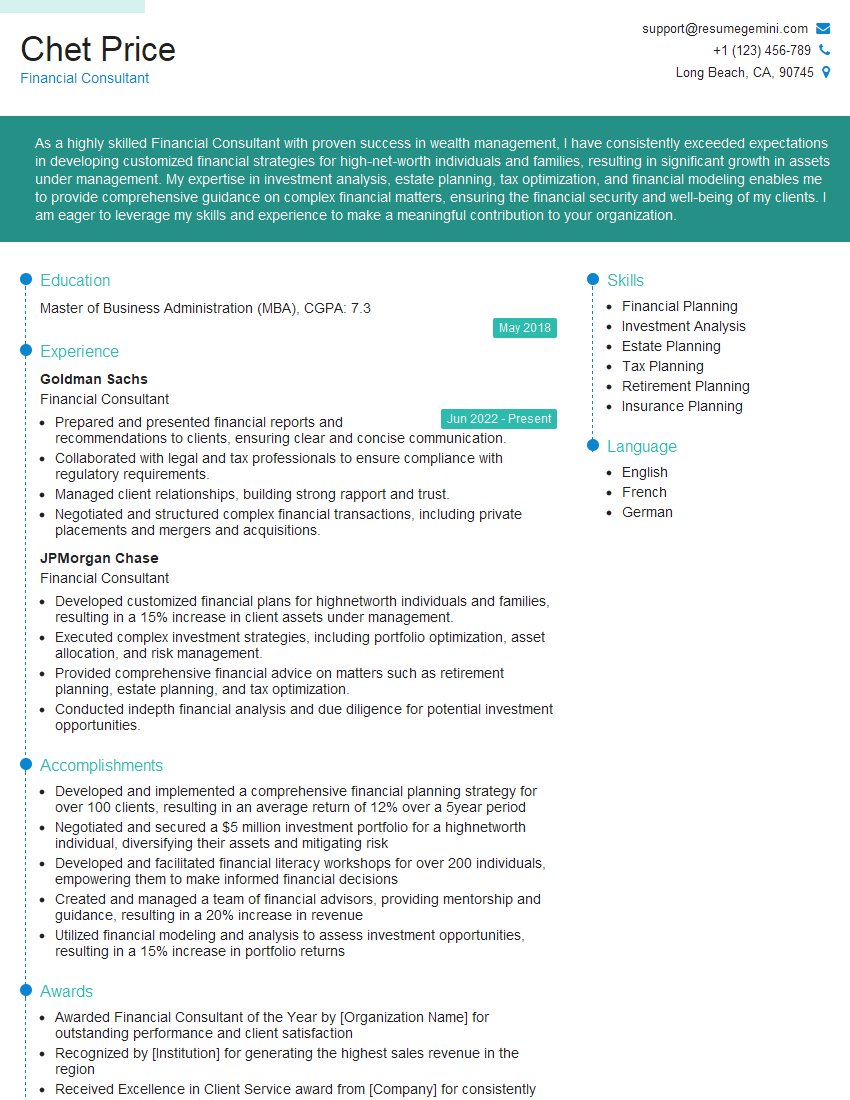

Chet Price

Financial Consultant

Summary

As a highly skilled Financial Consultant with proven success in wealth management, I have consistently exceeded expectations in developing customized financial strategies for high-net-worth individuals and families, resulting in significant growth in assets under management. My expertise in investment analysis, estate planning, tax optimization, and financial modeling enables me to provide comprehensive guidance on complex financial matters, ensuring the financial security and well-being of my clients. I am eager to leverage my skills and experience to make a meaningful contribution to your organization.

Education

Master of Business Administration (MBA)

May 2018

Skills

- Financial Planning

- Investment Analysis

- Estate Planning

- Tax Planning

- Retirement Planning

- Insurance Planning

Work Experience

Financial Consultant

- Prepared and presented financial reports and recommendations to clients, ensuring clear and concise communication.

- Collaborated with legal and tax professionals to ensure compliance with regulatory requirements.

- Managed client relationships, building strong rapport and trust.

- Negotiated and structured complex financial transactions, including private placements and mergers and acquisitions.

