Are you a seasoned General Adjuster seeking a new career path? Discover our professionally built General Adjuster Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

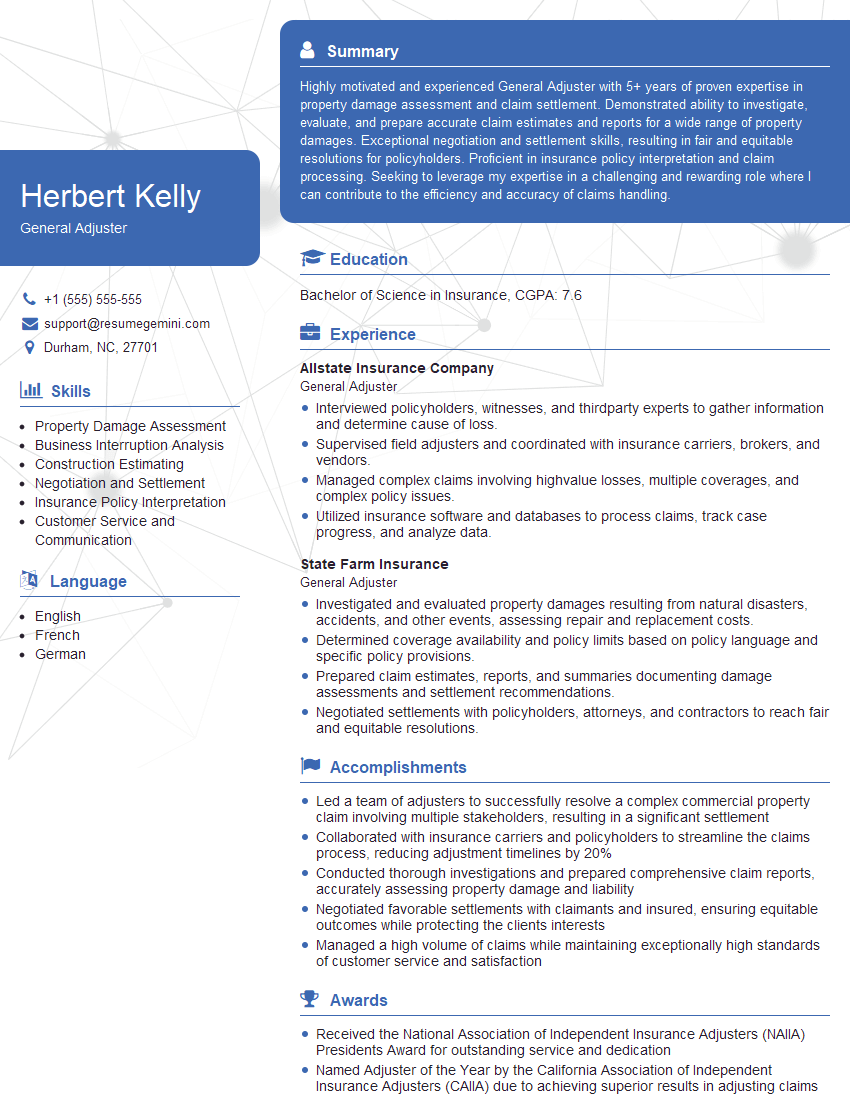

Herbert Kelly

General Adjuster

Summary

Highly motivated and experienced General Adjuster with 5+ years of proven expertise in property damage assessment and claim settlement. Demonstrated ability to investigate, evaluate, and prepare accurate claim estimates and reports for a wide range of property damages. Exceptional negotiation and settlement skills, resulting in fair and equitable resolutions for policyholders. Proficient in insurance policy interpretation and claim processing. Seeking to leverage my expertise in a challenging and rewarding role where I can contribute to the efficiency and accuracy of claims handling.

Education

Bachelor of Science in Insurance

August 2019

Skills

- Property Damage Assessment

- Business Interruption Analysis

- Construction Estimating

- Negotiation and Settlement

- Insurance Policy Interpretation

- Customer Service and Communication

Work Experience

General Adjuster

- Interviewed policyholders, witnesses, and thirdparty experts to gather information and determine cause of loss.

