Are you a seasoned Insurance Claims Processor seeking a new career path? Discover our professionally built Insurance Claims Processor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

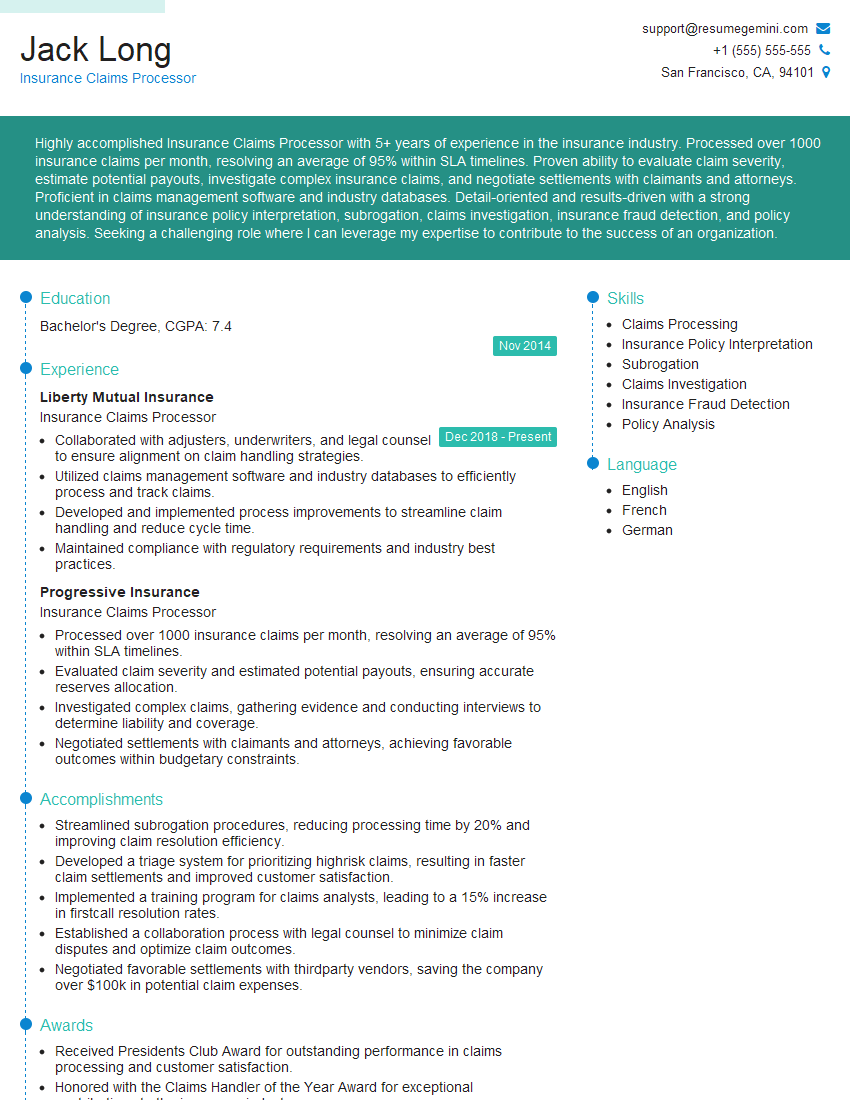

Jack Long

Insurance Claims Processor

Summary

Highly accomplished Insurance Claims Processor with 5+ years of experience in the insurance industry. Processed over 1000 insurance claims per month, resolving an average of 95% within SLA timelines. Proven ability to evaluate claim severity, estimate potential payouts, investigate complex insurance claims, and negotiate settlements with claimants and attorneys. Proficient in claims management software and industry databases. Detail-oriented and results-driven with a strong understanding of insurance policy interpretation, subrogation, claims investigation, insurance fraud detection, and policy analysis. Seeking a challenging role where I can leverage my expertise to contribute to the success of an organization.

