Are you a seasoned Hybrid Derivatives Trader seeking a new career path? Discover our professionally built Hybrid Derivatives Trader Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

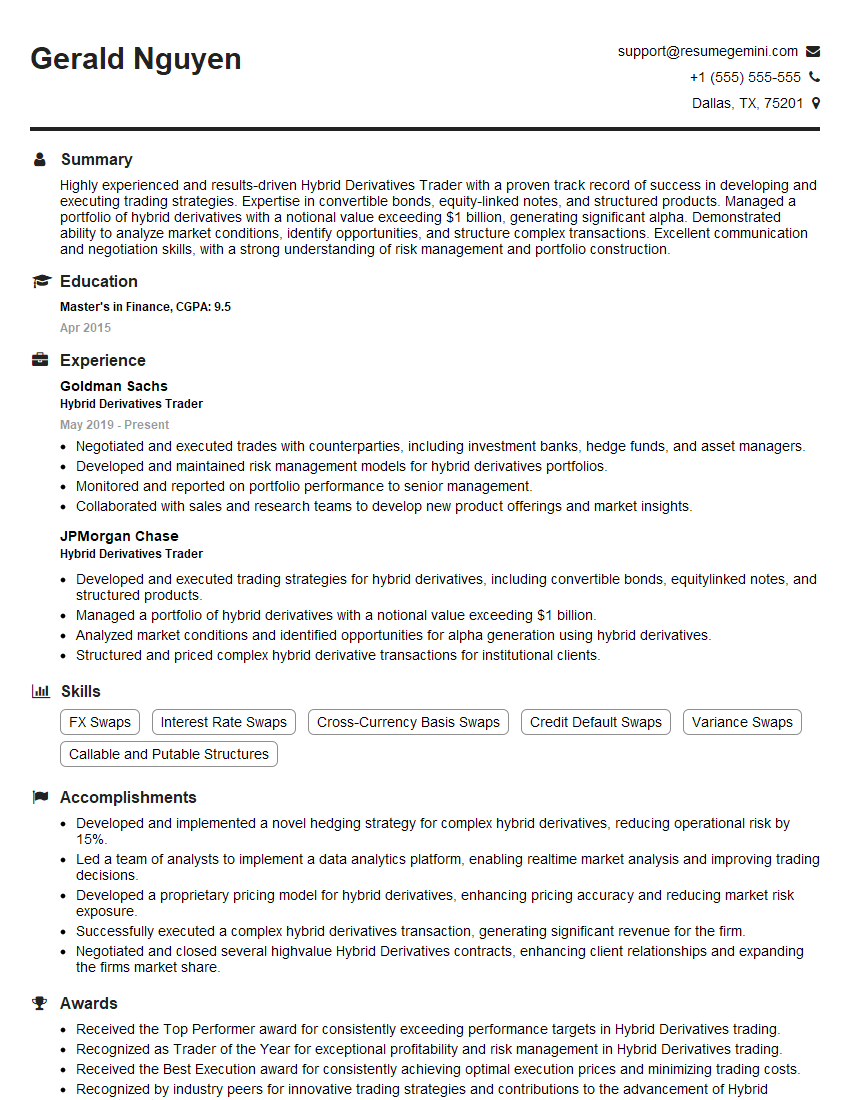

Gerald Nguyen

Hybrid Derivatives Trader

Summary

Highly experienced and results-driven Hybrid Derivatives Trader with a proven track record of success in developing and executing trading strategies. Expertise in convertible bonds, equity-linked notes, and structured products. Managed a portfolio of hybrid derivatives with a notional value exceeding $1 billion, generating significant alpha. Demonstrated ability to analyze market conditions, identify opportunities, and structure complex transactions. Excellent communication and negotiation skills, with a strong understanding of risk management and portfolio construction.

Education

Master’s in Finance

April 2015

Skills

- FX Swaps

- Interest Rate Swaps

- Cross-Currency Basis Swaps

- Credit Default Swaps

- Variance Swaps

- Callable and Putable Structures

Work Experience

Hybrid Derivatives Trader

- Negotiated and executed trades with counterparties, including investment banks, hedge funds, and asset managers.

