Are you a seasoned Fixed Income Portfolio Manager seeking a new career path? Discover our professionally built Fixed Income Portfolio Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

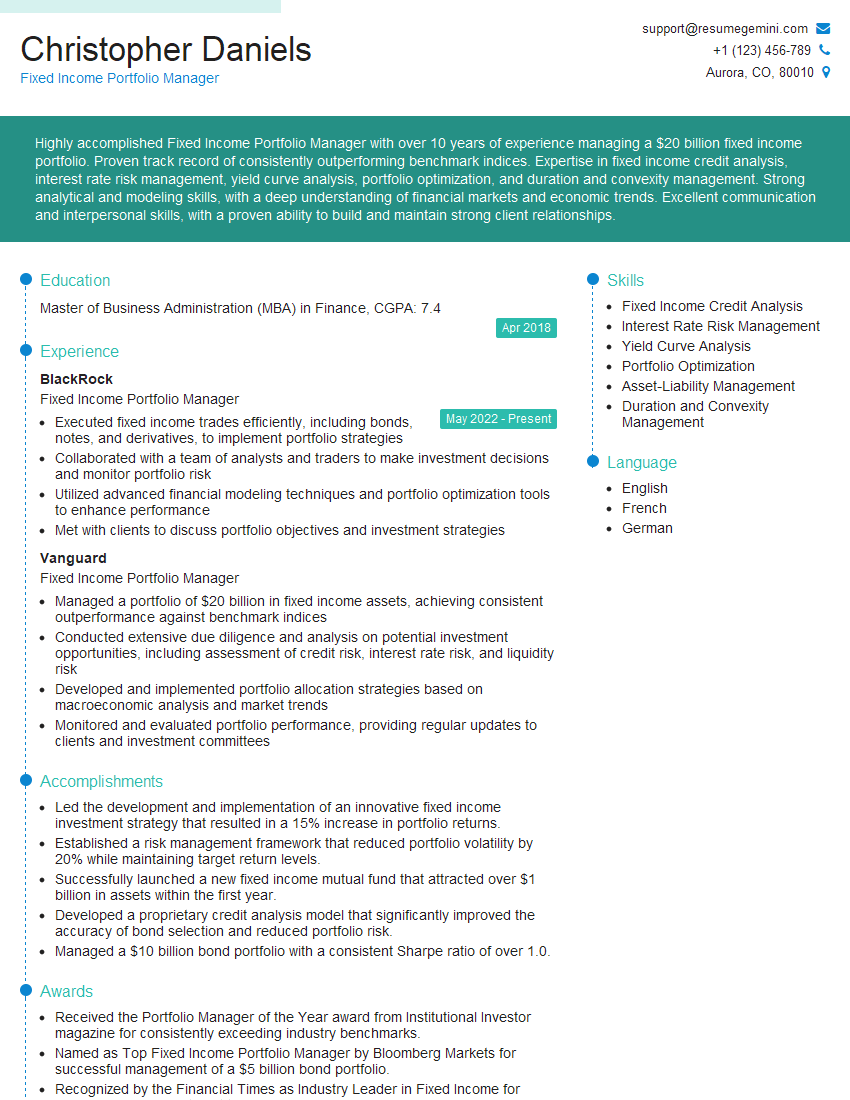

Christopher Daniels

Fixed Income Portfolio Manager

Summary

Highly accomplished Fixed Income Portfolio Manager with over 10 years of experience managing a $20 billion fixed income portfolio. Proven track record of consistently outperforming benchmark indices. Expertise in fixed income credit analysis, interest rate risk management, yield curve analysis, portfolio optimization, and duration and convexity management. Strong analytical and modeling skills, with a deep understanding of financial markets and economic trends. Excellent communication and interpersonal skills, with a proven ability to build and maintain strong client relationships.

