Are you a seasoned Fiscal Specialist seeking a new career path? Discover our professionally built Fiscal Specialist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

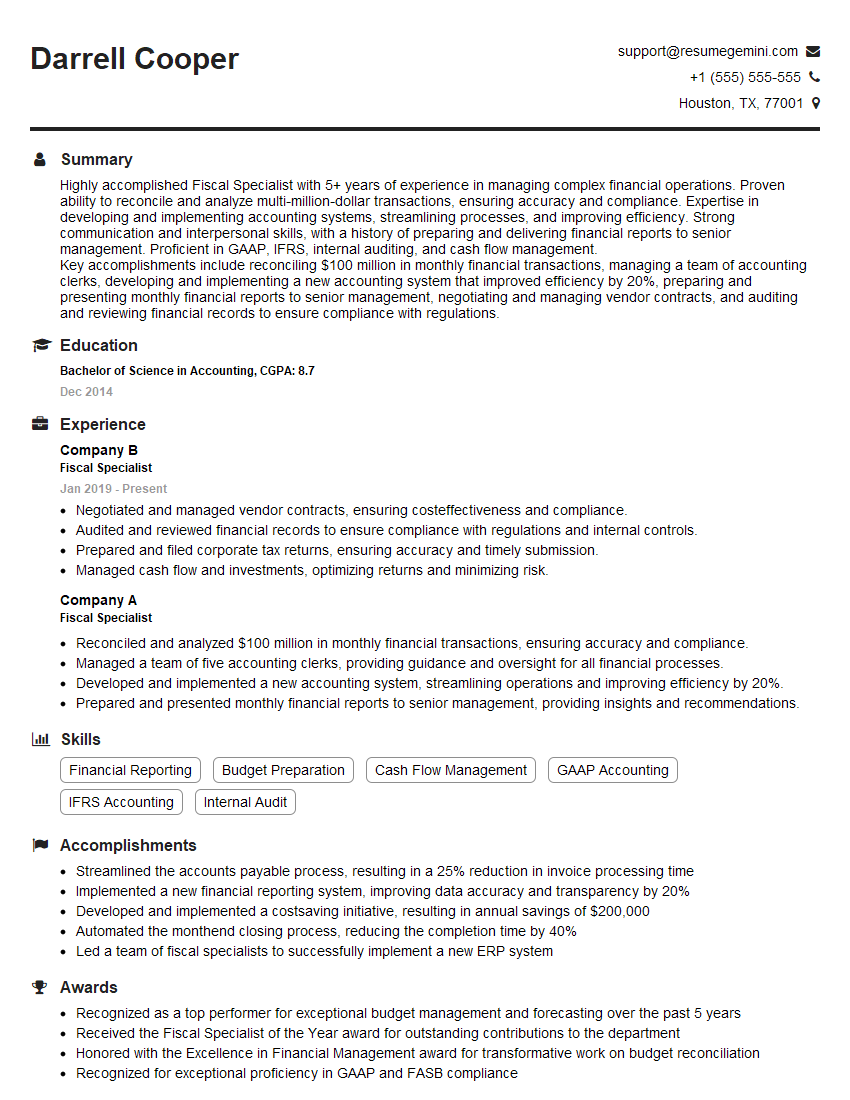

Darrell Cooper

Fiscal Specialist

Summary

Highly accomplished Fiscal Specialist with 5+ years of experience in managing complex financial operations. Proven ability to reconcile and analyze multi-million-dollar transactions, ensuring accuracy and compliance. Expertise in developing and implementing accounting systems, streamlining processes, and improving efficiency. Strong communication and interpersonal skills, with a history of preparing and delivering financial reports to senior management. Proficient in GAAP, IFRS, internal auditing, and cash flow management.

Key accomplishments include reconciling $100 million in monthly financial transactions, managing a team of accounting clerks, developing and implementing a new accounting system that improved efficiency by 20%, preparing and presenting monthly financial reports to senior management, negotiating and managing vendor contracts, and auditing and reviewing financial records to ensure compliance with regulations.

