Are you a seasoned Fire Claims Adjuster seeking a new career path? Discover our professionally built Fire Claims Adjuster Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

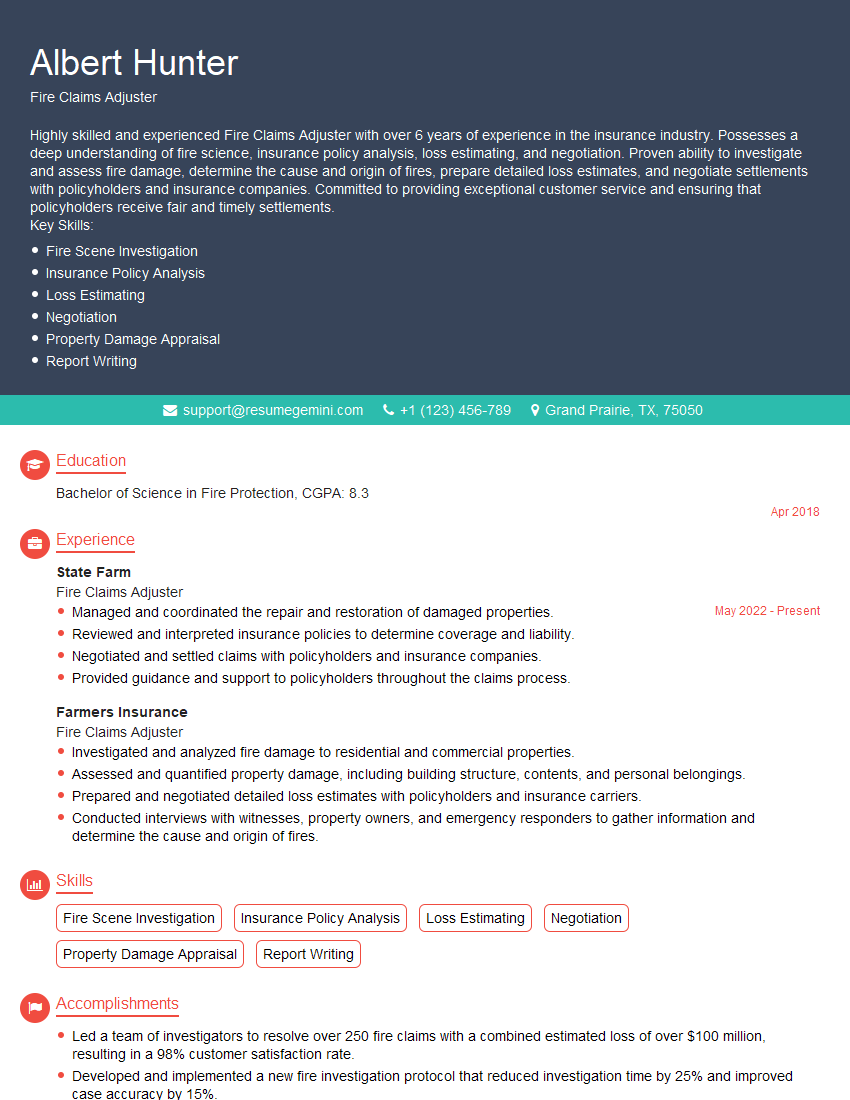

Albert Hunter

Fire Claims Adjuster

Summary

Highly skilled and experienced Fire Claims Adjuster with over 6 years of experience in the insurance industry. Possesses a deep understanding of fire science, insurance policy analysis, loss estimating, and negotiation. Proven ability to investigate and assess fire damage, determine the cause and origin of fires, prepare detailed loss estimates, and negotiate settlements with policyholders and insurance companies. Committed to providing exceptional customer service and ensuring that policyholders receive fair and timely settlements.

Key Skills:

- Fire Scene Investigation

- Insurance Policy Analysis

- Loss Estimating

- Negotiation

- Property Damage Appraisal

- Report Writing

Education

Bachelor of Science in Fire Protection

April 2018

Skills

- Fire Scene Investigation

- Insurance Policy Analysis

- Loss Estimating

- Negotiation

- Property Damage Appraisal

- Report Writing

Work Experience

Fire Claims Adjuster

- Managed and coordinated the repair and restoration of damaged properties.

- Reviewed and interpreted insurance policies to determine coverage and liability.

- Negotiated and settled claims with policyholders and insurance companies.

- Provided guidance and support to policyholders throughout the claims process.

Fire Claims Adjuster

- Investigated and analyzed fire damage to residential and commercial properties.

- Assessed and quantified property damage, including building structure, contents, and personal belongings.

