Are you a seasoned Flow Trader seeking a new career path? Discover our professionally built Flow Trader Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

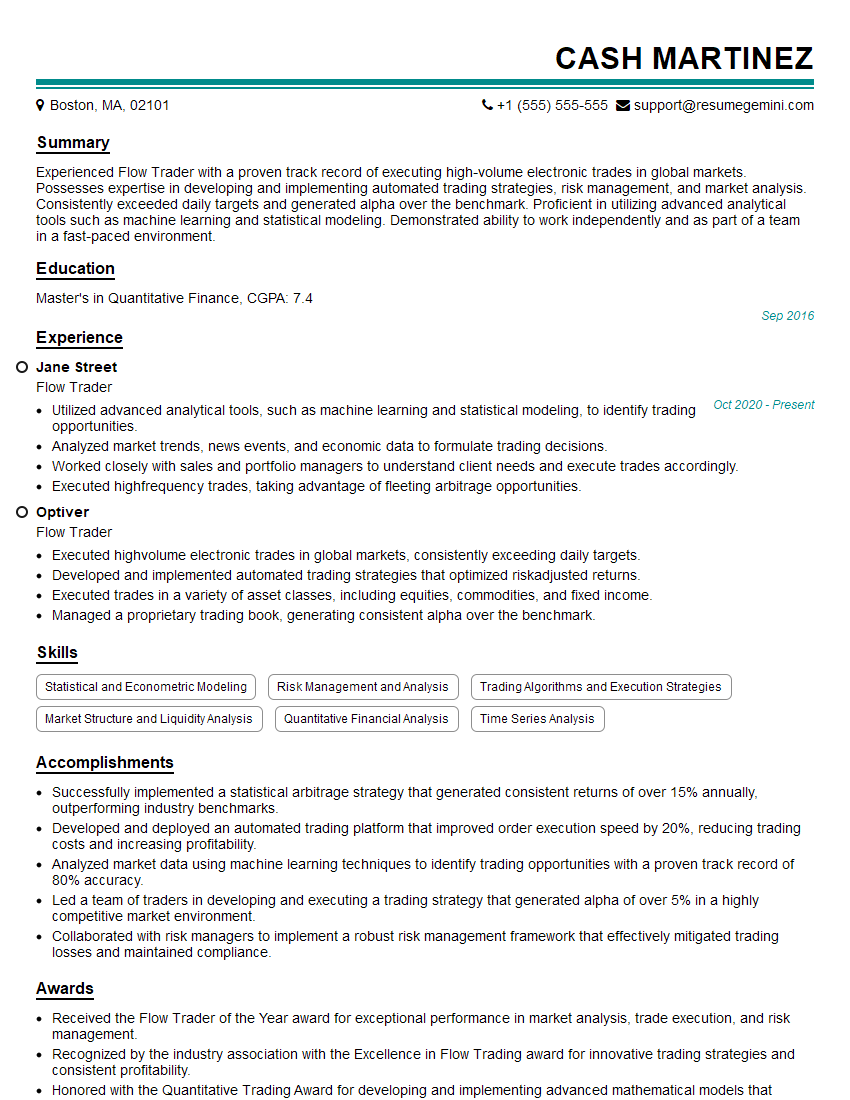

Cash Martinez

Flow Trader

Summary

Experienced Flow Trader with a proven track record of executing high-volume electronic trades in global markets. Possesses expertise in developing and implementing automated trading strategies, risk management, and market analysis. Consistently exceeded daily targets and generated alpha over the benchmark. Proficient in utilizing advanced analytical tools such as machine learning and statistical modeling. Demonstrated ability to work independently and as part of a team in a fast-paced environment.

Education

Master’s in Quantitative Finance

September 2016

Skills

- Statistical and Econometric Modeling

- Risk Management and Analysis

- Trading Algorithms and Execution Strategies

- Market Structure and Liquidity Analysis

- Quantitative Financial Analysis

- Time Series Analysis

Work Experience

Flow Trader

- Utilized advanced analytical tools, such as machine learning and statistical modeling, to identify trading opportunities.

