Are you a seasoned Fiscal Accountant seeking a new career path? Discover our professionally built Fiscal Accountant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

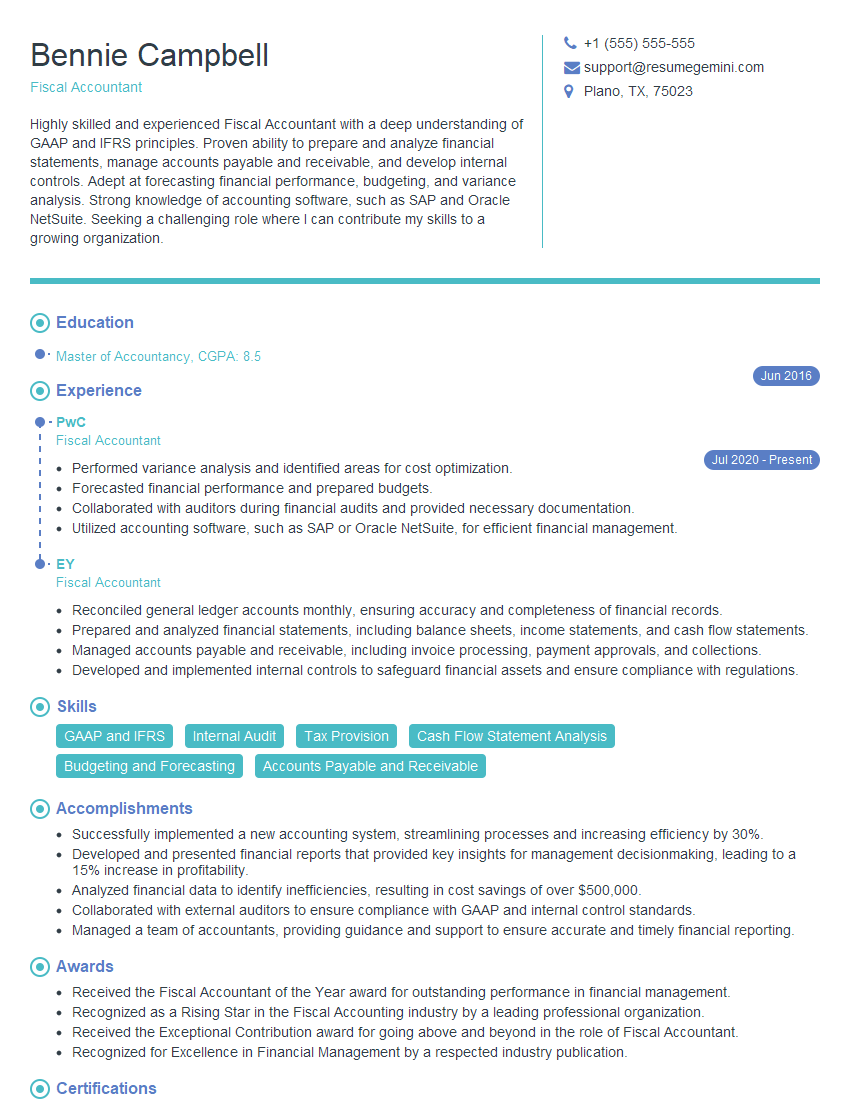

Bennie Campbell

Fiscal Accountant

Summary

Highly skilled and experienced Fiscal Accountant with a deep understanding of GAAP and IFRS principles. Proven ability to prepare and analyze financial statements, manage accounts payable and receivable, and develop internal controls. Adept at forecasting financial performance, budgeting, and variance analysis. Strong knowledge of accounting software, such as SAP and Oracle NetSuite. Seeking a challenging role where I can contribute my skills to a growing organization.

Education

Master of Accountancy

June 2016

Skills

- GAAP and IFRS

- Internal Audit

- Tax Provision

- Cash Flow Statement Analysis

- Budgeting and Forecasting

- Accounts Payable and Receivable

Work Experience

Fiscal Accountant

- Performed variance analysis and identified areas for cost optimization.

