Are you a seasoned Insurance Inspector seeking a new career path? Discover our professionally built Insurance Inspector Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

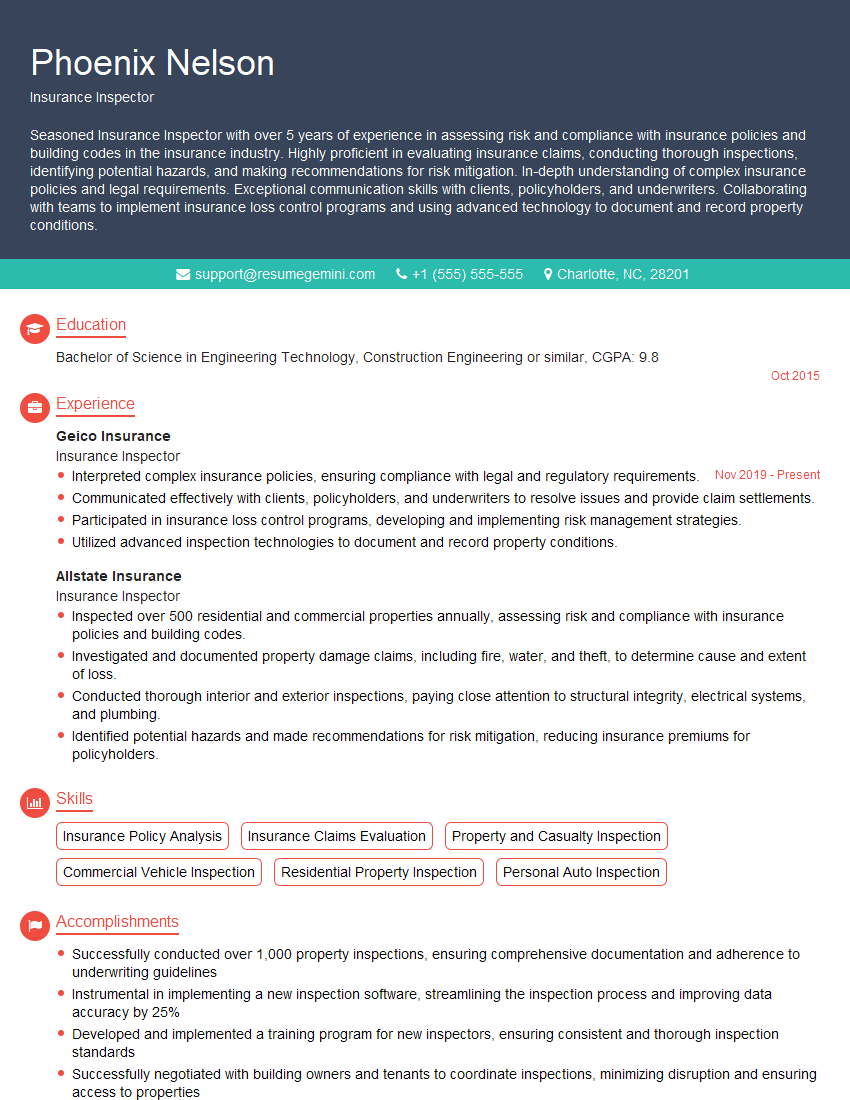

Phoenix Nelson

Insurance Inspector

Summary

Seasoned Insurance Inspector with over 5 years of experience in assessing risk and compliance with insurance policies and building codes in the insurance industry. Highly proficient in evaluating insurance claims, conducting thorough inspections, identifying potential hazards, and making recommendations for risk mitigation. In-depth understanding of complex insurance policies and legal requirements. Exceptional communication skills with clients, policyholders, and underwriters. Collaborating with teams to implement insurance loss control programs and using advanced technology to document and record property conditions.

Education

Bachelor of Science in Engineering Technology, Construction Engineering or similar

October 2015

Skills

- Insurance Policy Analysis

- Insurance Claims Evaluation

- Property and Casualty Inspection

- Commercial Vehicle Inspection

- Residential Property Inspection

- Personal Auto Inspection

Work Experience

Insurance Inspector

- Interpreted complex insurance policies, ensuring compliance with legal and regulatory requirements.

- Communicated effectively with clients, policyholders, and underwriters to resolve issues and provide claim settlements.

