Are you a seasoned Financial Institution Vice President seeking a new career path? Discover our professionally built Financial Institution Vice President Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

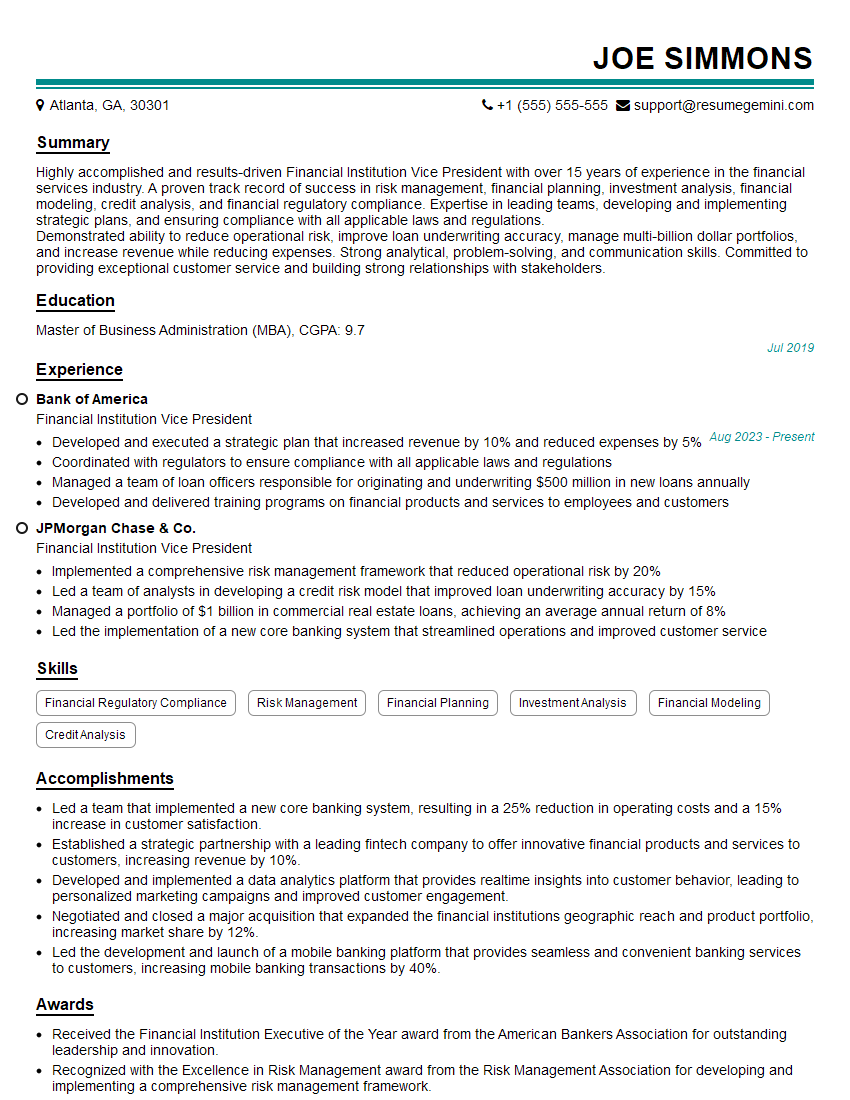

Joe Simmons

Financial Institution Vice President

Summary

Highly accomplished and results-driven Financial Institution Vice President with over 15 years of experience in the financial services industry. A proven track record of success in risk management, financial planning, investment analysis, financial modeling, credit analysis, and financial regulatory compliance. Expertise in leading teams, developing and implementing strategic plans, and ensuring compliance with all applicable laws and regulations.

Demonstrated ability to reduce operational risk, improve loan underwriting accuracy, manage multi-billion dollar portfolios, and increase revenue while reducing expenses. Strong analytical, problem-solving, and communication skills. Committed to providing exceptional customer service and building strong relationships with stakeholders.