Education

Bachelor of Science in Accounting

December 2014

Skills

- Financial Reporting

- Budget Preparation

- Cash Flow Management

- GAAP Accounting

- IFRS Accounting

- Internal Audit

Work Experience

Fiscal Specialist

- Negotiated and managed vendor contracts, ensuring costeffectiveness and compliance.

- Audited and reviewed financial records to ensure compliance with regulations and internal controls.

- Prepared and filed corporate tax returns, ensuring accuracy and timely submission.

- Managed cash flow and investments, optimizing returns and minimizing risk.

Fiscal Specialist

- Reconciled and analyzed $100 million in monthly financial transactions, ensuring accuracy and compliance.

- Managed a team of five accounting clerks, providing guidance and oversight for all financial processes.

- Developed and implemented a new accounting system, streamlining operations and improving efficiency by 20%.

- Prepared and presented monthly financial reports to senior management, providing insights and recommendations.

Accomplishments

- Streamlined the accounts payable process, resulting in a 25% reduction in invoice processing time

- Implemented a new financial reporting system, improving data accuracy and transparency by 20%

- Developed and implemented a costsaving initiative, resulting in annual savings of $200,000

- Automated the monthend closing process, reducing the completion time by 40%

- Led a team of fiscal specialists to successfully implement a new ERP system

Awards

- Recognized as a top performer for exceptional budget management and forecasting over the past 5 years

- Received the Fiscal Specialist of the Year award for outstanding contributions to the department

- Honored with the Excellence in Financial Management award for transformative work on budget reconciliation

- Recognized for exceptional proficiency in GAAP and FASB compliance

Certificates

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Certified Internal Auditor (CIA)

- Certified Government Financial Manager (CGFM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Fiscal Specialist

- Highlight your experience in reconciling and analyzing financial transactions, ensuring accuracy and compliance.

- Emphasize your skills in developing and implementing accounting systems, streamlining processes, and improving efficiency.

- Showcase your experience in preparing and presenting financial reports to senior management, providing insights and recommendations.

- Quantify your accomplishments whenever possible, providing specific examples of how you have contributed to the success of your organization.

- Proofread your resume carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Fiscal Specialist Resume

- Reconcile and analyze financial transactions to ensure accuracy and compliance with GAAP and IFRS.

- Manage a team of accounting clerks, providing guidance and oversight for all financial processes.

- Develop and implement accounting systems and procedures to streamline operations and improve efficiency.

- Prepare and present monthly financial reports to senior management, highlighting key trends and providing insights.

- Negotiate and manage vendor contracts, ensuring cost-effectiveness and compliance with company policies.

- Conduct internal audits and reviews of financial records to ensure adherence to regulations and internal controls.

- Prepare and file corporate tax returns, ensuring accuracy and timely submission.

- Manage cash flow and investments to optimize returns and minimize risk.

Frequently Asked Questions (FAQ’s) For Fiscal Specialist

What are the key responsibilities of a Fiscal Specialist?

The key responsibilities of a Fiscal Specialist include reconciling and analyzing financial transactions, managing a team of accounting clerks, developing and implementing accounting systems, preparing and presenting financial reports to senior management, negotiating and managing vendor contracts, conducting internal audits, preparing and filing corporate tax returns, and managing cash flow and investments.

What are the educational requirements for a Fiscal Specialist?

A Bachelor’s degree in Accounting, Finance, or a related field is typically required for a Fiscal Specialist position.

What are the skills required for a Fiscal Specialist?

The skills required for a Fiscal Specialist include proficiency in GAAP and IFRS, internal auditing, cash flow management, financial reporting, and budget preparation.

What are the career prospects for a Fiscal Specialist?

Fiscal Specialists can advance their careers by moving into management roles, such as Controller or CFO. They can also specialize in a particular area of finance, such as financial analysis or tax accounting.

What is the average salary for a Fiscal Specialist?

The average salary for a Fiscal Specialist in the United States is around $75,000 per year.