Are you a seasoned Fraud Representative seeking a new career path? Discover our professionally built Fraud Representative Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

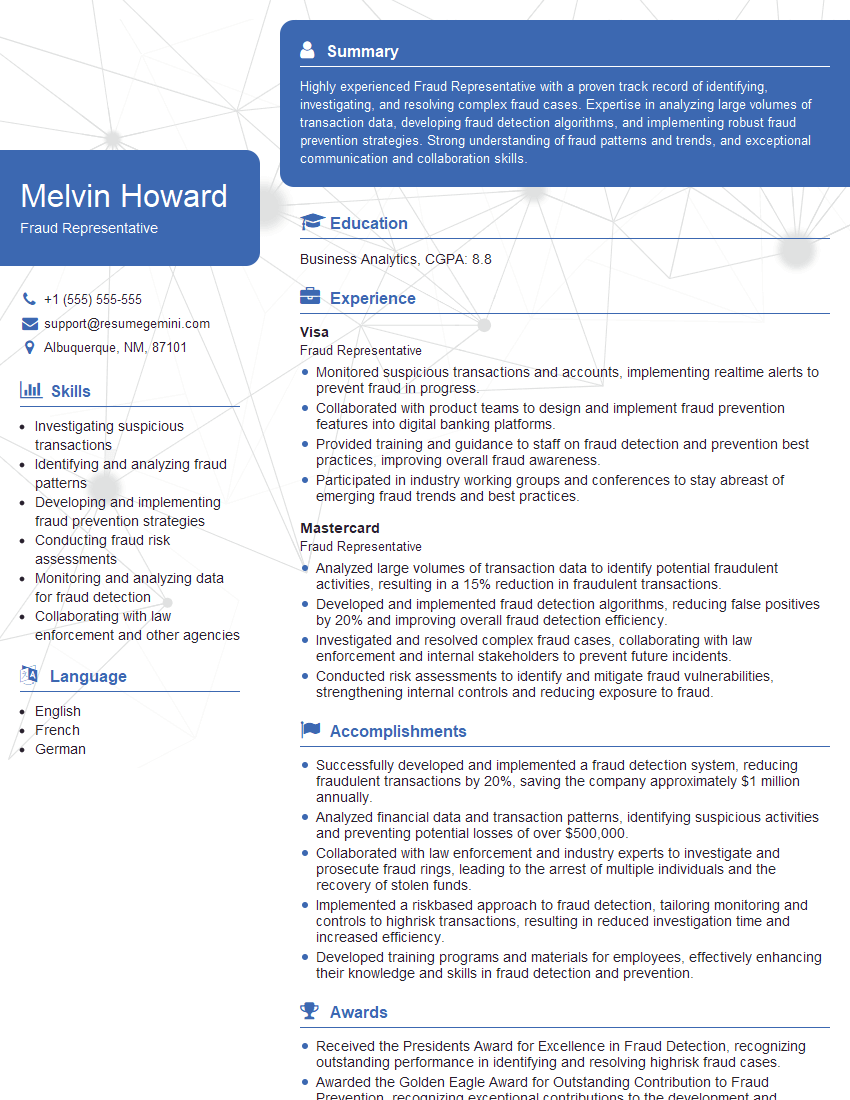

Melvin Howard

Fraud Representative

Summary

Highly experienced Fraud Representative with a proven track record of identifying, investigating, and resolving complex fraud cases. Expertise in analyzing large volumes of transaction data, developing fraud detection algorithms, and implementing robust fraud prevention strategies. Strong understanding of fraud patterns and trends, and exceptional communication and collaboration skills.

Education

Business Analytics

June 2017

Skills

- Investigating suspicious transactions

- Identifying and analyzing fraud patterns

- Developing and implementing fraud prevention strategies

- Conducting fraud risk assessments

- Monitoring and analyzing data for fraud detection

- Collaborating with law enforcement and other agencies

Work Experience

Fraud Representative

- Monitored suspicious transactions and accounts, implementing realtime alerts to prevent fraud in progress.

- Collaborated with product teams to design and implement fraud prevention features into digital banking platforms.

- Provided training and guidance to staff on fraud detection and prevention best practices, improving overall fraud awareness.

