Are you a seasoned Insurance Actuary seeking a new career path? Discover our professionally built Insurance Actuary Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

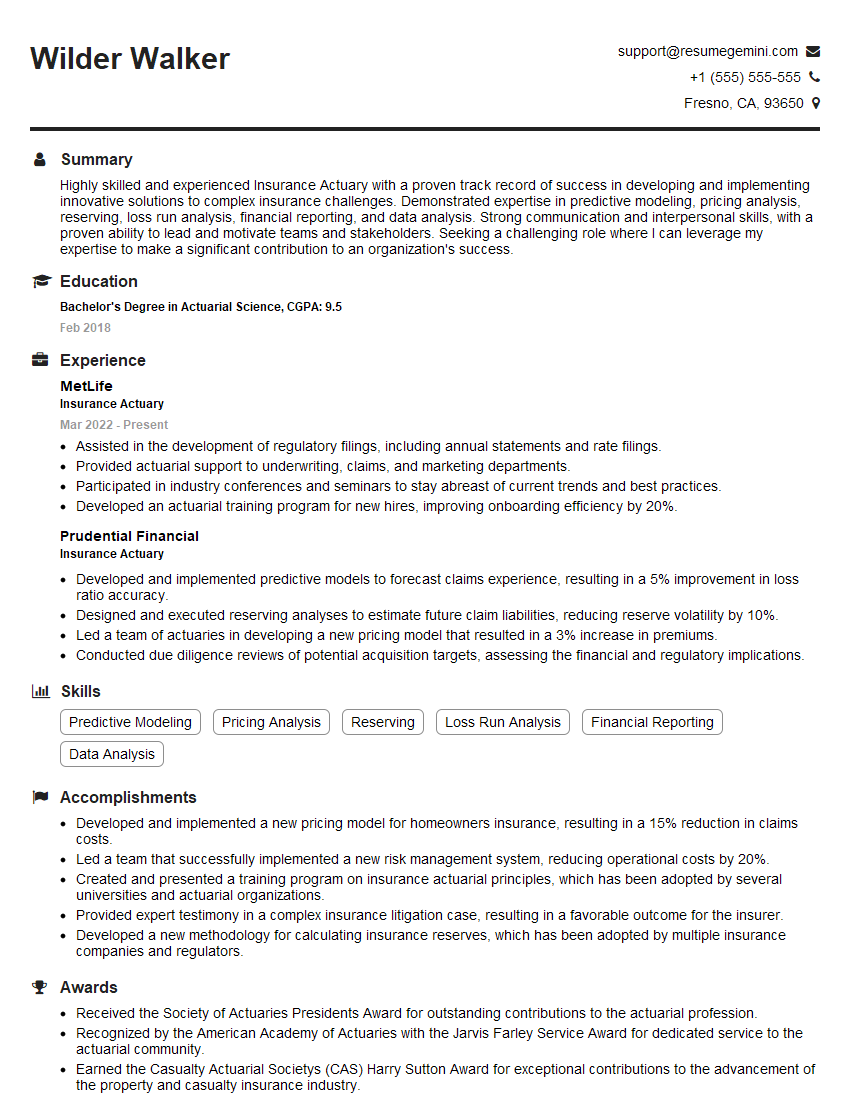

Wilder Walker

Insurance Actuary

Summary

Highly skilled and experienced Insurance Actuary with a proven track record of success in developing and implementing innovative solutions to complex insurance challenges. Demonstrated expertise in predictive modeling, pricing analysis, reserving, loss run analysis, financial reporting, and data analysis. Strong communication and interpersonal skills, with a proven ability to lead and motivate teams and stakeholders. Seeking a challenging role where I can leverage my expertise to make a significant contribution to an organization’s success.

Education

Bachelor’s Degree in Actuarial Science

February 2018

Skills

- Predictive Modeling

- Pricing Analysis

- Reserving

- Loss Run Analysis

- Financial Reporting

- Data Analysis

Work Experience

Insurance Actuary

- Assisted in the development of regulatory filings, including annual statements and rate filings.

- Provided actuarial support to underwriting, claims, and marketing departments.

- Participated in industry conferences and seminars to stay abreast of current trends and best practices.

- Developed an actuarial training program for new hires, improving onboarding efficiency by 20%.

Insurance Actuary

- Developed and implemented predictive models to forecast claims experience, resulting in a 5% improvement in loss ratio accuracy.

