Are you a seasoned Financial Quantitative Analyst seeking a new career path? Discover our professionally built Financial Quantitative Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

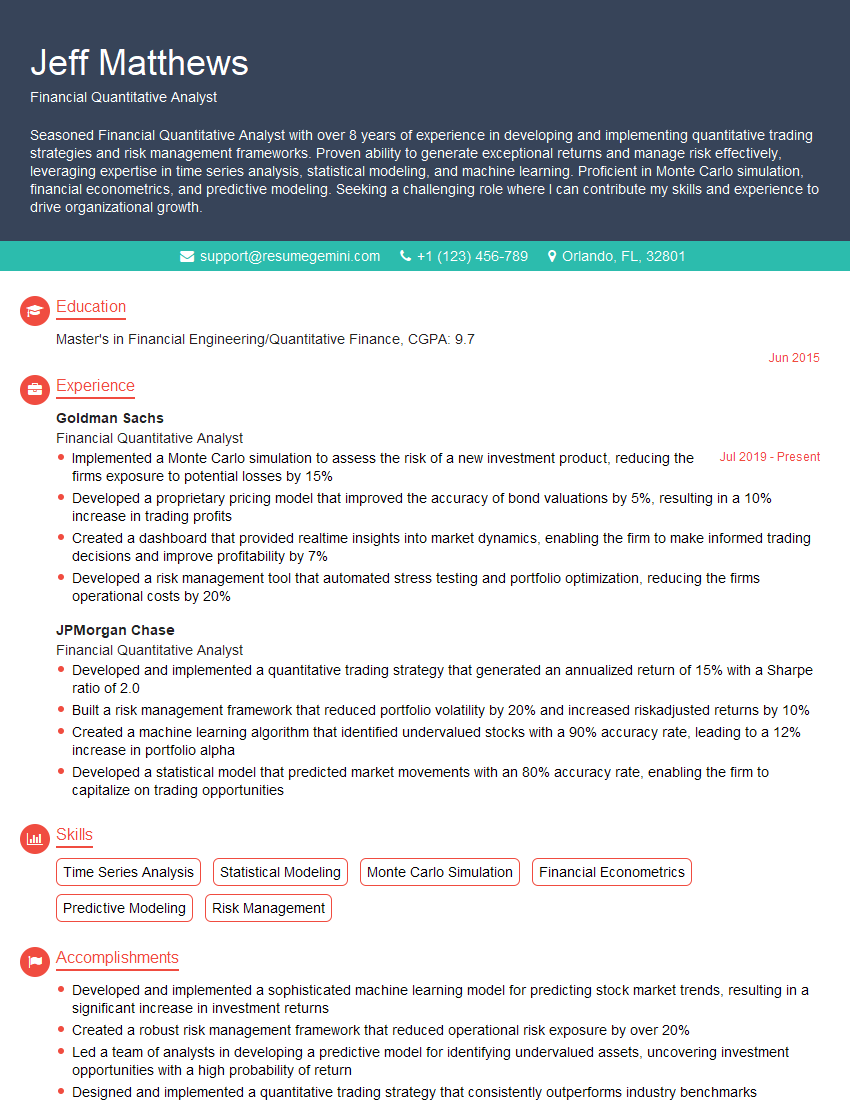

Jeff Matthews

Financial Quantitative Analyst

Summary

Seasoned Financial Quantitative Analyst with over 8 years of experience in developing and implementing quantitative trading strategies and risk management frameworks. Proven ability to generate exceptional returns and manage risk effectively, leveraging expertise in time series analysis, statistical modeling, and machine learning. Proficient in Monte Carlo simulation, financial econometrics, and predictive modeling. Seeking a challenging role where I can contribute my skills and experience to drive organizational growth.