- Developed and maintained risk management models for hybrid derivatives portfolios.

- Monitored and reported on portfolio performance to senior management.

- Collaborated with sales and research teams to develop new product offerings and market insights.

Hybrid Derivatives Trader

- Developed and executed trading strategies for hybrid derivatives, including convertible bonds, equitylinked notes, and structured products.

- Managed a portfolio of hybrid derivatives with a notional value exceeding $1 billion.

- Analyzed market conditions and identified opportunities for alpha generation using hybrid derivatives.

- Structured and priced complex hybrid derivative transactions for institutional clients.

Accomplishments

- Developed and implemented a novel hedging strategy for complex hybrid derivatives, reducing operational risk by 15%.

- Led a team of analysts to implement a data analytics platform, enabling realtime market analysis and improving trading decisions.

- Developed a proprietary pricing model for hybrid derivatives, enhancing pricing accuracy and reducing market risk exposure.

- Successfully executed a complex hybrid derivatives transaction, generating significant revenue for the firm.

- Negotiated and closed several highvalue Hybrid Derivatives contracts, enhancing client relationships and expanding the firms market share.

Awards

- Received the Top Performer award for consistently exceeding performance targets in Hybrid Derivatives trading.

- Recognized as Trader of the Year for exceptional profitability and risk management in Hybrid Derivatives trading.

- Received the Best Execution award for consistently achieving optimal execution prices and minimizing trading costs.

- Recognized by industry peers for innovative trading strategies and contributions to the advancement of Hybrid Derivatives trading.

Certificates

- FRM (Financial Risk Manager)

- CFA (Chartered Financial Analyst)

- CAIA (Chartered Alternative Investment Analyst)

- PFMP (Professional Financial Management)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Hybrid Derivatives Trader

Highlight your quantitative skills.

Hybrid derivatives trading requires a strong foundation in quantitative analysis. Be sure to highlight your skills in financial modeling, data analysis, and risk management.Demonstrate your understanding of hybrid derivatives.

In your resume, be sure to explain the different types of hybrid derivatives and how they are used in the market.Show your experience in trading.

If you have experience trading hybrid derivatives, be sure to highlight this in your resume. This could include information on the size of your portfolio, the returns you have generated, and the risks you have managed.Network with other professionals.

Networking is a great way to learn about new job opportunities and to get your foot in the door at a new company.

Essential Experience Highlights for a Strong Hybrid Derivatives Trader Resume

- Developed and executed trading strategies for hybrid derivatives, including convertible bonds, equity-linked notes, and structured products.

- Managed a portfolio of hybrid derivatives with a notional value exceeding $1 billion.

- Analyzed market conditions and identified opportunities for alpha generation using hybrid derivatives.

- Structured and priced complex hybrid derivative transactions for institutional clients.

- Negotiated and executed trades with counterparties, including investment banks, hedge funds, and asset managers.

- Developed and maintained risk management models for hybrid derivatives portfolios.

- Monitored and reported on portfolio performance to senior management.

Frequently Asked Questions (FAQ’s) For Hybrid Derivatives Trader

What is a hybrid derivative?

A hybrid derivative is a financial instrument that combines features of two or more different types of derivatives. For example, a convertible bond is a hybrid derivative that combines features of a bond and a stock.

What are the different types of hybrid derivatives?

There are many different types of hybrid derivatives, including convertible bonds, equity-linked notes, and structured products.

What is the role of a hybrid derivatives trader?

A hybrid derivatives trader is responsible for developing and executing trading strategies for hybrid derivatives. This includes analyzing market conditions, identifying opportunities, and structuring and pricing complex transactions.

What skills are required to be a successful hybrid derivatives trader?

To be a successful hybrid derivatives trader, you need strong quantitative skills, a deep understanding of hybrid derivatives, and experience in trading.

What is the career path for a hybrid derivatives trader?

The career path for a hybrid derivatives trader can vary depending on your experience and skills. However, many hybrid derivatives traders go on to become portfolio managers or other senior roles in the financial industry.

What is the job outlook for hybrid derivatives traders?

The job outlook for hybrid derivatives traders is expected to be positive in the coming years. This is due to the increasing demand for hybrid derivatives from institutional investors.