Are you a seasoned Financial Counselor seeking a new career path? Discover our professionally built Financial Counselor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

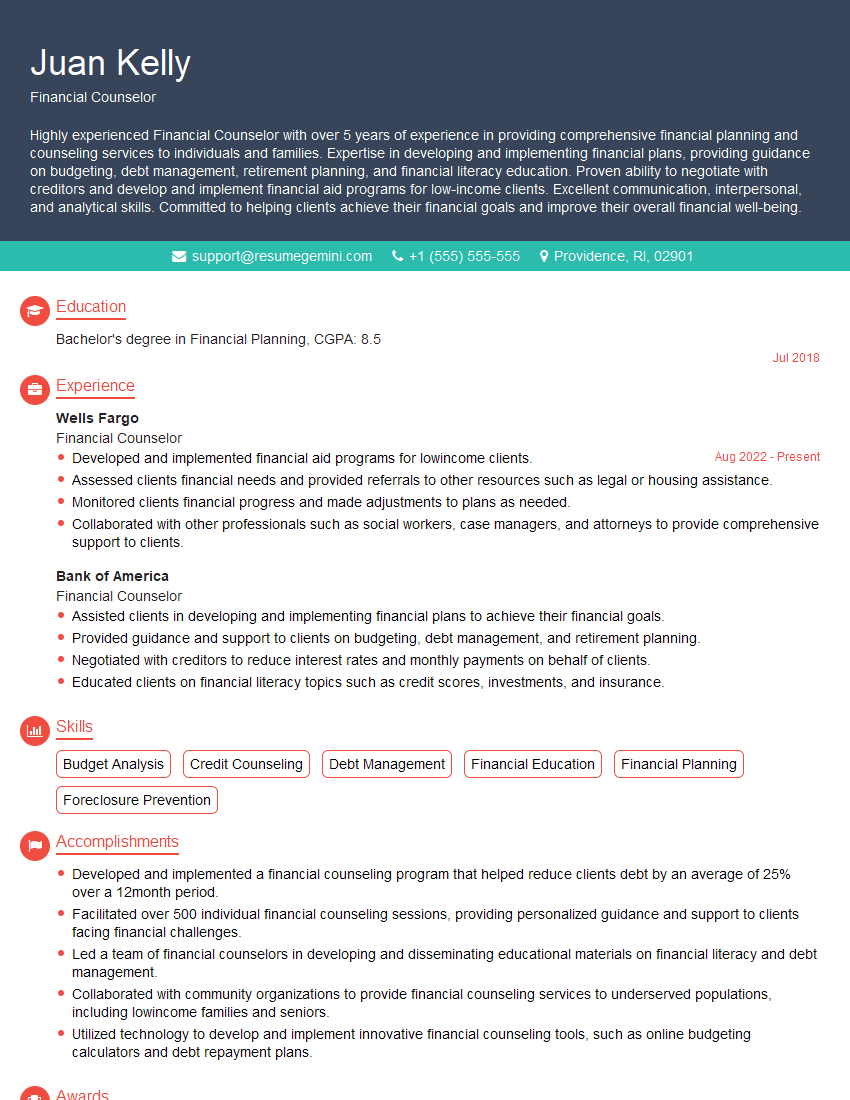

Juan Kelly

Financial Counselor

Summary

Highly experienced Financial Counselor with over 5 years of experience in providing comprehensive financial planning and counseling services to individuals and families. Expertise in developing and implementing financial plans, providing guidance on budgeting, debt management, retirement planning, and financial literacy education. Proven ability to negotiate with creditors and develop and implement financial aid programs for low-income clients. Excellent communication, interpersonal, and analytical skills. Committed to helping clients achieve their financial goals and improve their overall financial well-being.

Education

Bachelor’s degree in Financial Planning

July 2018

Skills

- Budget Analysis

- Credit Counseling

- Debt Management

- Financial Education

- Financial Planning

- Foreclosure Prevention

Work Experience

Financial Counselor

- Developed and implemented financial aid programs for lowincome clients.

- Assessed clients financial needs and provided referrals to other resources such as legal or housing assistance.

- Monitored clients financial progress and made adjustments to plans as needed.

- Collaborated with other professionals such as social workers, case managers, and attorneys to provide comprehensive support to clients.

Financial Counselor

- Assisted clients in developing and implementing financial plans to achieve their financial goals.

- Provided guidance and support to clients on budgeting, debt management, and retirement planning.

- Negotiated with creditors to reduce interest rates and monthly payments on behalf of clients.

- Educated clients on financial literacy topics such as credit scores, investments, and insurance.

Accomplishments

- Developed and implemented a financial counseling program that helped reduce clients debt by an average of 25% over a 12month period.

- Facilitated over 500 individual financial counseling sessions, providing personalized guidance and support to clients facing financial challenges.

- Led a team of financial counselors in developing and disseminating educational materials on financial literacy and debt management.

- Collaborated with community organizations to provide financial counseling services to underserved populations, including lowincome families and seniors.

- Utilized technology to develop and implement innovative financial counseling tools, such as online budgeting calculators and debt repayment plans.

Awards

- CFA Institute Member Award for Excellence in Financial Counseling

- National Financial Counseling Association (NFCA) Presidents Award

- United Way Financial Stability Champion Award

Certificates

- Certified Credit Counselor (CCC)

- Certified Financial Counselor (CFC)

- Certified Housing Counselor (CHC)

- Certified Personal Finance Counselor (CPFC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Financial Counselor

- Highlight your key skills and experience in your resume summary.

- Provide concrete examples of your accomplishments to demonstrate your impact.

- Use action verbs to describe your responsibilities.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

- Proofread your resume carefully before submitting it.

Essential Experience Highlights for a Strong Financial Counselor Resume

- Provide financial counseling and guidance to individuals and families on budgeting, debt management, and retirement planning.

- Assist clients in developing and implementing financial plans to achieve their financial goals.

- Negotiate with creditors to reduce interest rates and monthly payments on behalf of clients.

- Educate clients on financial literacy topics such as credit scores, investments, and insurance.

- Develop and implement financial aid programs for low-income clients.

- Assess clients’ financial needs and provide referrals to other resources such as legal or housing assistance.

- Monitor clients’ financial progress and make adjustments to plans as needed.

Frequently Asked Questions (FAQ’s) For Financial Counselor

What is the role of a Financial Counselor?

Financial Counselors help individuals and families manage their finances and achieve their financial goals. They provide guidance on budgeting, debt management, retirement planning, and other financial matters.

What are the qualifications for becoming a Financial Counselor?

Most Financial Counselors have a bachelor’s degree in financial planning, personal finance, or a related field. Some states require Financial Counselors to be licensed or certified.

What are the key skills for a Financial Counselor?

Financial Counselors should have strong communication, interpersonal, and analytical skills. They should also be able to understand and explain complex financial concepts in a clear and concise manner.

What is the job outlook for Financial Counselors?

The job outlook for Financial Counselors is expected to grow faster than average in the coming years as more and more people seek help with managing their finances.

What is the average salary for a Financial Counselor?

The average salary for a Financial Counselor is around $50,000 per year.

What are the benefits of working as a Financial Counselor?

Financial Counselors can enjoy a rewarding career helping people achieve their financial goals. They can also make a positive impact on the community by providing financial education and counseling.

What are the challenges of working as a Financial Counselor?

Financial Counselors may face challenges such as dealing with clients who are in financial distress. They may also need to work long hours and deal with difficult financial situations.

How can I become a Financial Counselor?

To become a Financial Counselor, you can earn a bachelor’s degree in financial planning, personal finance, or a related field. You may also need to obtain a license or certification in your state.