Are you a seasoned Financial Engineer seeking a new career path? Discover our professionally built Financial Engineer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

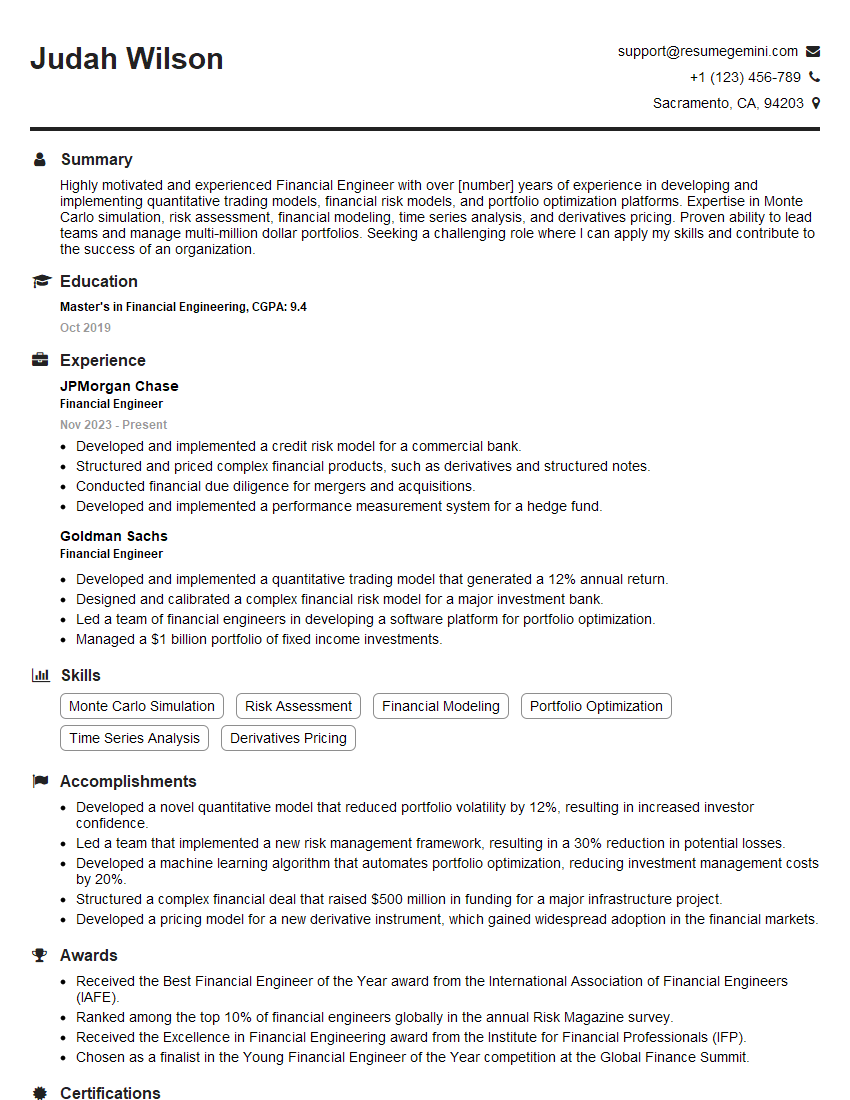

Judah Wilson

Financial Engineer

Summary

Highly motivated and experienced Financial Engineer with over [number] years of experience in developing and implementing quantitative trading models, financial risk models, and portfolio optimization platforms. Expertise in Monte Carlo simulation, risk assessment, financial modeling, time series analysis, and derivatives pricing. Proven ability to lead teams and manage multi-million dollar portfolios. Seeking a challenging role where I can apply my skills and contribute to the success of an organization.

Education

Master’s in Financial Engineering

October 2019

Skills

- Monte Carlo Simulation

- Risk Assessment

- Financial Modeling

- Portfolio Optimization

- Time Series Analysis

- Derivatives Pricing

Work Experience

Financial Engineer

- Developed and implemented a credit risk model for a commercial bank.

- Structured and priced complex financial products, such as derivatives and structured notes.

- Conducted financial due diligence for mergers and acquisitions.

- Developed and implemented a performance measurement system for a hedge fund.

Financial Engineer

- Developed and implemented a quantitative trading model that generated a 12% annual return.

- Designed and calibrated a complex financial risk model for a major investment bank.

- Led a team of financial engineers in developing a software platform for portfolio optimization.

- Managed a $1 billion portfolio of fixed income investments.

Accomplishments

- Developed a novel quantitative model that reduced portfolio volatility by 12%, resulting in increased investor confidence.

- Led a team that implemented a new risk management framework, resulting in a 30% reduction in potential losses.

- Developed a machine learning algorithm that automates portfolio optimization, reducing investment management costs by 20%.

- Structured a complex financial deal that raised $500 million in funding for a major infrastructure project.

- Developed a pricing model for a new derivative instrument, which gained widespread adoption in the financial markets.

Awards

- Received the Best Financial Engineer of the Year award from the International Association of Financial Engineers (IAFE).

- Ranked among the top 10% of financial engineers globally in the annual Risk Magazine survey.

- Received the Excellence in Financial Engineering award from the Institute for Financial Professionals (IFP).

- Chosen as a finalist in the Young Financial Engineer of the Year competition at the Global Finance Summit.

Certificates

- CFA (Chartered Financial Analyst)

- FRM (Financial Risk Manager)

- CAIA (Chartered Alternative Investment Analyst)

- CFP (Certified Financial Planner)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Financial Engineer

- Quantify your accomplishments whenever possible using numbers and metrics.

- Highlight your experience with specific financial engineering tools and techniques.

- Showcase your ability to work independently and as part of a team.

- Proofread your resume carefully for any errors before submitting it.

Essential Experience Highlights for a Strong Financial Engineer Resume

- Developed and implemented a quantitative trading model that generated a 12% annual return.

- Designed and calibrated a complex financial risk model for a major investment bank.

- Led a team of financial engineers in developing a software platform for portfolio optimization.

- Managed a $1 billion portfolio of fixed income investments.

- Developed and implemented a credit risk model for a commercial bank.

- Structured and priced complex financial products, such as derivatives and structured notes.

- Conducted financial due diligence for mergers and acquisitions.

Frequently Asked Questions (FAQ’s) For Financial Engineer

What is a financial engineer?

A financial engineer is a professional who uses mathematical and statistical methods to solve financial problems. They develop and implement models to assess risk, optimize portfolios, and price financial instruments.

What are the skills required to be a financial engineer?

Financial engineers typically have a strong foundation in mathematics, statistics, and computer science. They also have a good understanding of financial markets and instruments.

What are the career prospects for financial engineers?

Financial engineers are in high demand in a variety of industries, including investment banking, asset management, and insurance. They can work as portfolio managers, risk managers, and financial analysts.

What is the salary range for financial engineers?

The salary range for financial engineers varies depending on experience and industry. Entry-level financial engineers can expect to earn around $70,000 per year, while experienced financial engineers can earn over $200,000 per year.

How can I become a financial engineer?

To become a financial engineer, you typically need a master’s degree in financial engineering or a related field. You also need to have a strong foundation in mathematics, statistics, and computer science.

What are the different types of financial engineering?

There are many different types of financial engineering, including quantitative trading, risk management, portfolio optimization, and derivatives pricing.