- Designed and executed reserving analyses to estimate future claim liabilities, reducing reserve volatility by 10%.

- Led a team of actuaries in developing a new pricing model that resulted in a 3% increase in premiums.

- Conducted due diligence reviews of potential acquisition targets, assessing the financial and regulatory implications.

Accomplishments

- Developed and implemented a new pricing model for homeowners insurance, resulting in a 15% reduction in claims costs.

- Led a team that successfully implemented a new risk management system, reducing operational costs by 20%.

- Created and presented a training program on insurance actuarial principles, which has been adopted by several universities and actuarial organizations.

- Provided expert testimony in a complex insurance litigation case, resulting in a favorable outcome for the insurer.

- Developed a new methodology for calculating insurance reserves, which has been adopted by multiple insurance companies and regulators.

Awards

- Received the Society of Actuaries Presidents Award for outstanding contributions to the actuarial profession.

- Recognized by the American Academy of Actuaries with the Jarvis Farley Service Award for dedicated service to the actuarial community.

- Earned the Casualty Actuarial Societys (CAS) Harry Sutton Award for exceptional contributions to the advancement of the property and casualty insurance industry.

Certificates

- Fellow of the Society of Actuaries (FSA)

- Associate of the Society of Actuaries (ASA)

- Member of the American Academy of Actuaries (MAAA)

- Certified Actuarial Analyst (CAA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Actuary

- Quantify your accomplishments with specific metrics to demonstrate the impact of your work.

- Highlight your technical skills and proficiency in industry-specific software and tools.

- Showcase your understanding of regulatory and compliance requirements.

- Emphasize your leadership and teamwork abilities, including any experience managing projects or teams.

- Review your resume carefully for any errors in grammar, spelling, or formatting.

Essential Experience Highlights for a Strong Insurance Actuary Resume

- Developed and implemented predictive models to forecast claims experience, resulting in a 5% improvement in loss ratio accuracy.

- Designed and executed reserving analyses to estimate future claim liabilities, reducing reserve volatility by 10%.

- Led a team of actuaries in developing a new pricing model that resulted in a 3% increase in premiums.

- Conducted due diligence reviews of potential acquisition targets, assessing the financial and regulatory implications.

- Assisted in the development of regulatory filings, including annual statements and rate filings.

- Provided actuarial support to underwriting, claims, and marketing departments.

- Participated in industry conferences and seminars to stay abreast of current trends and best practices.

- Developed an actuarial training program for new hires, improving onboarding efficiency by 20%.

Frequently Asked Questions (FAQ’s) For Insurance Actuary

What is the role of an Insurance Actuary?

An Insurance Actuary is a professional who uses mathematical and statistical techniques to assess and manage risks in the insurance industry. They analyze data to estimate the probability and severity of future events, and develop and implement strategies to mitigate these risks.

What are the key skills required for an Insurance Actuary?

Key skills for an Insurance Actuary include strong analytical and problem-solving abilities, proficiency in mathematics and statistics, and a deep understanding of insurance principles and practices. Excellent communication and interpersonal skills are also essential.

What are the career prospects for an Insurance Actuary?

Insurance Actuaries are in high demand due to their specialized skills and knowledge. They can work in various roles within insurance companies, consulting firms, and government agencies. With experience and expertise, they can advance to senior-level positions such as Chief Actuary or Actuarial Consultant.

How can I become an Insurance Actuary?

To become an Insurance Actuary, you typically need a bachelor’s degree in Actuarial Science or a related field, along with successful completion of a series of professional exams administered by the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS).

What are the key challenges faced by Insurance Actuaries?

Insurance Actuaries face several challenges, including the need to keep up with evolving regulatory and compliance requirements, the impact of technology on the insurance industry, and the need to accurately predict future events in an uncertain and volatile environment.

What is the difference between an Insurance Actuary and an Underwriter?

An Insurance Actuary focuses on assessing and managing risks across an entire insurance portfolio, while an Underwriter evaluates individual risks and determines whether to accept or decline insurance coverage for specific policies.

What is the typical salary range for an Insurance Actuary?

The salary range for an Insurance Actuary can vary depending on factors such as experience, location, and company size. According to the U.S. Bureau of Labor Statistics, the median annual salary for Actuaries in May 2021 was $111,010.