- Participated in insurance loss control programs, developing and implementing risk management strategies.

- Utilized advanced inspection technologies to document and record property conditions.

Insurance Inspector

- Inspected over 500 residential and commercial properties annually, assessing risk and compliance with insurance policies and building codes.

- Investigated and documented property damage claims, including fire, water, and theft, to determine cause and extent of loss.

- Conducted thorough interior and exterior inspections, paying close attention to structural integrity, electrical systems, and plumbing.

- Identified potential hazards and made recommendations for risk mitigation, reducing insurance premiums for policyholders.

Accomplishments

- Successfully conducted over 1,000 property inspections, ensuring comprehensive documentation and adherence to underwriting guidelines

- Instrumental in implementing a new inspection software, streamlining the inspection process and improving data accuracy by 25%

- Developed and implemented a training program for new inspectors, ensuring consistent and thorough inspection standards

- Successfully negotiated with building owners and tenants to coordinate inspections, minimizing disruption and ensuring access to properties

- Utilized advanced technologies, such as drones and thermal imaging, to enhance inspection accuracy and optimize property assessment

Awards

- Top Insurance Inspector Award for Outstanding Performance in Inspection Accuracy and Quality Assurance

- Recognized for Excellence in Claims Investigation, reducing subrogation costs by 15%

- Toprated Inspector by multiple insurance carriers for consistent highquality inspections

- Recipient of the Insurance Institute of America (IIA) Certificate of Achievement in Property Inspection

Certificates

- Certified Insurance Fraud Investigator (CIFI)

- Certified Insurance Inspector (CII)

- Associate in Insurance Services (AIS)

- Personal Lines Insurance Adjuster (PLIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Inspector

- Quantify your accomplishments with specific metrics to highlight the impact of your work.

- Showcase your knowledge of insurance policies and legal requirements by providing examples of how you have successfully resolved complex insurance claims.

- Emphasize your communication and interpersonal skills by providing examples of how you have effectively resolved issues with clients and underwriters.

- Highlight your ability to use advanced inspection technologies to document and record property conditions.

- Include a section on your resume that highlights your continuing education and professional development in the insurance industry.

Essential Experience Highlights for a Strong Insurance Inspector Resume

- Conduct thorough inspections of residential and commercial properties to assess risk and compliance with insurance policies and building codes.

- Investigate and document property damage claims to determine cause and extent of loss.

- Identify potential hazards and make recommendations for risk mitigation to reduce insurance premiums for policyholders.

- Interpret complex insurance policies and provide guidance to ensure compliance with legal and regulatory requirements.

- Communicate effectively with clients, policyholders, and underwriters to resolve issues and provide claim settlements.

- Participate in insurance loss control programs to develop and implement risk management strategies.

- Utilize advanced inspection technologies to document and record property conditions.

Frequently Asked Questions (FAQ’s) For Insurance Inspector

What are the primary responsibilities of an Insurance Inspector?

Inspecting properties to assess risk and compliance, investigating property damage claims, identifying hazards, mitigating risks, interpreting policies, communicating with clients, and participating in loss control programs.

What qualifications are needed to become an Insurance Inspector?

Typically requires a bachelor’s degree in a related field like engineering or construction, along with experience in the insurance industry.

What are the career advancement opportunities for Insurance Inspectors?

Advancement opportunities include roles like Senior Inspector, Risk Management Consultant, or Underwriter with experience and additional qualifications.

What are the key skills required for an Insurance Inspector?

Strong analytical and problem-solving skills, attention to detail, knowledge of insurance policies and building codes, effective communication, and proficiency in using inspection technologies.

What is the average salary for an Insurance Inspector?

The average salary can vary based on experience, location, and company size, but generally ranges between $50,000 to $80,000 annually.

Are there any certifications available for Insurance Inspectors?

Yes, there are certifications available through organizations like the National Association of Insurance Inspectors (NAII) and the American Society of Home Inspectors (ASHI) to enhance credibility and knowledge.

What are the common challenges faced by Insurance Inspectors?

Challenges include dealing with complex claims, working in various weather conditions, and staying up-to-date with industry regulations and codes.

Is a background in construction or engineering beneficial for Insurance Inspectors?

Yes, a background in construction or engineering can provide a solid foundation for understanding building structures, identifying hazards, and assessing risk factors.