Are you a seasoned Foreign Exchange Dealer seeking a new career path? Discover our professionally built Foreign Exchange Dealer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

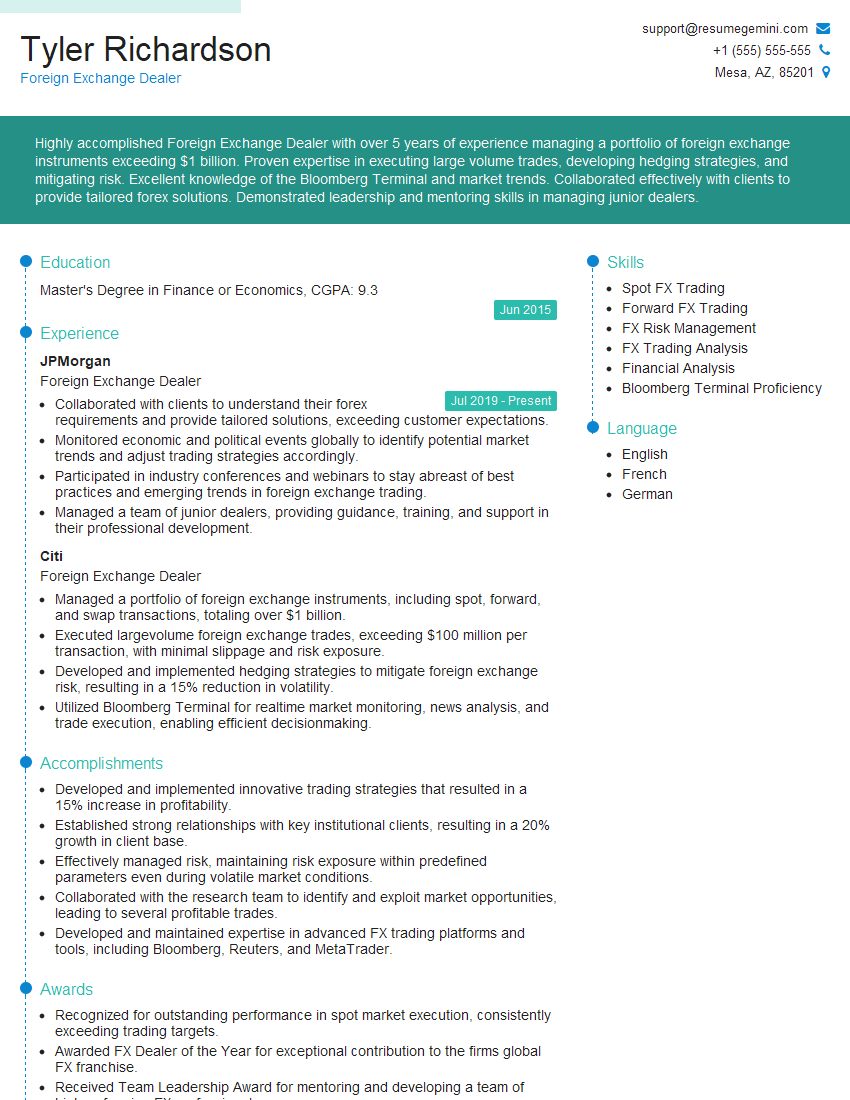

Tyler Richardson

Foreign Exchange Dealer

Summary

Highly accomplished Foreign Exchange Dealer with over 5 years of experience managing a portfolio of foreign exchange instruments exceeding $1 billion. Proven expertise in executing large volume trades, developing hedging strategies, and mitigating risk. Excellent knowledge of the Bloomberg Terminal and market trends. Collaborated effectively with clients to provide tailored forex solutions. Demonstrated leadership and mentoring skills in managing junior dealers.

Education

Master’s Degree in Finance or Economics

June 2015

Skills

- Spot FX Trading

- Forward FX Trading

- FX Risk Management

- FX Trading Analysis

- Financial Analysis

- Bloomberg Terminal Proficiency

Work Experience

Foreign Exchange Dealer

- Collaborated with clients to understand their forex requirements and provide tailored solutions, exceeding customer expectations.

