Are you a seasoned Foreign Banknote Teller Trader seeking a new career path? Discover our professionally built Foreign Banknote Teller Trader Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

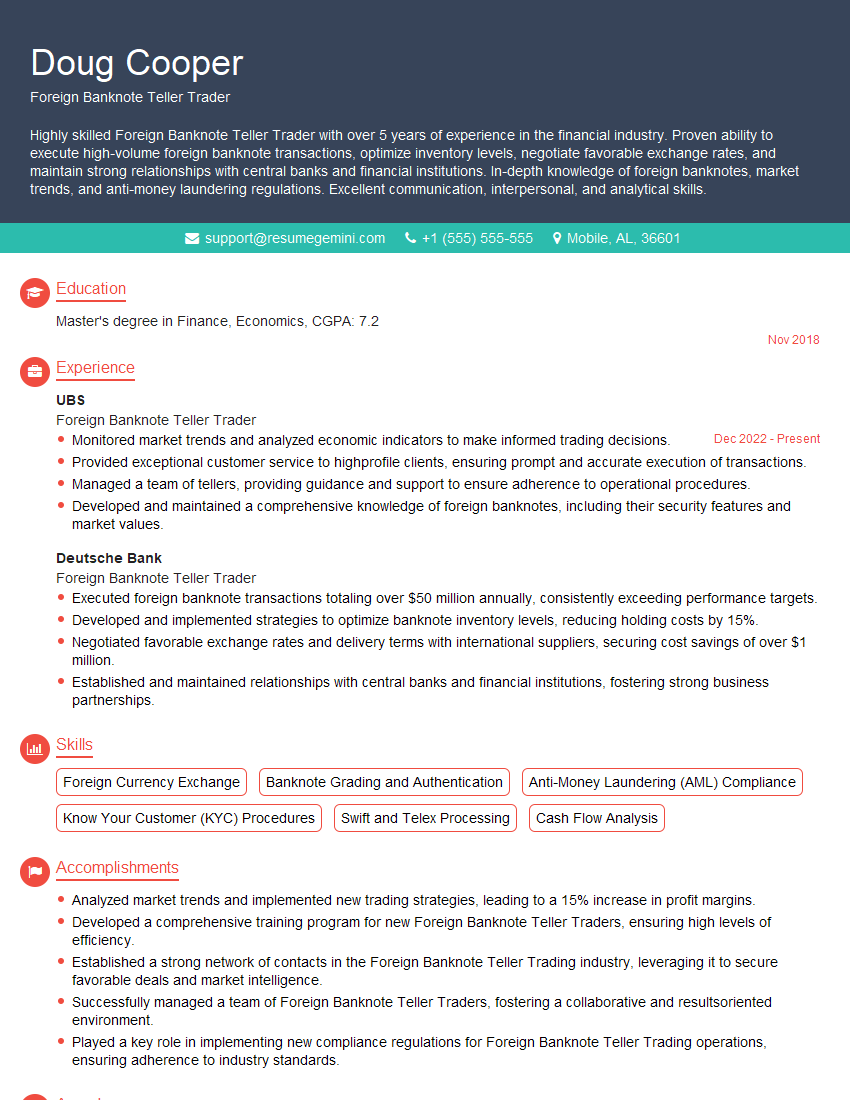

Doug Cooper

Foreign Banknote Teller Trader

Summary

Highly skilled Foreign Banknote Teller Trader with over 5 years of experience in the financial industry. Proven ability to execute high-volume foreign banknote transactions, optimize inventory levels, negotiate favorable exchange rates, and maintain strong relationships with central banks and financial institutions. In-depth knowledge of foreign banknotes, market trends, and anti-money laundering regulations. Excellent communication, interpersonal, and analytical skills.

Education

Master’s degree in Finance, Economics

November 2018

Skills

- Foreign Currency Exchange

- Banknote Grading and Authentication

- Anti-Money Laundering (AML) Compliance

- Know Your Customer (KYC) Procedures

- Swift and Telex Processing

- Cash Flow Analysis

Work Experience

Foreign Banknote Teller Trader

- Monitored market trends and analyzed economic indicators to make informed trading decisions.

