Are you a seasoned Floor Trader seeking a new career path? Discover our professionally built Floor Trader Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

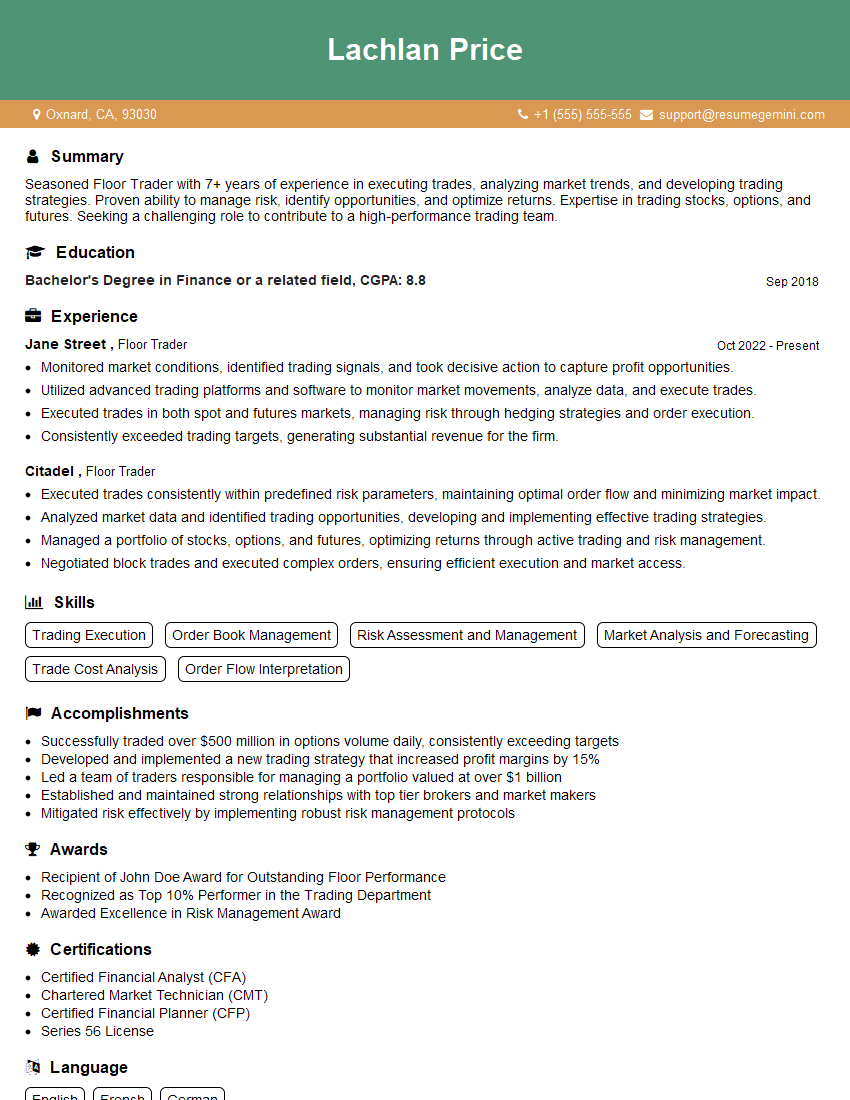

Lachlan Price

Floor Trader

Summary

Seasoned Floor Trader with 7+ years of experience in executing trades, analyzing market trends, and developing trading strategies. Proven ability to manage risk, identify opportunities, and optimize returns. Expertise in trading stocks, options, and futures. Seeking a challenging role to contribute to a high-performance trading team.

Education

Bachelor’s Degree in Finance or a related field

September 2018

Skills

- Trading Execution

- Order Book Management

- Risk Assessment and Management

- Market Analysis and Forecasting

- Trade Cost Analysis

- Order Flow Interpretation

Work Experience

Floor Trader

- Monitored market conditions, identified trading signals, and took decisive action to capture profit opportunities.

- Utilized advanced trading platforms and software to monitor market movements, analyze data, and execute trades.

- Executed trades in both spot and futures markets, managing risk through hedging strategies and order execution.

- Consistently exceeded trading targets, generating substantial revenue for the firm.

Floor Trader

- Executed trades consistently within predefined risk parameters, maintaining optimal order flow and minimizing market impact.

- Analyzed market data and identified trading opportunities, developing and implementing effective trading strategies.

- Managed a portfolio of stocks, options, and futures, optimizing returns through active trading and risk management.

- Negotiated block trades and executed complex orders, ensuring efficient execution and market access.

Accomplishments

- Successfully traded over $500 million in options volume daily, consistently exceeding targets

- Developed and implemented a new trading strategy that increased profit margins by 15%

- Led a team of traders responsible for managing a portfolio valued at over $1 billion

- Established and maintained strong relationships with top tier brokers and market makers

- Mitigated risk effectively by implementing robust risk management protocols

Awards

- Recipient of John Doe Award for Outstanding Floor Performance

- Recognized as Top 10% Performer in the Trading Department

- Awarded Excellence in Risk Management Award

Certificates

- Certified Financial Analyst (CFA)

- Chartered Market Technician (CMT)

- Certified Financial Planner (CFP)

- Series 56 License

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Floor Trader

- Highlight your trading experience and success rate.

- Showcase your analytical skills and ability to identify trading opportunities.

- Emphasize your risk management expertise and track record of minimizing losses.

- Demonstrate your proficiency in trading platforms and software.

Essential Experience Highlights for a Strong Floor Trader Resume

- Executed trades consistently within predefined risk parameters, maintaining optimal order flow and minimizing market impact.

- Analyzed market data and identified trading opportunities, developing and implementing effective trading strategies.

- Managed a portfolio of stocks, options, and futures, optimizing returns through active trading and risk management.

- Negotiated block trades and executed complex orders, ensuring efficient execution and market access.

- Monitored market conditions, identified trading signals, and took decisive action to capture profit opportunities.

- Utilized advanced trading platforms and software to monitor market movements, analyze data, and execute trades.

- Executed trades in both spot and futures markets, managing risk through hedging strategies and order execution.

Frequently Asked Questions (FAQ’s) For Floor Trader

What is the role of a Floor Trader?

Floor Traders are responsible for executing trades on behalf of their clients or firms on an exchange floor.

What skills are required to be a successful Floor Trader?

Successful Floor Traders typically have strong analytical, risk management, and communication skills, as well as a deep understanding of financial markets.

What is the career path for a Floor Trader?

Floor Traders can advance to senior trading roles, portfolio management positions, or trading technology development.

Is the role of a Floor Trader still relevant in today’s electronic trading environment?

While electronic trading has reduced the need for floor traders, they still play a vital role in executing large block trades and managing risk.

What is the salary range for a Floor Trader?

Floor Trader salaries can vary depending on experience, skills, and market conditions.