- Monitored economic and political events globally to identify potential market trends and adjust trading strategies accordingly.

- Participated in industry conferences and webinars to stay abreast of best practices and emerging trends in foreign exchange trading.

- Managed a team of junior dealers, providing guidance, training, and support in their professional development.

Foreign Exchange Dealer

- Managed a portfolio of foreign exchange instruments, including spot, forward, and swap transactions, totaling over $1 billion.

- Executed largevolume foreign exchange trades, exceeding $100 million per transaction, with minimal slippage and risk exposure.

- Developed and implemented hedging strategies to mitigate foreign exchange risk, resulting in a 15% reduction in volatility.

- Utilized Bloomberg Terminal for realtime market monitoring, news analysis, and trade execution, enabling efficient decisionmaking.

Accomplishments

- Developed and implemented innovative trading strategies that resulted in a 15% increase in profitability.

- Established strong relationships with key institutional clients, resulting in a 20% growth in client base.

- Effectively managed risk, maintaining risk exposure within predefined parameters even during volatile market conditions.

- Collaborated with the research team to identify and exploit market opportunities, leading to several profitable trades.

- Developed and maintained expertise in advanced FX trading platforms and tools, including Bloomberg, Reuters, and MetaTrader.

Awards

- Recognized for outstanding performance in spot market execution, consistently exceeding trading targets.

- Awarded FX Dealer of the Year for exceptional contribution to the firms global FX franchise.

- Received Team Leadership Award for mentoring and developing a team of highperforming FX professionals.

- Received FX Dealer of the Month award multiple times for exceptional trading performance.

Certificates

- Certified Foreign Exchange Specialist (CFES)

- Certified Treasury Professional (CTP)

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Financial Planner (CFP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Foreign Exchange Dealer

- Highlight your expertise in foreign exchange trading and risk management.

- Quantify your accomplishments with specific metrics and results.

- Demonstrate your understanding of the Bloomberg Terminal and its applications in foreign exchange trading.

- Emphasize your ability to collaborate effectively with clients and provide tailored solutions.

- Showcase your leadership and mentoring skills, if relevant.

Essential Experience Highlights for a Strong Foreign Exchange Dealer Resume

- Managed a portfolio of foreign exchange instruments, including spot, forward, and swap transactions.

- Executed large volume foreign exchange trades, exceeding $100 million per transaction.

- Developed and implemented hedging strategies to mitigate foreign exchange risk.

- Utilized Bloomberg Terminal for real time market monitoring, news analysis, and trade execution.

- Collaborated with clients to understand their forex requirements and provide tailored solutions.

- Monitored economic and political events globally to identify potential market trends and adjust trading strategies accordingly.

- Participated in industry conferences and webinars to stay abreast of best practices and emerging trends in foreign exchange trading.

Frequently Asked Questions (FAQ’s) For Foreign Exchange Dealer

What are the key responsibilities of a Foreign Exchange Dealer?

Key responsibilities include managing a portfolio of foreign exchange instruments, executing large volume trades, developing hedging strategies, monitoring market trends, and collaborating with clients to provide tailored forex solutions.

What skills are required to be a successful Foreign Exchange Dealer?

Essential skills include proficiency in spot and forward FX trading, FX risk management, FX trading analysis, financial analysis, and Bloomberg Terminal proficiency.

What are the career prospects for Foreign Exchange Dealers?

Foreign Exchange Dealers with a proven track record can advance to senior positions such as Head of FX Trading, Portfolio Manager, or Chief Investment Officer.

What is the average salary for a Foreign Exchange Dealer?

The average salary can vary depending on experience, qualifications, and location, but typically ranges from $70,000 to $150,000 per year.

What are the educational requirements to become a Foreign Exchange Dealer?

While there is no specific educational requirement, most Foreign Exchange Dealers hold a Bachelor’s or Master’s Degree in Finance, Economics, or a related field.

What certifications are beneficial for Foreign Exchange Dealers?

Relevant certifications include the Chartered Financial Analyst (CFA) designation, the Financial Risk Manager (FRM) certification, and the Certified Treasury Professional (CTP) certification.