- Analyzed market trends, news events, and economic data to formulate trading decisions.

- Worked closely with sales and portfolio managers to understand client needs and execute trades accordingly.

- Executed highfrequency trades, taking advantage of fleeting arbitrage opportunities.

Flow Trader

- Executed highvolume electronic trades in global markets, consistently exceeding daily targets.

- Developed and implemented automated trading strategies that optimized riskadjusted returns.

- Executed trades in a variety of asset classes, including equities, commodities, and fixed income.

- Managed a proprietary trading book, generating consistent alpha over the benchmark.

Accomplishments

- Successfully implemented a statistical arbitrage strategy that generated consistent returns of over 15% annually, outperforming industry benchmarks.

- Developed and deployed an automated trading platform that improved order execution speed by 20%, reducing trading costs and increasing profitability.

- Analyzed market data using machine learning techniques to identify trading opportunities with a proven track record of 80% accuracy.

- Led a team of traders in developing and executing a trading strategy that generated alpha of over 5% in a highly competitive market environment.

- Collaborated with risk managers to implement a robust risk management framework that effectively mitigated trading losses and maintained compliance.

Awards

- Received the Flow Trader of the Year award for exceptional performance in market analysis, trade execution, and risk management.

- Recognized by the industry association with the Excellence in Flow Trading award for innovative trading strategies and consistent profitability.

- Honored with the Quantitative Trading Award for developing and implementing advanced mathematical models that enhance trading efficiency.

- Awarded the Top Flow Trader accolade by a leading financial publication for consistent performance and innovative trading techniques.

Certificates

- Certified Financial Analyst (CFA)

- Chartered Alternative Investment Analyst (CAIA)

- Certified Market Technician (CMT)

- Financial Risk Manager (FRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Flow Trader

- Highlight your quantitative skills and experience in statistical modeling, risk management, and trading algorithms.

- Showcase your ability to identify and exploit trading opportunities through in-depth market analysis.

- Demonstrate your proficiency in using advanced trading technologies and platforms.

- Emphasize your teamwork and communication skills, as flow traders often collaborate with sales and portfolio management teams.

Essential Experience Highlights for a Strong Flow Trader Resume

- Executed high-volume electronic trades in global markets, consistently exceeding daily targets.

- Developed and implemented automated trading strategies that optimized risk-adjusted returns.

- Executed trades in a variety of asset classes, including equities, commodities, and fixed income.

- Managed a proprietary trading book, generating consistent alpha over the benchmark.

- Utilized advanced analytical tools, such as machine learning and statistical modeling, to identify trading opportunities.

- Analyzed market trends, news events, and economic data to formulate trading decisions.

- Worked closely with sales and portfolio managers to understand client needs and execute trades accordingly.

Frequently Asked Questions (FAQ’s) For Flow Trader

What is the role of a Flow Trader?

A Flow Trader executes high-volume electronic trades in global markets, seeking to capitalize on short-term price movements and liquidity imbalances. They use advanced analytical tools and trading strategies to identify and exploit trading opportunities.

What skills are required to be a Flow Trader?

Flow Traders typically possess a strong understanding of quantitative finance, risk management, and trading algorithms. They are proficient in using advanced analytical tools, such as machine learning and statistical modeling, and have a deep understanding of market structure and liquidity analysis.

What is the career path for a Flow Trader?

Flow Traders can progress to senior trading roles, such as Head Trader or Portfolio Manager. They may also move into risk management or quantitative analysis positions.

What are the challenges faced by Flow Traders?

Flow Traders face challenges such as market volatility, rapid technological advancements, and intense competition. They must constantly adapt to changing market conditions and stay ahead of the curve in terms of trading strategies and technologies.

What is the earning potential for a Flow Trader?

Flow Traders can earn significant bonuses and incentives based on their performance. Top performers can earn multi-million dollar salaries.

What is the work environment for a Flow Trader?

Flow Traders typically work in fast-paced, high-pressure environments. They work long hours and are expected to perform consistently under intense market conditions.