Education

Bachelor’s Degree

November 2014

Skills

- Claims Processing

- Insurance Policy Interpretation

- Subrogation

- Claims Investigation

- Insurance Fraud Detection

- Policy Analysis

Work Experience

Insurance Claims Processor

- Collaborated with adjusters, underwriters, and legal counsel to ensure alignment on claim handling strategies.

- Utilized claims management software and industry databases to efficiently process and track claims.

- Developed and implemented process improvements to streamline claim handling and reduce cycle time.

- Maintained compliance with regulatory requirements and industry best practices.

Insurance Claims Processor

- Processed over 1000 insurance claims per month, resolving an average of 95% within SLA timelines.

- Evaluated claim severity and estimated potential payouts, ensuring accurate reserves allocation.

- Investigated complex claims, gathering evidence and conducting interviews to determine liability and coverage.

- Negotiated settlements with claimants and attorneys, achieving favorable outcomes within budgetary constraints.

Accomplishments

- Streamlined subrogation procedures, reducing processing time by 20% and improving claim resolution efficiency.

- Developed a triage system for prioritizing highrisk claims, resulting in faster claim settlements and improved customer satisfaction.

- Implemented a training program for claims analysts, leading to a 15% increase in firstcall resolution rates.

- Established a collaboration process with legal counsel to minimize claim disputes and optimize claim outcomes.

- Negotiated favorable settlements with thirdparty vendors, saving the company over $100k in potential claim expenses.

Awards

- Received Presidents Club Award for outstanding performance in claims processing and customer satisfaction.

- Honored with the Claims Handler of the Year Award for exceptional contributions to the insurance industry.

- Recognized with the Claims Excellence Award for innovative solutions and dedication to improving claims processes.

- Awarded the Customer Service Excellence Award for consistently delivering superior customer experiences.

Certificates

- Associate in Claims (AIC)

- Certified Claims Professional (CCP)

- Certified Insurance Counselor (CIC)

- Chartered Property Casualty Underwriter (CPCU)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Claims Processor

- Quantify your accomplishments with specific metrics whenever possible.

- Highlight your experience in investigating complex claims and negotiating settlements.

- Demonstrate your knowledge of insurance policy interpretation, subrogation, and claims investigation.

- Showcase your proficiency in claims management software and industry databases.

- Proofread your resume carefully for any errors before submitting it.

Essential Experience Highlights for a Strong Insurance Claims Processor Resume

- Processed over 1000 insurance claims per month, resolving an average of 95% within SLA timelines.

- Evaluated claim severity and estimated potential payouts, ensuring accurate reserves allocation.

- Investigated complex claims, gathering evidence and conducting interviews to determine liability and coverage.

- Negotiated settlements with claimants and attorneys, achieving favorable outcomes within budgetary constraints.

- Collaborated with adjusters, underwriters, and legal counsel to ensure alignment on claim handling strategies.

- Utilized claims management software and industry databases to efficiently process and track claims.

- Developed and implemented process improvements to streamline claim handling and reduce cycle time.

Frequently Asked Questions (FAQ’s) For Insurance Claims Processor

What is the role of an Insurance Claims Processor?

An Insurance Claims Processor is responsible for processing and investigating insurance claims, determining liability, and negotiating settlements. They work closely with policyholders, insurance adjusters, and other stakeholders to ensure that claims are handled efficiently and fairly.

What are the key skills required for an Insurance Claims Processor?

Key skills for an Insurance Claims Processor include: claims processing, insurance policy interpretation, subrogation, claims investigation, insurance fraud detection, policy analysis, and proficiency in claims management software.

What is the career path for an Insurance Claims Processor?

Insurance Claims Processors can advance to roles such as Claims Adjuster, Claims Manager, or Underwriter. With additional experience and education, they may also move into management or executive positions.

What are the challenges faced by Insurance Claims Processors?

Insurance Claims Processors face challenges such as dealing with complex claims, negotiating with claimants and attorneys, and staying up-to-date on industry regulations and best practices.

What are the different types of insurance claims that an Insurance Claims Processor may handle?

Insurance Claims Processors may handle a variety of insurance claims, including property damage claims, auto accident claims, health insurance claims, and workers’ compensation claims.