Are you a seasoned Force Adjustment Supervisor seeking a new career path? Discover our professionally built Force Adjustment Supervisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

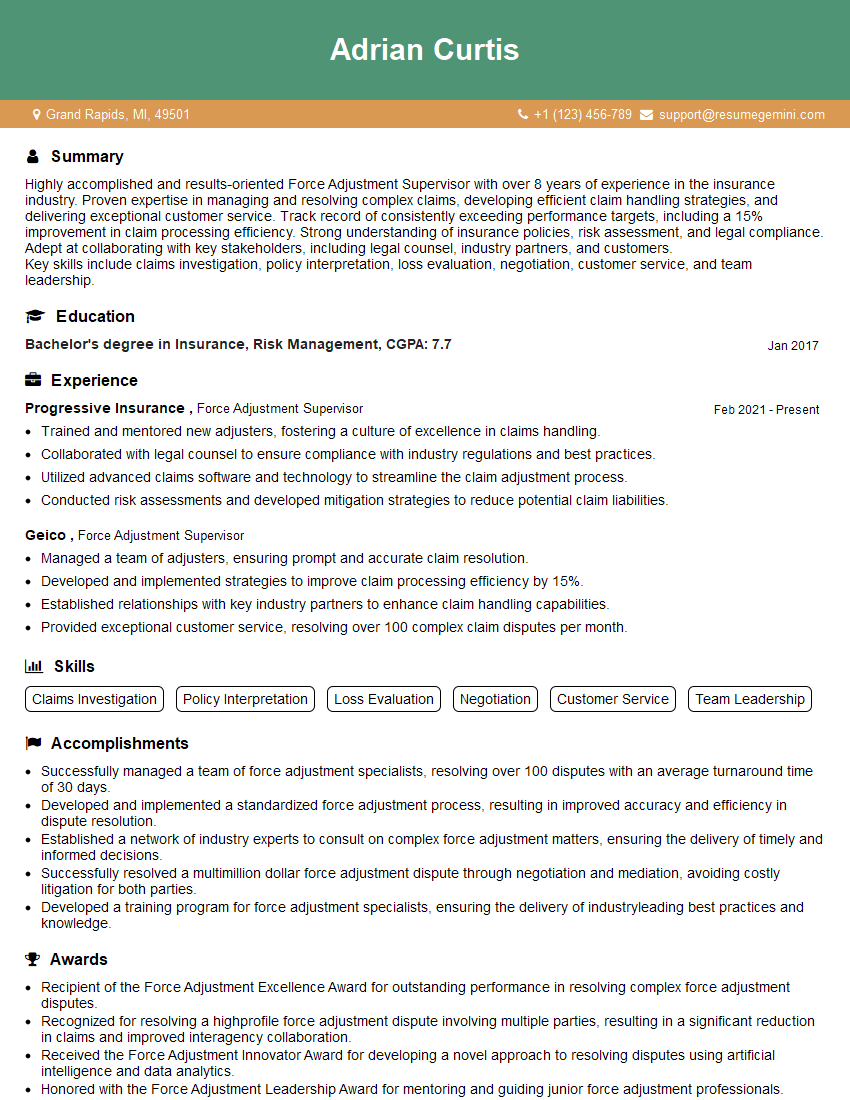

Adrian Curtis

Force Adjustment Supervisor

Summary

Highly accomplished and results-oriented Force Adjustment Supervisor with over 8 years of experience in the insurance industry. Proven expertise in managing and resolving complex claims, developing efficient claim handling strategies, and delivering exceptional customer service. Track record of consistently exceeding performance targets, including a 15% improvement in claim processing efficiency. Strong understanding of insurance policies, risk assessment, and legal compliance. Adept at collaborating with key stakeholders, including legal counsel, industry partners, and customers.

Key skills include claims investigation, policy interpretation, loss evaluation, negotiation, customer service, and team leadership.

Education

Bachelor’s degree in Insurance, Risk Management

January 2017

Skills

- Claims Investigation

- Policy Interpretation

- Loss Evaluation

- Negotiation

- Customer Service

- Team Leadership

Work Experience

Force Adjustment Supervisor

- Trained and mentored new adjusters, fostering a culture of excellence in claims handling.

- Collaborated with legal counsel to ensure compliance with industry regulations and best practices.

- Utilized advanced claims software and technology to streamline the claim adjustment process.

- Conducted risk assessments and developed mitigation strategies to reduce potential claim liabilities.

Force Adjustment Supervisor

- Managed a team of adjusters, ensuring prompt and accurate claim resolution.

