Are you a seasoned Installment Loan Collector seeking a new career path? Discover our professionally built Installment Loan Collector Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

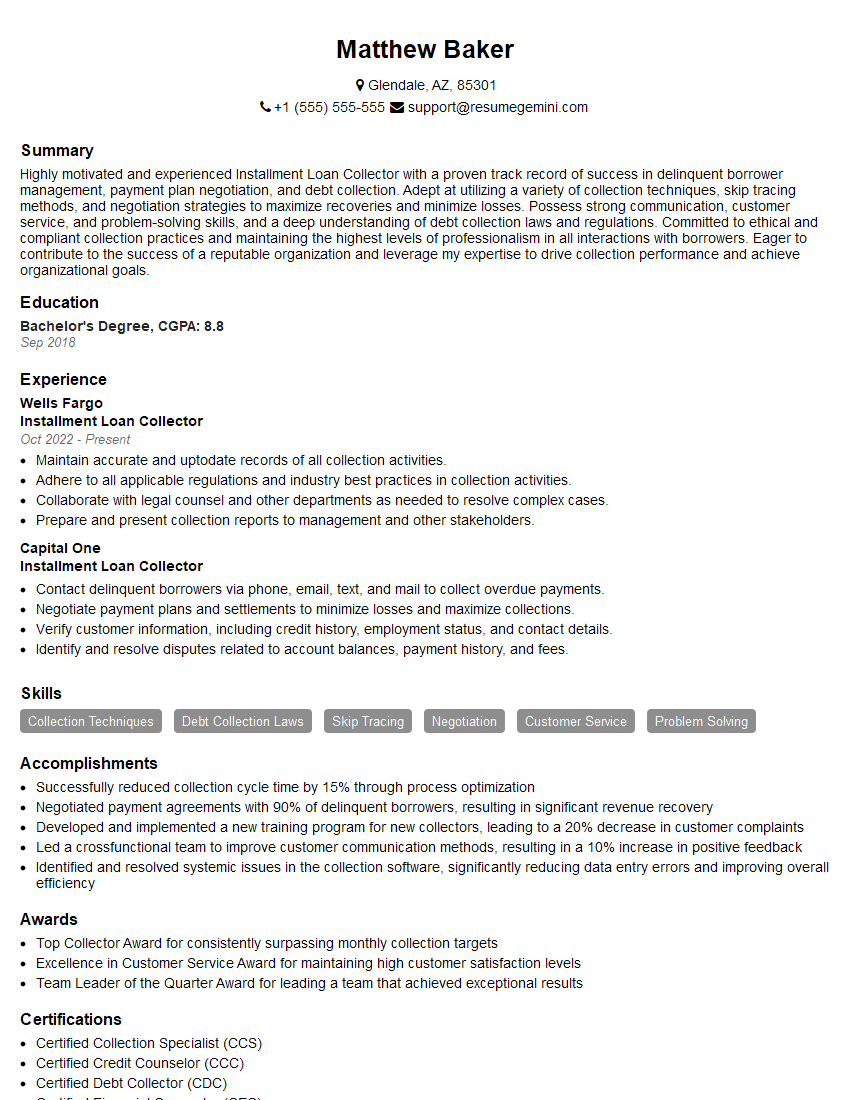

Matthew Baker

Installment Loan Collector

Summary

Highly motivated and experienced Installment Loan Collector with a proven track record of success in delinquent borrower management, payment plan negotiation, and debt collection. Adept at utilizing a variety of collection techniques, skip tracing methods, and negotiation strategies to maximize recoveries and minimize losses. Possess strong communication, customer service, and problem-solving skills, and a deep understanding of debt collection laws and regulations. Committed to ethical and compliant collection practices and maintaining the highest levels of professionalism in all interactions with borrowers. Eager to contribute to the success of a reputable organization and leverage my expertise to drive collection performance and achieve organizational goals.

Education

Bachelor’s Degree

September 2018

Skills

- Collection Techniques

- Debt Collection Laws

- Skip Tracing

- Negotiation

- Customer Service

- Problem Solving

Work Experience

Installment Loan Collector

- Maintain accurate and uptodate records of all collection activities.

- Adhere to all applicable regulations and industry best practices in collection activities.

