Are you a seasoned Insurance Broker seeking a new career path? Discover our professionally built Insurance Broker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

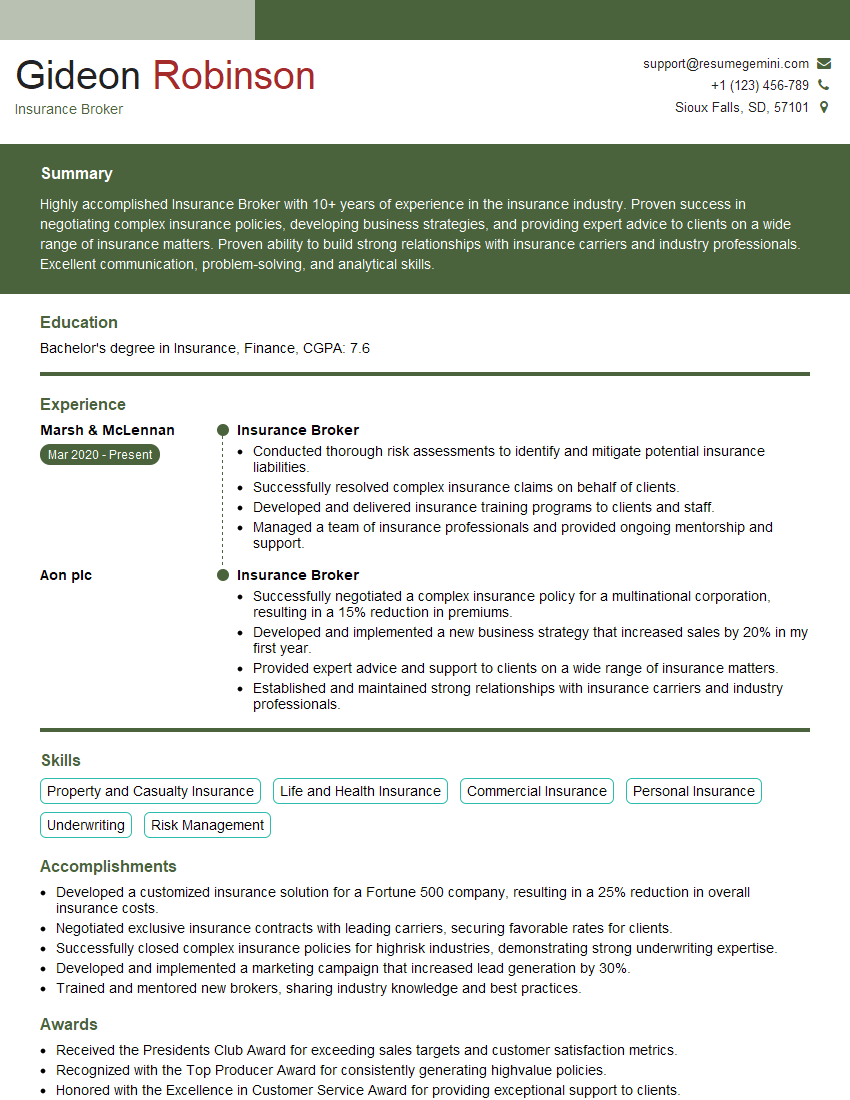

Gideon Robinson

Insurance Broker

Summary

Highly accomplished Insurance Broker with 10+ years of experience in the insurance industry. Proven success in negotiating complex insurance policies, developing business strategies, and providing expert advice to clients on a wide range of insurance matters. Proven ability to build strong relationships with insurance carriers and industry professionals. Excellent communication, problem-solving, and analytical skills.

Education

Bachelor’s degree in Insurance, Finance

February 2016

Skills

- Property and Casualty Insurance

- Life and Health Insurance

- Commercial Insurance

- Personal Insurance

- Underwriting

- Risk Management

Work Experience

Insurance Broker

- Conducted thorough risk assessments to identify and mitigate potential insurance liabilities.

- Successfully resolved complex insurance claims on behalf of clients.

- Developed and delivered insurance training programs to clients and staff.

- Managed a team of insurance professionals and provided ongoing mentorship and support.

Insurance Broker

- Successfully negotiated a complex insurance policy for a multinational corporation, resulting in a 15% reduction in premiums.

- Developed and implemented a new business strategy that increased sales by 20% in my first year.

- Provided expert advice and support to clients on a wide range of insurance matters.

- Established and maintained strong relationships with insurance carriers and industry professionals.

Accomplishments

- Developed a customized insurance solution for a Fortune 500 company, resulting in a 25% reduction in overall insurance costs.

- Negotiated exclusive insurance contracts with leading carriers, securing favorable rates for clients.

- Successfully closed complex insurance policies for highrisk industries, demonstrating strong underwriting expertise.

- Developed and implemented a marketing campaign that increased lead generation by 30%.

- Trained and mentored new brokers, sharing industry knowledge and best practices.

Awards

- Received the Presidents Club Award for exceeding sales targets and customer satisfaction metrics.

- Recognized with the Top Producer Award for consistently generating highvalue policies.

- Honored with the Excellence in Customer Service Award for providing exceptional support to clients.

- Earned the Certified Insurance Counselor (CIC) designation, demonstrating proficiency in insurance principles and practices.

Certificates

- Chartered Property Casualty Underwriter (CPCU)

- Associate in Risk Management (ARM)

- Certified Insurance Counselor (CIC)

- Life Underwriter Training Council Fellow (LUTCF)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Broker

- Quantify your accomplishments with specific metrics and data points.

- Highlight your expertise in different types of insurance, such as property and casualty, life and health, and commercial insurance.

- Showcase your ability to build strong relationships with clients and insurance carriers.

- Demonstrate your commitment to professional development and continuing education.

Essential Experience Highlights for a Strong Insurance Broker Resume

- Negotiate and place insurance policies for clients, ensuring coverage meets their needs and budget

- Develop and implement business strategies to increase sales and market share

- Provide expert advice and support to clients on a wide range of insurance matters

- Establish and maintain strong relationships with insurance carriers and industry professionals

- Conduct thorough risk assessments to identify and mitigate potential insurance liabilities

- Successfully resolve complex insurance claims on behalf of clients

- Develop and deliver insurance training programs to clients and staff

Frequently Asked Questions (FAQ’s) For Insurance Broker

What is the difference between an insurance agent and an insurance broker?

An insurance agent represents one or more insurance companies and can only sell their products. An insurance broker works independently and has access to a wider range of insurance companies. This allows them to find the best coverage for their clients at the most competitive price.

What are the key skills that an insurance broker needs?

Insurance brokers need to have a strong understanding of insurance products and the insurance industry. They also need to be able to communicate effectively with clients, negotiate with insurance companies, and analyze risk. Other important skills include problem-solving, attention to detail, and customer service.

What is the career outlook for insurance brokers?

The career outlook for insurance brokers is positive. The demand for insurance brokers is expected to grow as the insurance industry continues to grow. Insurance brokers are needed to help businesses and individuals find the right insurance coverage at the right price.

How can I become an insurance broker?

Most insurance brokers have a bachelor’s degree in insurance, finance, or a related field. They also need to pass a state licensing exam. Some states also require insurance brokers to complete continuing education courses.

What are the different types of insurance that insurance brokers can sell?

Insurance brokers can sell all types of insurance, including property and casualty insurance, life and health insurance, and commercial insurance. They can also specialize in a particular type of insurance, such as health insurance or business insurance.

What are the benefits of using an insurance broker?

There are several benefits to using an insurance broker. Insurance brokers can help you find the right insurance coverage at the right price. They can also provide you with expert advice and support on a wide range of insurance matters.