Are you a seasoned Insurance Appraiser seeking a new career path? Discover our professionally built Insurance Appraiser Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

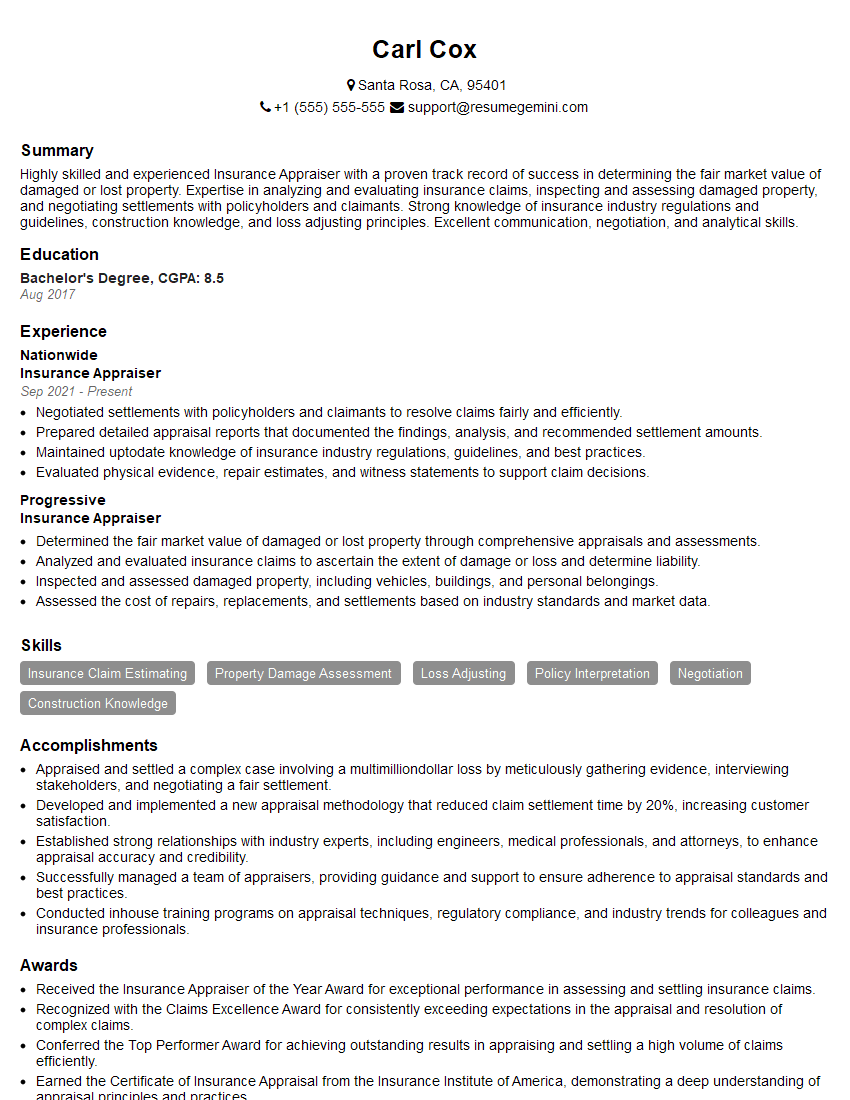

Carl Cox

Insurance Appraiser

Summary

Highly skilled and experienced Insurance Appraiser with a proven track record of success in determining the fair market value of damaged or lost property. Expertise in analyzing and evaluating insurance claims, inspecting and assessing damaged property, and negotiating settlements with policyholders and claimants. Strong knowledge of insurance industry regulations and guidelines, construction knowledge, and loss adjusting principles. Excellent communication, negotiation, and analytical skills.

Education

Bachelor’s Degree

August 2017

Skills

- Insurance Claim Estimating

- Property Damage Assessment

- Loss Adjusting

- Policy Interpretation

- Negotiation

- Construction Knowledge

Work Experience

Insurance Appraiser

- Negotiated settlements with policyholders and claimants to resolve claims fairly and efficiently.

- Prepared detailed appraisal reports that documented the findings, analysis, and recommended settlement amounts.

- Maintained uptodate knowledge of insurance industry regulations, guidelines, and best practices.

