Are you a seasoned Fraud Investigator seeking a new career path? Discover our professionally built Fraud Investigator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

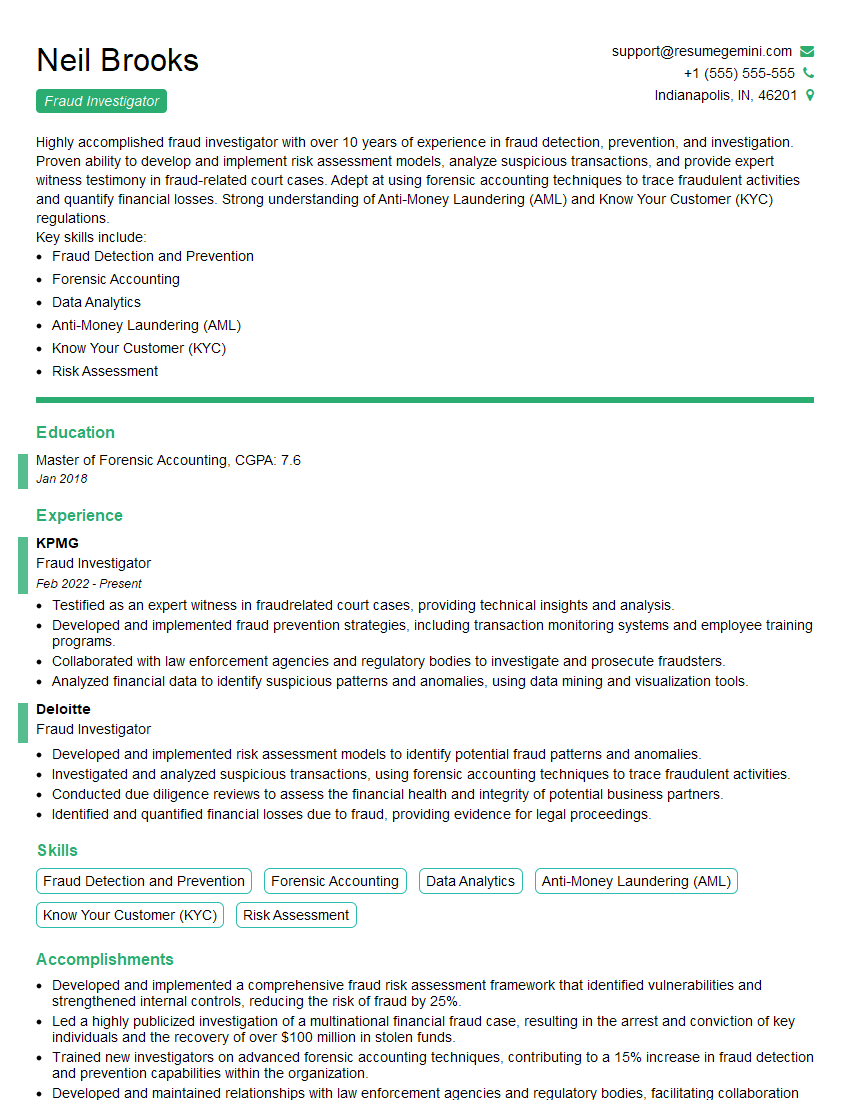

Neil Brooks

Fraud Investigator

Summary

Highly accomplished fraud investigator with over 10 years of experience in fraud detection, prevention, and investigation. Proven ability to develop and implement risk assessment models, analyze suspicious transactions, and provide expert witness testimony in fraud-related court cases. Adept at using forensic accounting techniques to trace fraudulent activities and quantify financial losses. Strong understanding of Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

Key skills include:

- Fraud Detection and Prevention

- Forensic Accounting

- Data Analytics

- Anti-Money Laundering (AML)

- Know Your Customer (KYC)

- Risk Assessment

Education

Master of Forensic Accounting

January 2018

Skills

- Fraud Detection and Prevention

- Forensic Accounting

- Data Analytics

- Anti-Money Laundering (AML)

- Know Your Customer (KYC)

- Risk Assessment

Work Experience

Fraud Investigator

- Testified as an expert witness in fraudrelated court cases, providing technical insights and analysis.

- Developed and implemented fraud prevention strategies, including transaction monitoring systems and employee training programs.

- Collaborated with law enforcement agencies and regulatory bodies to investigate and prosecute fraudsters.

- Analyzed financial data to identify suspicious patterns and anomalies, using data mining and visualization tools.

Fraud Investigator

- Developed and implemented risk assessment models to identify potential fraud patterns and anomalies.

- Investigated and analyzed suspicious transactions, using forensic accounting techniques to trace fraudulent activities.

- Conducted due diligence reviews to assess the financial health and integrity of potential business partners.

- Identified and quantified financial losses due to fraud, providing evidence for legal proceedings.

Accomplishments

- Developed and implemented a comprehensive fraud risk assessment framework that identified vulnerabilities and strengthened internal controls, reducing the risk of fraud by 25%.

- Led a highly publicized investigation of a multinational financial fraud case, resulting in the arrest and conviction of key individuals and the recovery of over $100 million in stolen funds.