- Forecasted financial performance and prepared budgets.

- Collaborated with auditors during financial audits and provided necessary documentation.

- Utilized accounting software, such as SAP or Oracle NetSuite, for efficient financial management.

Fiscal Accountant

- Reconciled general ledger accounts monthly, ensuring accuracy and completeness of financial records.

- Prepared and analyzed financial statements, including balance sheets, income statements, and cash flow statements.

- Managed accounts payable and receivable, including invoice processing, payment approvals, and collections.

- Developed and implemented internal controls to safeguard financial assets and ensure compliance with regulations.

Accomplishments

- Successfully implemented a new accounting system, streamlining processes and increasing efficiency by 30%.

- Developed and presented financial reports that provided key insights for management decisionmaking, leading to a 15% increase in profitability.

- Analyzed financial data to identify inefficiencies, resulting in cost savings of over $500,000.

- Collaborated with external auditors to ensure compliance with GAAP and internal control standards.

- Managed a team of accountants, providing guidance and support to ensure accurate and timely financial reporting.

Awards

- Received the Fiscal Accountant of the Year award for outstanding performance in financial management.

- Recognized as a Rising Star in the Fiscal Accounting industry by a leading professional organization.

- Received the Exceptional Contribution award for going above and beyond in the role of Fiscal Accountant.

- Recognized for Excellence in Financial Management by a respected industry publication.

Certificates

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Certified Internal Auditor (CIA)

- Certified Anti-Money Laundering Specialist (CAMS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Fiscal Accountant

Highlight your relevant skills and experience.

Make sure to tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.Use strong action verbs.

When describing your experience, use strong action verbs that convey your accomplishments. For example, instead of saying “I prepared financial statements,” say “I prepared and analyzed financial statements, including balance sheets, income statements, and cash flow statements.”Quantify your results.

When possible, quantify your results to show the impact of your work. For example, instead of saying “I implemented internal controls,” say “I implemented internal controls that resulted in a 15% reduction in fraud losses.”Proofread your resume carefully.

Before submitting your resume, proofread it carefully for any errors in grammar, spelling, or punctuation.

Essential Experience Highlights for a Strong Fiscal Accountant Resume

- Reconciled general ledger accounts monthly to ensure accuracy and completeness of financial records.

- Prepared and analyzed financial statements, including balance sheets, income statements, and cash flow statements.

- Managed accounts payable and receivable, including invoice processing, payment approvals, and collections.

- Developed and implemented internal controls to safeguard financial assets and ensure compliance with regulations.

- Performed variance analysis and identified areas for cost optimization.

- Forecasted financial performance and prepared budgets.

- Collaborated with auditors during financial audits and provided necessary documentation.

Frequently Asked Questions (FAQ’s) For Fiscal Accountant

What is the role of a Fiscal Accountant?

A Fiscal Accountant is responsible for the day-to-day accounting operations of an organization. This includes tasks such as preparing financial statements, managing accounts payable and receivable, and developing internal controls.

What are the qualifications for a Fiscal Accountant?

Most Fiscal Accountants have a bachelor’s degree in accounting or a related field. They also typically have several years of experience in accounting, including experience with GAAP and IFRS.

What are the career prospects for a Fiscal Accountant?

Fiscal Accountants can advance to positions such as Controller, CFO, or Vice President of Finance. They may also choose to specialize in a particular area of accounting, such as auditing or tax.

What is the average salary for a Fiscal Accountant?

The average salary for a Fiscal Accountant is $75,000 per year.

What are the challenges of being a Fiscal Accountant?

Some of the challenges of being a Fiscal Accountant include the need to stay up-to-date on accounting regulations, the pressure to meet deadlines, and the need to work long hours during busy seasons.

What are the rewards of being a Fiscal Accountant?

Some of the rewards of being a Fiscal Accountant include the opportunity to make a difference in an organization, the chance to learn about different industries, and the potential for career advancement.