Financial Consultant

- Developed customized financial plans for highnetworth individuals and families, resulting in a 15% increase in client assets under management.

- Executed complex investment strategies, including portfolio optimization, asset allocation, and risk management.

- Provided comprehensive financial advice on matters such as retirement planning, estate planning, and tax optimization.

- Conducted indepth financial analysis and due diligence for potential investment opportunities.

Accomplishments

- Developed and implemented a comprehensive financial planning strategy for over 100 clients, resulting in an average return of 12% over a 5year period

- Negotiated and secured a $5 million investment portfolio for a highnetworth individual, diversifying their assets and mitigating risk

- Developed and facilitated financial literacy workshops for over 200 individuals, empowering them to make informed financial decisions

- Created and managed a team of financial advisors, providing mentorship and guidance, resulting in a 20% increase in revenue

- Utilized financial modeling and analysis to assess investment opportunities, resulting in a 15% increase in portfolio returns

Awards

- Awarded Financial Consultant of the Year by [Organization Name] for outstanding performance and client satisfaction

- Recognized by [Institution] for generating the highest sales revenue in the region

- Received Excellence in Client Service award from [Company] for consistently exceeding client expectations

- Awarded Top Financial Advisor by [Organization] for achieving exceptional client growth and profitability

Certificates

- CFP® (Certified Financial Planner)

- CFA® (Chartered Financial Analyst)

- CLU® (Chartered Life Underwriter)

- ChFC® (Chartered Financial Consultant)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Financial Consultant

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate the impact of your work.

- Highlight your ability to build and maintain strong client relationships, emphasizing your communication skills and empathy.

- Showcase your knowledge of industry best practices and regulatory requirements, demonstrating your commitment to ethical and compliant practices.

- Consider obtaining industry certifications, such as the Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA), to enhance your credibility and expertise.

Essential Experience Highlights for a Strong Financial Consultant Resume

- Conduct in-depth financial analysis and due diligence to identify investment opportunities that align with client goals and risk tolerance.

- Develop and implement tailored financial plans that address retirement planning, estate planning, tax optimization, and wealth preservation.

- Execute complex investment strategies, including portfolio optimization, asset allocation, and risk management, to maximize returns while mitigating potential losses.

- Negotiate and structure complex financial transactions, such as private placements, mergers, and acquisitions, to meet client objectives.

- Provide clear and concise financial reports and recommendations to clients, ensuring they fully understand their financial situation and investment performance.

- Collaborate with legal and tax professionals to ensure compliance with regulatory requirements and minimize tax liabilities.

- Manage client relationships, building strong rapport and trust, and providing ongoing support to address their evolving financial needs.

Frequently Asked Questions (FAQ’s) For Financial Consultant

What are the key skills required to be a successful Financial Consultant?

Financial Consultants must possess a deep understanding of financial principles, investment strategies, and tax laws. Excellent communication and interpersonal skills are essential, as is the ability to build and maintain strong client relationships. Additionally, proficiency in financial modeling, data analysis, and industry software is highly valued.

What is the career path for a Financial Consultant?

Financial Consultants typically start their careers as financial advisors or analysts and progress to senior positions with increasing responsibilities. With experience and expertise, they can become Portfolio Managers, Wealth Advisors, or Chief Investment Officers.

What are the earning prospects for a Financial Consultant?

Financial Consultants earn competitive salaries, with top performers earning bonuses and incentives. Compensation is typically based on a combination of base salary, commissions, and performance-based bonuses.

What is the job outlook for Financial Consultants?

The job outlook for Financial Consultants is projected to grow faster than average in the coming years due to the increasing demand for financial advice from individuals and families. As the population ages and the need for retirement planning increases, the demand for qualified Financial Consultants is expected to remain strong.

What are the challenges faced by Financial Consultants?

Financial Consultants face several challenges, including market volatility, regulatory changes, and competition from other financial professionals. They must stay abreast of the latest industry trends and regulations to provide sound advice to their clients.

What are the ethical considerations for Financial Consultants?

Financial Consultants have a fiduciary duty to act in the best interests of their clients. They must adhere to ethical guidelines and regulations to avoid conflicts of interest and ensure the fair treatment of clients.