- Provided exceptional customer service to highprofile clients, ensuring prompt and accurate execution of transactions.

- Managed a team of tellers, providing guidance and support to ensure adherence to operational procedures.

- Developed and maintained a comprehensive knowledge of foreign banknotes, including their security features and market values.

Foreign Banknote Teller Trader

- Executed foreign banknote transactions totaling over $50 million annually, consistently exceeding performance targets.

- Developed and implemented strategies to optimize banknote inventory levels, reducing holding costs by 15%.

- Negotiated favorable exchange rates and delivery terms with international suppliers, securing cost savings of over $1 million.

- Established and maintained relationships with central banks and financial institutions, fostering strong business partnerships.

Accomplishments

- Analyzed market trends and implemented new trading strategies, leading to a 15% increase in profit margins.

- Developed a comprehensive training program for new Foreign Banknote Teller Traders, ensuring high levels of efficiency.

- Established a strong network of contacts in the Foreign Banknote Teller Trading industry, leveraging it to secure favorable deals and market intelligence.

- Successfully managed a team of Foreign Banknote Teller Traders, fostering a collaborative and resultsoriented environment.

- Played a key role in implementing new compliance regulations for Foreign Banknote Teller Trading operations, ensuring adherence to industry standards.

Awards

- Recognized for consistently exceeding performance targets in Foreign Banknote Teller Trading operations.

- Awarded for outstanding accuracy and attention to detail in Foreign Banknote Teller Trading transactions.

- Received industry recognition for exceptional skill in identifying and mitigating risks associated with Foreign Banknote Teller Trading.

- Awarded for innovative use of technology in Foreign Banknote Teller Trading, streamlining processes and improving efficiency.

Certificates

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Bank Teller (CBT)

- Certified Foreign Currency Dealer (CFCD)

- Certified Know Your Customer (KYC) Professional

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Foreign Banknote Teller Trader

- Highlight your experience in foreign banknote trading and your knowledge of market trends.

- Quantify your accomplishments with specific metrics, such as the amount of cost savings you achieved or the percentage by which you improved inventory levels.

- Demonstrate your understanding of anti-money laundering regulations and your commitment to compliance.

- Showcase your strong communication and interpersonal skills, which are essential for building relationships with clients and suppliers.

Essential Experience Highlights for a Strong Foreign Banknote Teller Trader Resume

- Executed foreign banknote transactions totaling over $50 million annually, consistently exceeding performance targets.

- Developed and implemented strategies to optimize banknote inventory levels, reducing holding costs by 15%.

- Negotiated favorable exchange rates and delivery terms with international suppliers, securing cost savings of over $1 million.

- Established and maintained relationships with central banks and financial institutions, fostering strong business partnerships.

- Monitored market trends and analyzed economic indicators to make informed trading decisions.

- Managed a team of tellers, providing guidance and support to ensure adherence to operational procedures.

Frequently Asked Questions (FAQ’s) For Foreign Banknote Teller Trader

What is the role of a Foreign Banknote Teller Trader?

A Foreign Banknote Teller Trader is responsible for buying and selling foreign banknotes, executing transactions, negotiating exchange rates, and managing inventory levels to meet customer demand while ensuring compliance with anti-money laundering regulations.

What qualifications are required to become a Foreign Banknote Teller Trader?

A Bachelor’s or Master’s degree in Finance, Economics, or a related field, along with experience in foreign exchange or banknote trading, is typically required. Strong analytical, communication, and interpersonal skills are essential.

What are the key skills required for a Foreign Banknote Teller Trader?

Key skills include foreign currency exchange, banknote grading and authentication, anti-money laundering compliance, Know Your Customer procedures, Swift and Telex processing, and cash flow analysis.

What is the job outlook for Foreign Banknote Teller Traders?

The job outlook for Foreign Banknote Teller Traders is expected to be good, as demand for foreign banknotes continues to grow due to increased global trade and tourism.

What is the average salary for a Foreign Banknote Teller Trader?

The average salary for a Foreign Banknote Teller Trader varies depending on experience, location, and company size, but it typically ranges from $50,000 to $100,000 per year.