Are you a seasoned General Accountant seeking a new career path? Discover our professionally built General Accountant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

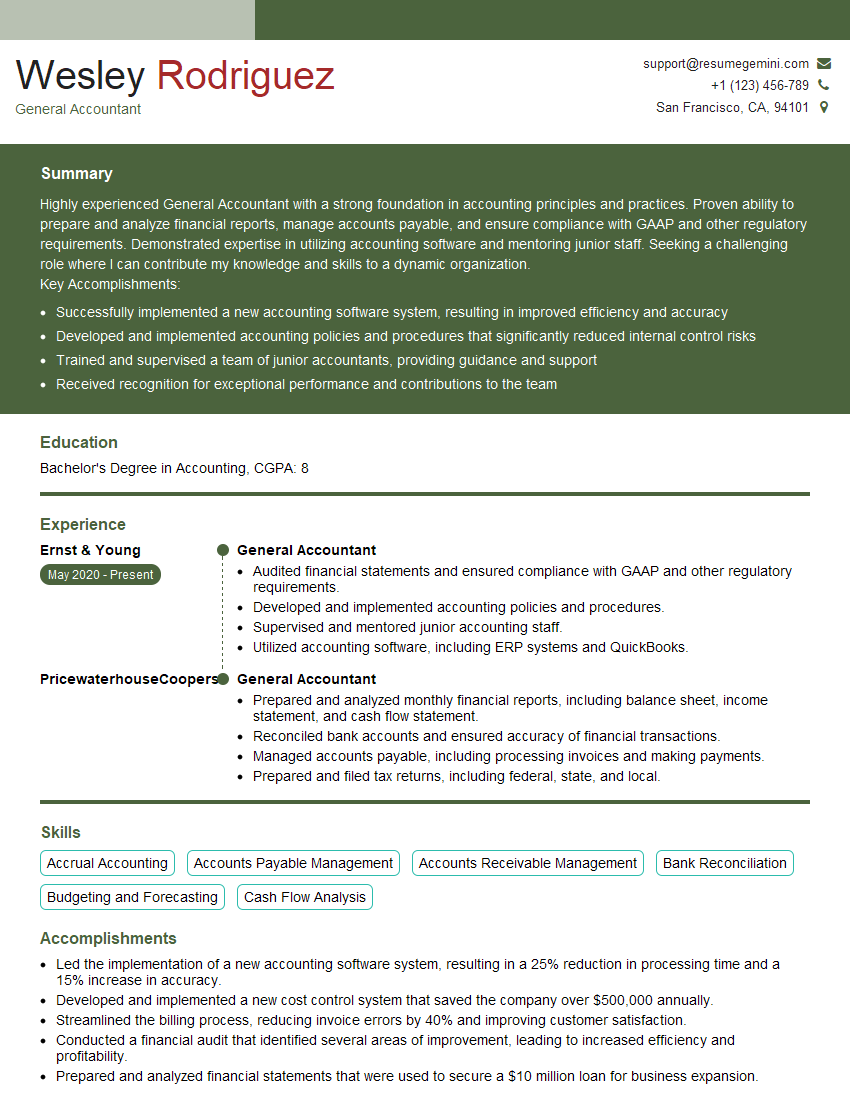

Wesley Rodriguez

General Accountant

Summary

Highly experienced General Accountant with a strong foundation in accounting principles and practices. Proven ability to prepare and analyze financial reports, manage accounts payable, and ensure compliance with GAAP and other regulatory requirements. Demonstrated expertise in utilizing accounting software and mentoring junior staff. Seeking a challenging role where I can contribute my knowledge and skills to a dynamic organization.

Key Accomplishments:

- Successfully implemented a new accounting software system, resulting in improved efficiency and accuracy

- Developed and implemented accounting policies and procedures that significantly reduced internal control risks

- Trained and supervised a team of junior accountants, providing guidance and support

- Received recognition for exceptional performance and contributions to the team

Education

Bachelor’s Degree in Accounting

April 2016

Skills

- Accrual Accounting

- Accounts Payable Management

- Accounts Receivable Management

- Bank Reconciliation

- Budgeting and Forecasting

- Cash Flow Analysis

Work Experience

General Accountant

- Audited financial statements and ensured compliance with GAAP and other regulatory requirements.

- Developed and implemented accounting policies and procedures.

- Supervised and mentored junior accounting staff.

- Utilized accounting software, including ERP systems and QuickBooks.

General Accountant

- Prepared and analyzed monthly financial reports, including balance sheet, income statement, and cash flow statement.