Education

Master of Business Administration (MBA)

July 2019

Skills

- Financial Regulatory Compliance

- Risk Management

- Financial Planning

- Investment Analysis

- Financial Modeling

- Credit Analysis

Work Experience

Financial Institution Vice President

- Developed and executed a strategic plan that increased revenue by 10% and reduced expenses by 5%

- Coordinated with regulators to ensure compliance with all applicable laws and regulations

- Managed a team of loan officers responsible for originating and underwriting $500 million in new loans annually

- Developed and delivered training programs on financial products and services to employees and customers

Financial Institution Vice President

- Implemented a comprehensive risk management framework that reduced operational risk by 20%

- Led a team of analysts in developing a credit risk model that improved loan underwriting accuracy by 15%

- Managed a portfolio of $1 billion in commercial real estate loans, achieving an average annual return of 8%

- Led the implementation of a new core banking system that streamlined operations and improved customer service

Accomplishments

- Led a team that implemented a new core banking system, resulting in a 25% reduction in operating costs and a 15% increase in customer satisfaction.

- Established a strategic partnership with a leading fintech company to offer innovative financial products and services to customers, increasing revenue by 10%.

- Developed and implemented a data analytics platform that provides realtime insights into customer behavior, leading to personalized marketing campaigns and improved customer engagement.

- Negotiated and closed a major acquisition that expanded the financial institutions geographic reach and product portfolio, increasing market share by 12%.

- Led the development and launch of a mobile banking platform that provides seamless and convenient banking services to customers, increasing mobile banking transactions by 40%.

Awards

- Received the Financial Institution Executive of the Year award from the American Bankers Association for outstanding leadership and innovation.

- Recognized with the Excellence in Risk Management award from the Risk Management Association for developing and implementing a comprehensive risk management framework.

- Honored with the Community Banking Champion award from the Independent Community Bankers of America for exceptional contributions to community development.

- Received the Women in Leadership award from the National Association of Women in Banking for fostering diversity and inclusion in the financial industry.

Certificates

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Certified Treasury Professional (CTP)

- Certified Trust and Financial Advisor (CTFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Financial Institution Vice President

- Quantify your accomplishments and provide specific metrics to demonstrate your impact.

- Highlight your leadership experience and ability to manage and motivate teams.

- Emphasize your knowledge of financial regulatory compliance and risk management best practices.

- Showcase your analytical skills and ability to develop and implement financial models.

- Tailor your resume to each specific job you apply for, highlighting the skills and experience that are most relevant.

Essential Experience Highlights for a Strong Financial Institution Vice President Resume

- Develop and implement comprehensive risk management frameworks to mitigate operational, credit, and investment risks.

- Lead teams of analysts in developing and implementing financial models and analytical tools to support decision-making.

- Manage large portfolios of commercial real estate loans, ensuring compliance with loan covenants and achieving target returns.

- Oversee the implementation and maintenance of core banking systems to enhance operational efficiency and customer satisfaction.

- Develop and execute strategic plans to drive revenue growth, reduce expenses, and improve overall financial performance.

- Ensure compliance with all applicable laws and regulations, including anti-money laundering, know-your-customer, and consumer protection regulations.

- Lead and motivate teams of loan officers to originate and underwrite high-quality loans while maintaining sound credit risk management practices.

Frequently Asked Questions (FAQ’s) For Financial Institution Vice President

What are the key responsibilities of a Financial Institution Vice President?

Key responsibilities include developing and implementing risk management frameworks, leading teams of analysts, managing loan portfolios, overseeing core banking system implementation, developing strategic plans, ensuring regulatory compliance, and leading loan origination and underwriting teams.

What are the qualifications for a Financial Institution Vice President?

Typically, a Master of Business Administration (MBA) degree is required, along with 10+ years of experience in the financial services industry. Strong analytical, problem-solving, and communication skills are essential.

What is the career path to becoming a Financial Institution Vice President?

Common career paths include starting as a financial analyst, credit analyst, or loan officer, and gradually progressing through management roles with increasing responsibility.

What are the earning prospects for a Financial Institution Vice President?

Earning prospects vary depending on experience, company size, and location, but Vice Presidents in the financial services industry generally earn six-figure salaries, with bonuses and other incentives.

What are the challenges of being a Financial Institution Vice President?

Challenges include managing risk, ensuring regulatory compliance, adapting to changing market conditions, and meeting financial performance targets.

What are the rewards of being a Financial Institution Vice President?

Rewards include leading and motivating teams, making a positive impact on the organization, and earning a competitive salary and benefits package.

What are the key skills and qualities for a Financial Institution Vice President?

Key skills and qualities include analytical thinking, problem-solving, leadership, communication, financial expertise, and a strong work ethic.