- Evaluated physical evidence, repair estimates, and witness statements to support claim decisions.

Insurance Appraiser

- Determined the fair market value of damaged or lost property through comprehensive appraisals and assessments.

- Analyzed and evaluated insurance claims to ascertain the extent of damage or loss and determine liability.

- Inspected and assessed damaged property, including vehicles, buildings, and personal belongings.

- Assessed the cost of repairs, replacements, and settlements based on industry standards and market data.

Accomplishments

- Appraised and settled a complex case involving a multimilliondollar loss by meticulously gathering evidence, interviewing stakeholders, and negotiating a fair settlement.

- Developed and implemented a new appraisal methodology that reduced claim settlement time by 20%, increasing customer satisfaction.

- Established strong relationships with industry experts, including engineers, medical professionals, and attorneys, to enhance appraisal accuracy and credibility.

- Successfully managed a team of appraisers, providing guidance and support to ensure adherence to appraisal standards and best practices.

- Conducted inhouse training programs on appraisal techniques, regulatory compliance, and industry trends for colleagues and insurance professionals.

Awards

- Received the Insurance Appraiser of the Year Award for exceptional performance in assessing and settling insurance claims.

- Recognized with the Claims Excellence Award for consistently exceeding expectations in the appraisal and resolution of complex claims.

- Conferred the Top Performer Award for achieving outstanding results in appraising and settling a high volume of claims efficiently.

- Earned the Certificate of Insurance Appraisal from the Insurance Institute of America, demonstrating a deep understanding of appraisal principles and practices.

Certificates

- Certified Insurance Appraiser (CIA)

- Associate in Claims (AIC)

- Advanced Claims Adjuster (ACA)

- Licensed Insurance Adjuster

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Appraiser

- Highlight your experience and expertise in insurance appraisals and loss adjusting.

- Quantify your accomplishments whenever possible, using specific numbers and metrics to demonstrate your impact.

- Showcase your knowledge of insurance industry regulations and guidelines, as well as your ability to interpret and apply them in your work.

- Emphasize your communication and negotiation skills, as these are essential for success in this role.

Essential Experience Highlights for a Strong Insurance Appraiser Resume

- Determined the fair market value of damaged or lost property through comprehensive appraisals and assessments.

- Analyzed and evaluated insurance claims to ascertain the extent of damage or loss and determine liability.

- Inspected and assessed damaged property, including vehicles, buildings, and personal belongings.

- Assessed the cost of repairs, replacements, and settlements based on industry standards and market data.

- Negotiated settlements with policyholders and claimants to resolve claims fairly and efficiently.

- Prepared detailed appraisal reports that documented the findings, analysis, and recommended settlement amounts.

- Maintained uptodate knowledge of insurance industry regulations, guidelines, and best practices.

Frequently Asked Questions (FAQ’s) For Insurance Appraiser

What is the role of an Insurance Appraiser?

An Insurance Appraiser is responsible for determining the fair market value of damaged or lost property, analyzing and evaluating insurance claims, and negotiating settlements with policyholders and claimants

What are the key skills required to be an Insurance Appraiser?

Key skills include insurance claim estimating, property damage assessment, loss adjusting, policy interpretation, negotiation, and construction knowledge

What are the career prospects for an Insurance Appraiser?

Insurance Appraisers with experience and expertise can advance to roles such as Senior Appraiser, Claims Manager, or Underwriter

What is the average salary for an Insurance Appraiser?

According to Salary.com, the average salary for an Insurance Appraiser in the United States is around $65,000 per year

What are the top companies that hire Insurance Appraisers?

Top companies that hire Insurance Appraisers include Nationwide, Progressive, and State Farm

What are the educational requirements to become an Insurance Appraiser?

A Bachelor’s Degree in a related field, such as business, economics, or finance, is typically required to become an Insurance Appraiser

What are the professional certifications available for Insurance Appraisers?

Professional certifications available for Insurance Appraisers include the Associate in Claims (AIC) and the Chartered Property Casualty Underwriter (CPCU) designations

What is the job outlook for Insurance Appraisers?

The job outlook for Insurance Appraisers is expected to grow in the coming years, as the demand for insurance services continues to increase