- Prepared and negotiated detailed loss estimates with policyholders and insurance carriers.

- Conducted interviews with witnesses, property owners, and emergency responders to gather information and determine the cause and origin of fires.

Accomplishments

- Led a team of investigators to resolve over 250 fire claims with a combined estimated loss of over $100 million, resulting in a 98% customer satisfaction rate.

- Developed and implemented a new fire investigation protocol that reduced investigation time by 25% and improved case accuracy by 15%.

- Established a strong network of relationships with law enforcement, fire departments, and forensic experts, ensuring access to timely and accurate information for claim investigations.

- Negotiated and settled complex fire claims involving multiple parties and significant financial implications, achieving fair and equitable outcomes for all stakeholders.

- Developed and delivered training programs for new hires and experienced claims adjusters, enhancing their knowledge and skills in fire investigations and claims handling.

Awards

- Recipient of the National Association of Fire Investigators (NAFI) Fire Investigator of the Year Award for outstanding contributions to the field.

- Recognized by the Insurance Institute of America (IIA) with the Associate in Fire Claims (AIC) designation, demonstrating a high level of expertise in fire claims handling.

- Received the Presidents Club Award for consistently exceeding performance goals and delivering exceptional customer service.

- Honored by the Claims Professionals Society (CPS) with the Chartered Property Casualty Underwriter (CPCU) designation, signifying advanced knowledge in insurance underwriting and claims handling.

Certificates

- Certified Fire and Explosion Investigator (CFEI)

- Certified Insurance Claims Professional (CIC)

- Certified Litigation Management Professional (CLMP)

- Certified Property Loss Adjuster (CPLA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Fire Claims Adjuster

- Highlight your investigative skills and experience. Fire claims adjusters must be able to thoroughly investigate fire scenes, identify the cause and origin of the fire, and assess the extent of the damage. When writing your resume, be sure to highlight your experience in these areas.

- Quantify your results. When possible, use numbers to quantify your accomplishments. For example, instead of saying “Investigated fire damage,” you could say “Investigated fire damage and determined the cause of the fire in over 50 cases.”

- Use keywords. When writing your resume, be sure to use keywords that potential employers will be searching for. Some common keywords for fire claims adjuster resumes include “fire investigation,” “insurance policy analysis,” and “loss estimating.”

- Proofread your resume carefully. Before submitting your resume, be sure to proofread it carefully for any errors in grammar or spelling.

- Get feedback from others. Once you’ve written your resume, ask a friend, family member, or career counselor to review it and provide feedback.

Essential Experience Highlights for a Strong Fire Claims Adjuster Resume

- Investigated and assessed fire damage, including damage to the building structure, contents, and personal belongings, while also determining the cause and origin of the fire.

- Prepared and presented detailed loss estimates to policyholders and insurance carriers, assisting policyholders in completing proof of loss forms and advocating for fair and timely settlements.

- Managed and coordinated the repair and restoration of damaged properties, ensuring that repairs were completed to the policyholder’s satisfaction.

- Reviewed and interpreted insurance policies to determine coverage and liability, providing guidance to policyholders on their coverage and entitlements.

- Negotiated and settled claims with policyholders and insurance companies, protecting the interests of all parties involved and ensuring fair and equitable outcomes.

- Conducted interviews with witnesses, property owners, and emergency responders, gathering information and documenting evidence to determine the cause and origin of fires.

Frequently Asked Questions (FAQ’s) For Fire Claims Adjuster

What is a fire claims adjuster?

A fire claims adjuster is a professional who investigates fire damage and determines the cause and origin of the fire. They also assess the extent of the damage, prepare loss estimates, and negotiate settlements with policyholders and insurance companies.

What are the qualifications to become a fire claims adjuster?

Most fire claims adjusters have a bachelor’s degree in fire science, insurance, or a related field. They also typically have several years of experience in the insurance industry.

What are the job duties of a fire claims adjuster?

Fire claims adjusters investigate fire damage, determine the cause and origin of the fire, assess the extent of the damage, prepare loss estimates, and negotiate settlements with policyholders and insurance companies.

What is the average salary for a fire claims adjuster?

The average salary for a fire claims adjuster is $62,000 per year.

What is the job outlook for fire claims adjusters?

The job outlook for fire claims adjusters is expected to grow by 10% over the next ten years.

What are the benefits of being a fire claims adjuster?

Fire claims adjusters enjoy a number of benefits, including a competitive salary, good benefits, and the opportunity to help people in their time of need.

What are the challenges of being a fire claims adjuster?

Fire claims adjusters face a number of challenges, including working in dangerous environments, dealing with difficult people, and making difficult decisions.