- Supervised field adjusters and coordinated with insurance carriers, brokers, and vendors.

- Managed complex claims involving highvalue losses, multiple coverages, and complex policy issues.

- Utilized insurance software and databases to process claims, track case progress, and analyze data.

General Adjuster

- Investigated and evaluated property damages resulting from natural disasters, accidents, and other events, assessing repair and replacement costs.

- Determined coverage availability and policy limits based on policy language and specific policy provisions.

- Prepared claim estimates, reports, and summaries documenting damage assessments and settlement recommendations.

- Negotiated settlements with policyholders, attorneys, and contractors to reach fair and equitable resolutions.

Accomplishments

- Led a team of adjusters to successfully resolve a complex commercial property claim involving multiple stakeholders, resulting in a significant settlement

- Collaborated with insurance carriers and policyholders to streamline the claims process, reducing adjustment timelines by 20%

- Conducted thorough investigations and prepared comprehensive claim reports, accurately assessing property damage and liability

- Negotiated favorable settlements with claimants and insured, ensuring equitable outcomes while protecting the clients interests

- Managed a high volume of claims while maintaining exceptionally high standards of customer service and satisfaction

Awards

- Received the National Association of Independent Insurance Adjusters (NAIIA) Presidents Award for outstanding service and dedication

- Named Adjuster of the Year by the California Association of Independent Insurance Adjusters (CAIIA) due to achieving superior results in adjusting claims

- Recognized by the Texas Department of Insurance (TDI) with a Certificate of Appreciation for exceptional contribution to the insurance industry

- Recognized by the Insurance Institute of America (IIA) for achieving the Associate in General Insurance (AINS) designation

Certificates

- Certified Insurance General Adjuster (CIGA)

- Associate in General Adjusting (AINS)

- National Flood Insurance Program (NFIP) Certified Adjuster

- Windstorm Insurance Network (WIND) Certified Adjuster

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For General Adjuster

- Quantify your accomplishments whenever possible. For example, instead of saying “Managed complex claims,” say “Managed over 100 complex claims, resulting in an average settlement reduction of 15%.”

- Highlight your soft skills, such as communication, negotiation, and customer service. These skills are essential for success in the insurance industry.

- Tailor your resume to each job you apply for. Be sure to highlight the skills and experience that are most relevant to the specific position.

- Proofread your resume carefully before submitting it. Make sure there are no errors in grammar or spelling.

Essential Experience Highlights for a Strong General Adjuster Resume

- Investigated and evaluated property damages resulting from natural disasters, accidents, and other events, assessing repair and replacement costs.

- Determined coverage availability and policy limits based on policy language and specific policy provisions.

- Prepared claim estimates, reports, and summaries documenting damage assessments and settlement recommendations.

- Negotiated settlements with policyholders, attorneys, and contractors to reach fair and equitable resolutions.

- Interviewed policyholders, witnesses, and thirdparty experts to gather information and determine cause of loss.

- Supervised field adjusters and coordinated with insurance carriers, brokers, and vendors.

- Managed complex claims involving highvalue losses, multiple coverages, and complex policy issues.

Frequently Asked Questions (FAQ’s) For General Adjuster

What is the average salary for a General Adjuster?

The average salary for a General Adjuster in the United States is $60,000 per year.

What are the job prospects for General Adjusters?

The job outlook for General Adjusters is expected to grow 6% from 2019 to 2029, faster than the average for all occupations.

What are the educational requirements for General Adjusters?

Most General Adjusters have a bachelor’s degree in insurance, business, or a related field.

What are the certification requirements for General Adjusters?

Many General Adjusters obtain the Associate in Claims (AIC) or Fellow, Claims (FCAS) designation from the Insurance Institute of America (IIA).

What are the key skills for General Adjusters?

Key skills for General Adjusters include property damage assessment, business interruption analysis, construction estimating, negotiation and settlement, insurance policy interpretation, customer service and communication.

What is the work environment for General Adjusters?

General Adjusters typically work in an office setting, but they may also travel to investigate claims.

What is the career path for General Adjusters?

General Adjusters can advance to positions such as claims manager, adjuster supervisor, or independent adjuster.