- Trained new investigators on advanced forensic accounting techniques, contributing to a 15% increase in fraud detection and prevention capabilities within the organization.

- Developed and maintained relationships with law enforcement agencies and regulatory bodies, facilitating collaboration and timely investigations.

- Utilized data analytics and artificial intelligence to detect and investigate anomalies and patterns suggestive of fraudulent activity.

Awards

- Recipient of the ACFE Certified Fraud Examiner (CFE) of the Year Award, recognizing outstanding contributions to the field of fraud investigation.

- Recognized as a Top 10 Fraud Buster by Fraud Magazine for successfully leading complex fraud investigations resulting in multimillion dollar recoveries.

- Received the International Association of Certified Fraud Examiners (IAFCE) Outstanding Fraud Examiner Award for excellence in fraud investigation and prevention initiatives.

- Recognized as a fellow of the Association of Certified Fraud Examiners (ACFE), demonstrating exceptional expertise and commitment to the profession.

Certificates

- Certified Fraud Examiner (CFE)

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Financial Crime Specialist (CFCS)

- Certified Fraud Detection Professional (CFDP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Fraud Investigator

Quantify your accomplishments:

When describing your experience, be sure to use specific numbers and metrics to quantify your accomplishments. This will help potential employers understand the impact of your work.Tailor your resume to the job description:

Take the time to carefully read the job description and tailor your resume to the specific requirements of the position. This will show potential employers that you are genuinely interested in the job and that you have the skills and experience they are looking for.Use strong action verbs:

Use strong action verbs to describe your accomplishments. This will make your resume more dynamic and engaging.Proofread carefully:

Before submitting your resume, proofread it carefully for any errors. A well-written resume with no errors will make a good impression on potential employers.Get feedback:

Ask a friend, family member, or career counselor to review your resume and provide feedback. This can help you identify any areas that need improvement.

Essential Experience Highlights for a Strong Fraud Investigator Resume

- Developed and implemented risk assessment models to identify potential fraud patterns and anomalies.

- Investigated and analyzed suspicious transactions, using forensic accounting techniques to trace fraudulent activities.

- Conducted due diligence reviews to assess the financial health and integrity of potential business partners.

- Identified and quantified financial losses due to fraud, providing evidence for legal proceedings.

- Testified as an expert witness in fraud-related court cases, providing technical insights and analysis.

- Developed and implemented fraud prevention strategies, including transaction monitoring systems and employee training programs.

- Collaborated with law enforcement agencies and regulatory bodies to investigate and prosecute fraudsters.

Frequently Asked Questions (FAQ’s) For Fraud Investigator

What are the most common types of fraud?

The most common types of fraud include financial statement fraud, misappropriation of assets, and corruption. Financial statement fraud involves manipulating financial statements to make a company appear more profitable or less indebted than it actually is. Misappropriation of assets involves stealing or misusing company assets for personal gain. Corruption involves bribing or otherwise influencing public officials for personal gain.

What are the red flags of fraud?

Some common red flags of fraud include unexplained variances in financial statements, unusual transactions, and changes in vendor or customer relationships. Unexplained variances in financial statements can indicate that fraud has been committed to hide losses or inflate profits. Unusual transactions can also be a sign of fraud, as they may be used to move money or assets out of the company without detection. Changes in vendor or customer relationships can also be a red flag, as they may be used to conceal kickbacks or other forms of fraud.

What are the steps involved in investigating fraud?

The steps involved in investigating fraud typically include gathering evidence, interviewing witnesses, and analyzing financial data. Gathering evidence involves collecting all relevant documents and records, such as financial statements, bank statements, and contracts. Interviewing witnesses involves talking to employees, customers, and other individuals who may have information about the fraud. Analyzing financial data involves examining financial statements and other financial records to identify any suspicious patterns or anomalies.

What are the challenges of investigating fraud?

Some of the challenges of investigating fraud include the complexity of fraud schemes, the lack of cooperation from witnesses, and the difficulty of obtaining evidence. Fraud schemes can be complex and sophisticated, making them difficult to detect and investigate. Witnesses may be reluctant to cooperate with investigators, especially if they are involved in the fraud or fear retaliation. Obtaining evidence can also be difficult, as fraudsters often take steps to conceal their activities.

What are the consequences of fraud?

The consequences of fraud can be severe, both for the victims of fraud and for the perpetrators. Victims of fraud can suffer financial losses, reputational damage, and emotional distress. Perpetrators of fraud can face criminal prosecution, civil lawsuits, and imprisonment.

What are the most effective ways to prevent fraud?

Some of the most effective ways to prevent fraud include implementing strong internal controls, educating employees about fraud, and conducting regular audits. Strong internal controls can help to prevent fraud by making it more difficult for fraudsters to commit fraud and by making it easier to detect fraud if it does occur. Educating employees about fraud can help to raise awareness of the risks of fraud and to encourage employees to report any suspicious activity. Conducting regular audits can help to identify any weaknesses in internal controls and to deter fraudsters from committing fraud.