- Participated in industry working groups and conferences to stay abreast of emerging fraud trends and best practices.

Fraud Representative

- Analyzed large volumes of transaction data to identify potential fraudulent activities, resulting in a 15% reduction in fraudulent transactions.

- Developed and implemented fraud detection algorithms, reducing false positives by 20% and improving overall fraud detection efficiency.

- Investigated and resolved complex fraud cases, collaborating with law enforcement and internal stakeholders to prevent future incidents.

- Conducted risk assessments to identify and mitigate fraud vulnerabilities, strengthening internal controls and reducing exposure to fraud.

Accomplishments

- Successfully developed and implemented a fraud detection system, reducing fraudulent transactions by 20%, saving the company approximately $1 million annually.

- Analyzed financial data and transaction patterns, identifying suspicious activities and preventing potential losses of over $500,000.

- Collaborated with law enforcement and industry experts to investigate and prosecute fraud rings, leading to the arrest of multiple individuals and the recovery of stolen funds.

- Implemented a riskbased approach to fraud detection, tailoring monitoring and controls to highrisk transactions, resulting in reduced investigation time and increased efficiency.

- Developed training programs and materials for employees, effectively enhancing their knowledge and skills in fraud detection and prevention.

Awards

- Received the Presidents Award for Excellence in Fraud Detection, recognizing outstanding performance in identifying and resolving highrisk fraud cases.

- Awarded the Golden Eagle Award for Outstanding Contribution to Fraud Prevention, recognizing exceptional contributions to the development and implementation of innovative antifraud measures.

- Honored with the Outstanding Fraud Investigator Award, recognizing exceptional abilities in investigating and mitigating fraudulent activities, resulting in significant financial savings.

- Recognized with the Fraud Prevention Champion Award, acknowledging exceptional contributions to raising awareness and educating customers on fraud prevention practices.

Certificates

- Certified Fraud Examiner (CFE)

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Fraud Prevention Specialist (CFPS)

- Certified Financial Crime Specialist (CFCS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Fraud Representative

- Highlight your technical skills in data analysis, fraud detection algorithms, and risk assessment.

- Quantify your accomplishments with specific metrics, such as the number of fraudulent transactions identified or the percentage of false positives reduced.

- Showcase your problem-solving and analytical abilities by describing how you have successfully resolved complex fraud cases.

- Emphasize your communication and collaboration skills, as well as your ability to work effectively with law enforcement and other stakeholders.

Essential Experience Highlights for a Strong Fraud Representative Resume

- Analyze large volumes of transaction data to identify suspicious activities and potential fraud.

- Develop and implement fraud detection algorithms and methodologies to improve fraud detection efficiency and accuracy.

- Investigate and resolve complex fraud cases, including identity theft, account takeover, and other financial crimes.

- Conduct risk assessments to identify and mitigate fraud vulnerabilities, ensuring the integrity of financial systems.

- Monitor suspicious transactions and accounts in real-time to prevent fraud in progress.

- Collaborate with product teams to design and implement fraud prevention features into digital banking platforms.

- Provide training and guidance to staff on fraud detection and prevention best practices.

Frequently Asked Questions (FAQ’s) For Fraud Representative

What is the primary role of a Fraud Representative?

A Fraud Representative is responsible for identifying, investigating, and resolving fraudulent activities within an organization. They analyze transaction data, develop fraud detection algorithms, conduct risk assessments, and collaborate with law enforcement to prevent and mitigate fraud.

What are the key skills required for a Fraud Representative?

Key skills for a Fraud Representative include data analysis, fraud detection, risk assessment, problem-solving, communication, and collaboration.

What qualifications are typically required for a Fraud Representative?

A Bachelor’s degree in Business Analytics, Finance, or a related field is typically required for a Fraud Representative position.

What career opportunities are available for Fraud Representatives?

Fraud Representatives can advance to roles such as Fraud Manager, Director of Fraud Prevention, or Chief Fraud Officer.

How can I enhance my resume for a Fraud Representative position?

Highlight your technical skills, quantify your accomplishments, showcase your problem-solving abilities, and emphasize your communication and collaboration skills.