Are you a seasoned Financing Analyst seeking a new career path? Discover our professionally built Financing Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

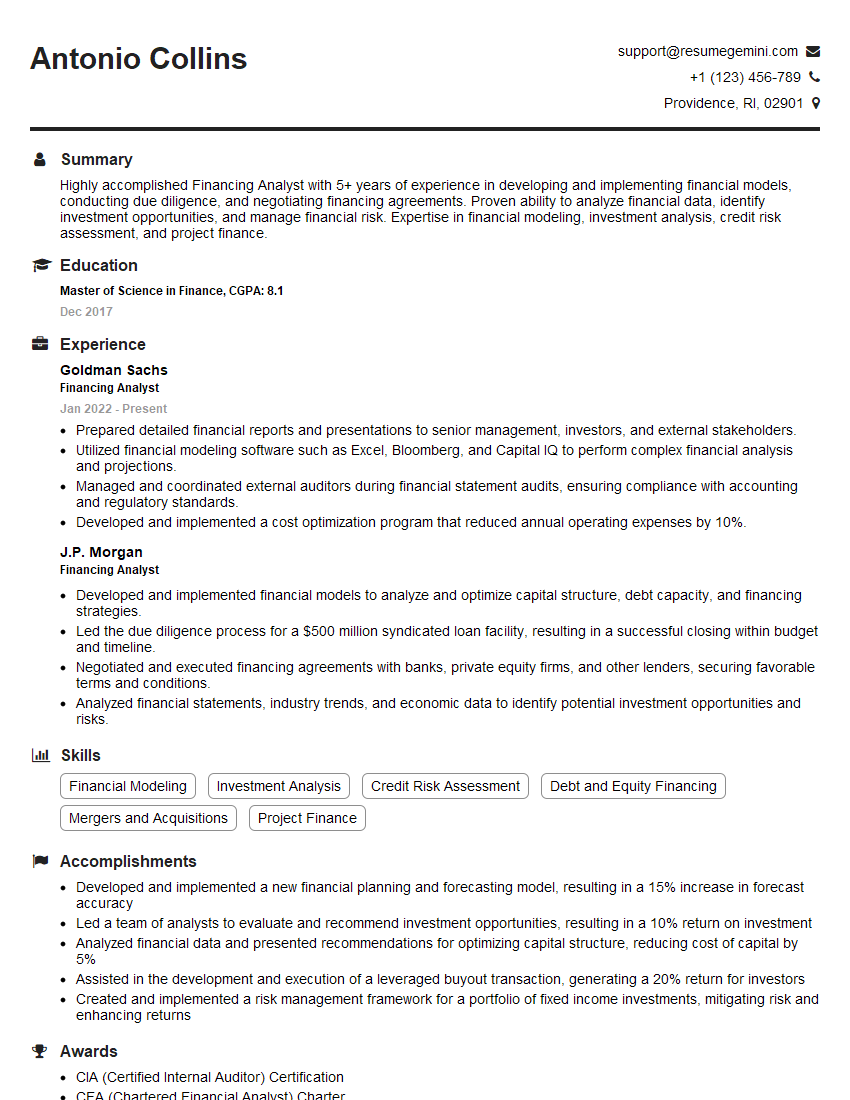

Antonio Collins

Financing Analyst

Summary

Highly accomplished Financing Analyst with 5+ years of experience in developing and implementing financial models, conducting due diligence, and negotiating financing agreements. Proven ability to analyze financial data, identify investment opportunities, and manage financial risk. Expertise in financial modeling, investment analysis, credit risk assessment, and project finance.

Education

Master of Science in Finance

December 2017

Skills

- Financial Modeling

- Investment Analysis

- Credit Risk Assessment

- Debt and Equity Financing

- Mergers and Acquisitions

- Project Finance

Work Experience

Financing Analyst

- Prepared detailed financial reports and presentations to senior management, investors, and external stakeholders.

- Utilized financial modeling software such as Excel, Bloomberg, and Capital IQ to perform complex financial analysis and projections.

- Managed and coordinated external auditors during financial statement audits, ensuring compliance with accounting and regulatory standards.

- Developed and implemented a cost optimization program that reduced annual operating expenses by 10%.

Financing Analyst

- Developed and implemented financial models to analyze and optimize capital structure, debt capacity, and financing strategies.

- Led the due diligence process for a $500 million syndicated loan facility, resulting in a successful closing within budget and timeline.

- Negotiated and executed financing agreements with banks, private equity firms, and other lenders, securing favorable terms and conditions.

- Analyzed financial statements, industry trends, and economic data to identify potential investment opportunities and risks.

Accomplishments

- Developed and implemented a new financial planning and forecasting model, resulting in a 15% increase in forecast accuracy

- Led a team of analysts to evaluate and recommend investment opportunities, resulting in a 10% return on investment

- Analyzed financial data and presented recommendations for optimizing capital structure, reducing cost of capital by 5%

- Assisted in the development and execution of a leveraged buyout transaction, generating a 20% return for investors

- Created and implemented a risk management framework for a portfolio of fixed income investments, mitigating risk and enhancing returns

Awards

- CIA (Certified Internal Auditor) Certification

- CFA (Chartered Financial Analyst) Charter

- FMI (Financial Modeling Institute) Certification

- CAIA (Chartered Alternative Investment Analyst) Designation

Certificates

- CFA (Chartered Financial Analyst)

- CAIA (Chartered Alternative Investment Analyst)

- FRM (Financial Risk Manager)

- CPA (Certified Public Accountant)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Financing Analyst

- Quantify your accomplishments whenever possible. Use specific numbers and metrics to demonstrate the impact of your work.

- Highlight your technical skills in financial modeling, investment analysis, and credit risk assessment.

- Demonstrate your ability to work independently and as part of a team.

- Proofread your resume carefully for any errors, including typos and grammatical mistakes.

Essential Experience Highlights for a Strong Financing Analyst Resume

- Develop and implement financial models to analyze and optimize capital structure, debt capacity, and financing strategies.

- Lead due diligence processes for syndicated loan facilities and other financing transactions.

- Negotiate and execute financing agreements with banks, private equity firms, and other lenders.

- Analyze financial statements, industry trends, and economic data to identify potential investment opportunities and risks.

- Prepare detailed financial reports and presentations to senior management, investors, and external stakeholders.

- Manage and coordinate external auditors during financial statement audits, ensuring compliance with accounting and regulatory standards.

- Develop and implement cost optimization programs to reduce operating expenses.

Frequently Asked Questions (FAQ’s) For Financing Analyst

What are the key responsibilities of a Financing Analyst?

Financing Analysts are responsible for developing and implementing financial models, conducting due diligence, and negotiating financing agreements. They also analyze financial data, identify investment opportunities, and manage financial risk.

What are the qualifications for a Financing Analyst?

Financing Analysts typically have a Master’s degree in Finance or a related field. They also have strong analytical skills, financial modeling experience, and knowledge of accounting and financial reporting.

What are the career prospects for a Financing Analyst?

Financing Analysts can advance to senior roles in corporate finance, investment banking, or private equity. They can also become financial advisors or portfolio managers.

What is the difference between a Financing Analyst and a Financial Analyst?

Financing Analysts focus on the financing aspects of a company, while Financial Analysts focus on the overall financial health of a company.

What are the top skills for a Financing Analyst?

The top skills for a Financing Analyst include financial modeling, investment analysis, credit risk assessment, and negotiation skills.