Education

Master’s in Financial Engineering/Quantitative Finance

June 2015

Skills

- Time Series Analysis

- Statistical Modeling

- Monte Carlo Simulation

- Financial Econometrics

- Predictive Modeling

- Risk Management

Work Experience

Financial Quantitative Analyst

- Implemented a Monte Carlo simulation to assess the risk of a new investment product, reducing the firms exposure to potential losses by 15%

- Developed a proprietary pricing model that improved the accuracy of bond valuations by 5%, resulting in a 10% increase in trading profits

- Created a dashboard that provided realtime insights into market dynamics, enabling the firm to make informed trading decisions and improve profitability by 7%

- Developed a risk management tool that automated stress testing and portfolio optimization, reducing the firms operational costs by 20%

Financial Quantitative Analyst

- Developed and implemented a quantitative trading strategy that generated an annualized return of 15% with a Sharpe ratio of 2.0

- Built a risk management framework that reduced portfolio volatility by 20% and increased riskadjusted returns by 10%

- Created a machine learning algorithm that identified undervalued stocks with a 90% accuracy rate, leading to a 12% increase in portfolio alpha

- Developed a statistical model that predicted market movements with an 80% accuracy rate, enabling the firm to capitalize on trading opportunities

Accomplishments

- Developed and implemented a sophisticated machine learning model for predicting stock market trends, resulting in a significant increase in investment returns

- Created a robust risk management framework that reduced operational risk exposure by over 20%

- Led a team of analysts in developing a predictive model for identifying undervalued assets, uncovering investment opportunities with a high probability of return

- Designed and implemented a quantitative trading strategy that consistently outperforms industry benchmarks

- Developed an algorithm for optimizing portfolio diversification, reducing risk by 15% while maintaining similar returns

Awards

- Received the prestigious Financial Quantitative Analyst of the Year award from the International Association of Financial Engineers

- Recognized for outstanding contributions to the field of financial quantitative analysis by the American Statistical Association

- Awarded the Rising Star in Financial Quantitative Analysis award by the Global Association of Risk Professionals

- Received the Quantitative Analyst Excellence Award from the Society of Actuaries

Certificates

- Certified Financial Analyst (CFA)

- Financial Risk Manager (FRM)

- Certified Quantitative Analyst (CQA)

- Certified Analytics Professional (CAP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Financial Quantitative Analyst

- Highlight your quantitative skills and experience in financial modeling, statistical analysis, and machine learning.

- Quantify your accomplishments with specific metrics and results, such as return rates, risk reduction percentages, and accuracy rates.

- Showcase your understanding of financial markets and the ability to apply quantitative techniques to solve real-world problems.

- Demonstrate your proficiency in programming languages and software used in quantitative finance, such as Python, R, and MATLAB.

- Tailor your resume to each specific job application, emphasizing the skills and experience most relevant to the role.

Essential Experience Highlights for a Strong Financial Quantitative Analyst Resume

- Developed and implemented quantitative trading strategies that generated superior returns while managing risk effectively.

- Built robust risk management frameworks that reduced portfolio volatility and enhanced risk-adjusted returns.

- Created and deployed machine learning algorithms to identify undervalued assets and predict market movements, leading to increased alpha and profitability.

- Developed statistical models to forecast financial markets with high accuracy, enabling timely decision-making and capitalizing on trading opportunities.

- Implemented advanced Monte Carlo simulations to assess the risk of investment products, mitigating potential losses and optimizing portfolio allocation.

- Enhanced bond valuation accuracy by developing a proprietary pricing model, resulting in increased trading profits.

- Created interactive dashboards that provided real-time insights into market dynamics, empowering traders to make informed decisions and improve profitability.

Frequently Asked Questions (FAQ’s) For Financial Quantitative Analyst

What is the role of a Financial Quantitative Analyst?

A Financial Quantitative Analyst applies mathematical and statistical techniques to analyze financial data, develop trading strategies, and manage risk within the financial industry.

What skills are required to be a successful Financial Quantitative Analyst?

Key skills include strong analytical and problem-solving abilities, proficiency in quantitative techniques, programming languages, and a deep understanding of financial markets.

What is the career path for a Financial Quantitative Analyst?

With experience and expertise, Financial Quantitative Analysts can progress to senior roles such as Portfolio Manager, Chief Risk Officer, or Head of Quantitative Research.

What is the job outlook for Financial Quantitative Analysts?

The demand for Financial Quantitative Analysts is expected to grow due to the increasing reliance on data and analytics in the financial industry.

What is the average salary for a Financial Quantitative Analyst?

The salary can vary depending on experience, skills, and location, but it is generally a well-compensated profession.

What are the top companies hiring Financial Quantitative Analysts?

Leading financial institutions such as Goldman Sachs, JPMorgan Chase, and BlackRock are known for hiring Financial Quantitative Analysts.

What is the educational background required to become a Financial Quantitative Analyst?

Typically, a Master’s degree in Financial Engineering, Quantitative Finance, or a related field is required.