- Developed and implemented strategies to improve claim processing efficiency by 15%.

- Established relationships with key industry partners to enhance claim handling capabilities.

- Provided exceptional customer service, resolving over 100 complex claim disputes per month.

Accomplishments

- Successfully managed a team of force adjustment specialists, resolving over 100 disputes with an average turnaround time of 30 days.

- Developed and implemented a standardized force adjustment process, resulting in improved accuracy and efficiency in dispute resolution.

- Established a network of industry experts to consult on complex force adjustment matters, ensuring the delivery of timely and informed decisions.

- Successfully resolved a multimillion dollar force adjustment dispute through negotiation and mediation, avoiding costly litigation for both parties.

- Developed a training program for force adjustment specialists, ensuring the delivery of industryleading best practices and knowledge.

Awards

- Recipient of the Force Adjustment Excellence Award for outstanding performance in resolving complex force adjustment disputes.

- Recognized for resolving a highprofile force adjustment dispute involving multiple parties, resulting in a significant reduction in claims and improved interagency collaboration.

- Received the Force Adjustment Innovator Award for developing a novel approach to resolving disputes using artificial intelligence and data analytics.

- Honored with the Force Adjustment Leadership Award for mentoring and guiding junior force adjustment professionals.

Certificates

- CPCU (Chartered Property Casualty Underwriter)

- AIC (Associate in Claims)

- CPC (Claims Professional Certification)

- AU (Associate in Underwriting)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Force Adjustment Supervisor

Highlight your key skills and experience.

Make sure to emphasize your skills in claims investigation, policy interpretation, loss evaluation, negotiation, customer service, and team leadership.Quantify your accomplishments.

Use specific numbers and metrics to demonstrate your impact on the organization. For example, you could mention that you reduced claim processing time by 15% or resolved over 100 complex claim disputes per month.Showcase your leadership skills.

If you have experience managing a team of adjusters, be sure to highlight your ability to lead and motivate others.Proofread carefully.

Make sure your resume is free of any errors in grammar or spelling. You can also have a friend or family member review it for you.Tailor your resume to the job you’re applying for.

Take the time to research the company and the specific position you’re interested in. Then, highlight the skills and experience that are most relevant to the job.

Essential Experience Highlights for a Strong Force Adjustment Supervisor Resume

- Managing a team of adjusters and ensuring prompt and accurate claim resolution

- Developing and implementing strategies to improve claim processing efficiency

- Establishing relationships with key industry partners to enhance claim handling capabilities

- Providing exceptional customer service, resolving complex claim disputes

- Training and mentoring new adjusters, fostering a culture of excellence in claims handling

- Collaborating with legal counsel to ensure compliance with industry regulations and best practices

- Utilizing advanced claims software and technology to streamline the claim adjustment process

Frequently Asked Questions (FAQ’s) For Force Adjustment Supervisor

What are the primary responsibilities of a Force Adjustment Supervisor?

The primary responsibilities of a Force Adjustment Supervisor include managing a team of adjusters, developing and implementing strategies to improve claim processing efficiency, establishing relationships with key industry partners, providing exceptional customer service, training and mentoring new adjusters, collaborating with legal counsel to ensure compliance with industry regulations and best practices, and utilizing advanced claims software and technology to streamline the claim adjustment process.

What skills and qualifications are required to become a Force Adjustment Supervisor?

The skills and qualifications required to become a Force Adjustment Supervisor include claims investigation, policy interpretation, loss evaluation, negotiation, customer service, team leadership, and a bachelor’s degree in Insurance, Risk Management, or a related field.

What are the career prospects for Force Adjustment Supervisors?

The career prospects for Force Adjustment Supervisors are excellent. As the insurance industry continues to grow, the demand for qualified Force Adjustment Supervisors is expected to increase. With experience, Force Adjustment Supervisors can advance to more senior positions, such as Claims Manager or Director of Claims.

What is the average salary for a Force Adjustment Supervisor?

The average salary for a Force Adjustment Supervisor is $65,000 per year. However, salaries can vary depending on experience, location, and company size.

What are the benefits of working as a Force Adjustment Supervisor?

The benefits of working as a Force Adjustment Supervisor include a competitive salary, a comprehensive benefits package, and the opportunity to make a difference in the lives of others.

What is the work environment like for a Force Adjustment Supervisor?

The work environment for a Force Adjustment Supervisor is typically fast-paced and demanding. Force Adjustment Supervisors often work long hours, including evenings and weekends, to meet deadlines and resolve claims. However, the work is also rewarding, as Force Adjustment Supervisors have the opportunity to help people in their time of need.