- Reconciled bank accounts and ensured accuracy of financial transactions.

- Managed accounts payable, including processing invoices and making payments.

- Prepared and filed tax returns, including federal, state, and local.

Accomplishments

- Led the implementation of a new accounting software system, resulting in a 25% reduction in processing time and a 15% increase in accuracy.

- Developed and implemented a new cost control system that saved the company over $500,000 annually.

- Streamlined the billing process, reducing invoice errors by 40% and improving customer satisfaction.

- Conducted a financial audit that identified several areas of improvement, leading to increased efficiency and profitability.

- Prepared and analyzed financial statements that were used to secure a $10 million loan for business expansion.

Awards

- Received the Outstanding General Accountant of the Year award from the local chapter of the American Institute of Certified Public Accountants.

- Honored with the Excellence in Financial Reporting award from the state society of CPAs.

- Recognized by the company for Exceptional Performance in Financial Analysis.

- Commended by the management for Outstanding Contribution to Financial Management.

Certificates

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Certified Internal Auditor (CIA)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For General Accountant

1. Highlight your relevant skills and experience.

The most important thing is to make sure that your resume showcases your skills and experience that are relevant to the job you’re applying for. For a General Accountant position, this would include things like experience in preparing and analyzing financial reports, managing accounts payable, and auditing financial statements.

2. Use strong action verbs.

When describing your experience, use strong action verbs that will make your resume more impactful. For example, instead of saying “I was responsible for preparing financial reports,” you could say “I prepared and analyzed monthly financial reports, including balance sheet, income statement, and cash flow statement.”

3. Quantify your accomplishments.

Whenever possible, quantify your accomplishments to show the impact of your work. For example, instead of saying “I implemented a new accounting software system,” you could say “I implemented a new accounting software system, resulting in a 10% increase in efficiency and a 5% reduction in errors.”

4. Tailor your resume to each job you apply for.

Take the time to tailor your resume to each job you apply for. This means highlighting the skills and experience that are most relevant to the specific job requirements. You can also use keywords from the job description in your resume to make it more likely to be seen by recruiters.

5. Proofread your resume carefully.

Before you submit your resume, make sure to proofread it carefully for any errors. This includes checking for typos, grammatical errors, and formatting errors. A well-proofread resume will make a good impression on potential employers.

Essential Experience Highlights for a Strong General Accountant Resume

- Prepare and analyze monthly financial reports, including balance sheet, income statement, and cash flow statement.

- Reconcile bank accounts and ensure accuracy of financial transactions.

- Manage accounts payable, including processing invoices and making payments.

- Prepare and file tax returns, including federal, state, and local.

- Audit financial statements and ensure compliance with GAAP and other regulatory requirements.

- Develop and implement accounting policies and procedures.

- Supervise and mentor junior accounting staff.

Frequently Asked Questions (FAQ’s) For General Accountant

What is the primary role of a General Accountant?

A General Accountant is responsible for preparing and analyzing financial reports, managing accounts payable, and ensuring compliance with GAAP and other regulatory requirements. They may also be responsible for auditing financial statements, developing and implementing accounting policies and procedures, and supervising junior accounting staff.

What are the key skills required for a General Accountant?

The key skills required for a General Accountant include financial reporting, accounts payable management, auditing, GAAP compliance, and accounting software proficiency.

What is the career path for a General Accountant?

With experience, General Accountants can advance to roles such as Senior Accountant, Accounting Manager, or Controller. They may also specialize in a particular area of accounting, such as auditing or taxation.

What is the job outlook for General Accountants?

The job outlook for General Accountants is expected to be good in the coming years. The demand for qualified accountants is expected to grow as businesses become increasingly complex and regulations become more stringent.

What are the salary expectations for General Accountants?

The salary expectations for General Accountants vary depending on experience, location, and industry. However, according to the Bureau of Labor Statistics, the median annual salary for Accountants and Auditors was $73,500 in May 2020.

What are the benefits of working as a General Accountant?

The benefits of working as a General Accountant include job security, career advancement opportunities, and a competitive salary. Accountants are also in high demand, which means that they have the opportunity to work in a variety of industries and locations.

What is the work environment like for General Accountants?

General Accountants typically work in an office setting. They may work independently or as part of a team. The work can be challenging, but it is also rewarding. Accountants have the opportunity to make a real difference in the success of their organizations.

What are the challenges of working as a General Accountant?

The challenges of working as a General Accountant include the need to stay up-to-date on accounting regulations, the potential for long hours during tax season, and the need to work with a variety of people, including clients, auditors, and other accountants.