- Collaborate with legal counsel and other departments as needed to resolve complex cases.

- Prepare and present collection reports to management and other stakeholders.

Installment Loan Collector

- Contact delinquent borrowers via phone, email, text, and mail to collect overdue payments.

- Negotiate payment plans and settlements to minimize losses and maximize collections.

- Verify customer information, including credit history, employment status, and contact details.

- Identify and resolve disputes related to account balances, payment history, and fees.

Accomplishments

- Successfully reduced collection cycle time by 15% through process optimization

- Negotiated payment agreements with 90% of delinquent borrowers, resulting in significant revenue recovery

- Developed and implemented a new training program for new collectors, leading to a 20% decrease in customer complaints

- Led a crossfunctional team to improve customer communication methods, resulting in a 10% increase in positive feedback

- Identified and resolved systemic issues in the collection software, significantly reducing data entry errors and improving overall efficiency

Awards

- Top Collector Award for consistently surpassing monthly collection targets

- Excellence in Customer Service Award for maintaining high customer satisfaction levels

- Team Leader of the Quarter Award for leading a team that achieved exceptional results

Certificates

- Certified Collection Specialist (CCS)

- Certified Credit Counselor (CCC)

- Certified Debt Collector (CDC)

- Certified Financial Counselor (CFC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Installment Loan Collector

- Highlight your experience and success in negotiating payment plans and settlements, demonstrating your ability to recover funds and minimize losses.

- Emphasize your knowledge of debt collection laws and regulations, including the Fair Debt Collection Practices Act (FDCPA).

- Showcase your strong communication and customer service skills, as effective communication is crucial in dealing with delinquent borrowers.

- Quantify your accomplishments whenever possible, providing specific metrics and results to demonstrate your impact on collection performance.

Essential Experience Highlights for a Strong Installment Loan Collector Resume

- Initiate and maintain contact with delinquent borrowers through multiple communication channels, including phone, email, text, and mail.

- Negotiate payment plans and settlements to recover past due payments and minimize financial losses.

- Verify and update customer information, including credit history, employment status, and contact details.

- Resolve disputes related to account balances, payment history, and fees, ensuring customer satisfaction and compliance with regulations.

- Maintain accurate and up-to-date records of all collection activities, ensuring compliance with internal policies and external regulations.

- Collaborate with legal counsel and other departments as necessary to resolve complex cases and pursue legal remedies.

- Prepare and present collection reports to management and other stakeholders, providing insights into collection trends and performance.

Frequently Asked Questions (FAQ’s) For Installment Loan Collector

What are the key skills required for an Installment Loan Collector?

The key skills required for an Installment Loan Collector include collection techniques, debt collection laws, skip tracing, negotiation, customer service, and problem solving.

What are the typical job duties of an Installment Loan Collector?

The typical job duties of an Installment Loan Collector involve contacting delinquent borrowers, negotiating payment plans and settlements, verifying customer information, resolving disputes, maintaining accurate records, collaborating with legal counsel, and preparing collection reports.

What are the qualifications required to become an Installment Loan Collector?

The minimum qualification required to become an Installment Loan Collector is a high school diploma or equivalent. However, most employers prefer candidates with a Bachelor’s Degree in a related field, such as business, finance, or accounting.

What is the average salary of an Installment Loan Collector?

The average salary of an Installment Loan Collector varies depending on experience, location, and employer. According to the U.S. Bureau of Labor Statistics, the median annual salary for debt collectors is around $45,000.

What are the career prospects for an Installment Loan Collector?

The career prospects for an Installment Loan Collector can be good, with opportunities for advancement to supervisory or management positions. With experience and additional training, Installment Loan Collectors can also transition into related roles in the financial services industry, such as credit analysts or loan officers.

What are the challenges faced by Installment Loan Collectors?

The challenges faced by Installment Loan Collectors include dealing with difficult customers, managing high stress levels, and meeting performance targets. Installment Loan Collectors must also be aware of and compliant with all applicable laws and regulations governing debt collection practices.

How can I improve my chances of getting hired as an Installment Loan Collector?

To improve your chances of getting hired as an Installment Loan Collector, you can obtain a relevant degree or certification, gain experience in customer service or debt collection, and develop strong negotiation and communication skills. You should also be familiar with debt collection laws and regulations.