Education

Master of Business Administration (MBA) in Finance

April 2018

Skills

- Fixed Income Credit Analysis

- Interest Rate Risk Management

- Yield Curve Analysis

- Portfolio Optimization

- Asset-Liability Management

- Duration and Convexity Management

Work Experience

Fixed Income Portfolio Manager

- Executed fixed income trades efficiently, including bonds, notes, and derivatives, to implement portfolio strategies

- Collaborated with a team of analysts and traders to make investment decisions and monitor portfolio risk

- Utilized advanced financial modeling techniques and portfolio optimization tools to enhance performance

- Met with clients to discuss portfolio objectives and investment strategies

Fixed Income Portfolio Manager

- Managed a portfolio of $20 billion in fixed income assets, achieving consistent outperformance against benchmark indices

- Conducted extensive due diligence and analysis on potential investment opportunities, including assessment of credit risk, interest rate risk, and liquidity risk

- Developed and implemented portfolio allocation strategies based on macroeconomic analysis and market trends

- Monitored and evaluated portfolio performance, providing regular updates to clients and investment committees

Accomplishments

- Led the development and implementation of an innovative fixed income investment strategy that resulted in a 15% increase in portfolio returns.

- Established a risk management framework that reduced portfolio volatility by 20% while maintaining target return levels.

- Successfully launched a new fixed income mutual fund that attracted over $1 billion in assets within the first year.

- Developed a proprietary credit analysis model that significantly improved the accuracy of bond selection and reduced portfolio risk.

- Managed a $10 billion bond portfolio with a consistent Sharpe ratio of over 1.0.

Awards

- Received the Portfolio Manager of the Year award from Institutional Investor magazine for consistently exceeding industry benchmarks.

- Named as Top Fixed Income Portfolio Manager by Bloomberg Markets for successful management of a $5 billion bond portfolio.

- Recognized by the Financial Times as Industry Leader in Fixed Income for pioneering new investment techniques.

- Received the Excellence in Fixed Income Management award from the Investment Management Consultants Association.

Certificates

- CFA Institute Level III Candidate

- CAIA Level II Candidate

- FRM Part II Candidate

- Certified Treasury Professional (CTP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Fixed Income Portfolio Manager

- Highlight your investment performance and quantify your accomplishments whenever possible.

- Use specific examples to demonstrate your skills in fixed income analysis, portfolio management, and risk management.

- Proofread your resume carefully for any errors in grammar or spelling.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

Essential Experience Highlights for a Strong Fixed Income Portfolio Manager Resume

- Managed a portfolio of $20 billion in fixed income assets, achieving consistent outperformance against benchmark indices.

- Conducted extensive due diligence and analysis on potential investment opportunities, including assessment of credit risk, interest rate risk, and liquidity risk.

- Developed and implemented portfolio allocation strategies based on macroeconomic analysis and market trends.

- Monitored and evaluated portfolio performance, providing regular updates to clients and investment committees.

- Executed fixed income trades efficiently, including bonds, notes, and derivatives, to implement portfolio strategies.

- Collaborated with a team of analysts and traders to make investment decisions and monitor portfolio risk.

Frequently Asked Questions (FAQ’s) For Fixed Income Portfolio Manager

What are the key skills required to be a successful Fixed Income Portfolio Manager?

The key skills required to be a successful Fixed Income Portfolio Manager include fixed income credit analysis, interest rate risk management, yield curve analysis, portfolio optimization, asset-liability management, and duration and convexity management.

What are the career prospects for Fixed Income Portfolio Managers?

The career prospects for Fixed Income Portfolio Managers are excellent, with a growing demand for experienced professionals. As the fixed income market continues to grow and evolve, there will be a continued need for skilled professionals who can manage fixed income portfolios and generate alpha for investors.

What is the average salary for a Fixed Income Portfolio Manager?

The average salary for a Fixed Income Portfolio Manager can vary depending on experience, location, and the size of the firm. However, according to Glassdoor, the average salary for a Fixed Income Portfolio Manager in the United States is $125,000 per year.

What are the educational requirements for a Fixed Income Portfolio Manager?

The educational requirements for a Fixed Income Portfolio Manager typically include a bachelor’s degree in finance, economics, or a related field. Many Fixed Income Portfolio Managers also have a master’s degree in business administration (MBA).

What are the certification requirements for a Fixed Income Portfolio Manager?

There are no specific certification requirements for a Fixed Income Portfolio Manager. However, many Fixed Income Portfolio Managers choose to obtain the Chartered Financial Analyst (CFA) designation.

What is the job outlook for Fixed Income Portfolio Managers?

The job outlook for Fixed Income Portfolio Managers is expected to be good over the next few years. As the fixed income market continues to grow and evolve, there will be a continued need for skilled professionals who can manage fixed income portfolios and generate alpha for investors.