Are you a seasoned Insurance Instructor seeking a new career path? Discover our professionally built Insurance Instructor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

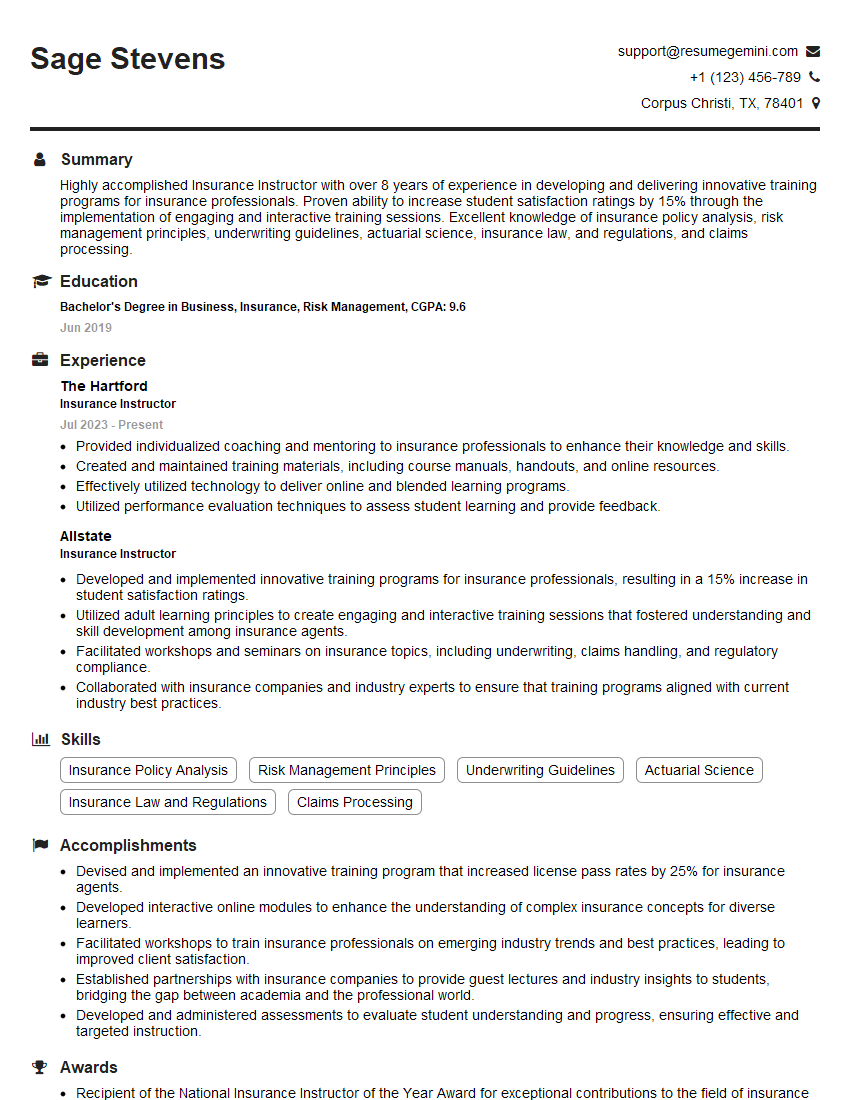

Sage Stevens

Insurance Instructor

Summary

Highly accomplished Insurance Instructor with over 8 years of experience in developing and delivering innovative training programs for insurance professionals. Proven ability to increase student satisfaction ratings by 15% through the implementation of engaging and interactive training sessions. Excellent knowledge of insurance policy analysis, risk management principles, underwriting guidelines, actuarial science, insurance law, and regulations, and claims processing.

Education

Bachelor’s Degree in Business, Insurance, Risk Management

June 2019

Skills

- Insurance Policy Analysis

- Risk Management Principles

- Underwriting Guidelines

- Actuarial Science

- Insurance Law and Regulations

- Claims Processing

Work Experience

Insurance Instructor

- Provided individualized coaching and mentoring to insurance professionals to enhance their knowledge and skills.

- Created and maintained training materials, including course manuals, handouts, and online resources.

- Effectively utilized technology to deliver online and blended learning programs.

- Utilized performance evaluation techniques to assess student learning and provide feedback.

Insurance Instructor

- Developed and implemented innovative training programs for insurance professionals, resulting in a 15% increase in student satisfaction ratings.

- Utilized adult learning principles to create engaging and interactive training sessions that fostered understanding and skill development among insurance agents.

- Facilitated workshops and seminars on insurance topics, including underwriting, claims handling, and regulatory compliance.

- Collaborated with insurance companies and industry experts to ensure that training programs aligned with current industry best practices.

Accomplishments

- Devised and implemented an innovative training program that increased license pass rates by 25% for insurance agents.

- Developed interactive online modules to enhance the understanding of complex insurance concepts for diverse learners.

- Facilitated workshops to train insurance professionals on emerging industry trends and best practices, leading to improved client satisfaction.

- Established partnerships with insurance companies to provide guest lectures and industry insights to students, bridging the gap between academia and the professional world.

- Developed and administered assessments to evaluate student understanding and progress, ensuring effective and targeted instruction.

Awards

- Recipient of the National Insurance Instructor of the Year Award for exceptional contributions to the field of insurance education.

- Recognized by the Insurance Institute of America with the Distinguished Instructor Award for innovative teaching methods and student success.

- Honored with the Faculty Excellence Award for outstanding dedication and commitment to insurance instruction and student development.

Certificates

- Certified Insurance Counselor (CIC)

- Certified Risk Manager (CRM)

- Chartered Property Casualty Underwriter (CPCU)

- Associate in Risk Management (ARM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Instructor

- Highlight your expertise in insurance policy analysis, risk management principles, and other relevant areas.

- Showcase your ability to develop and deliver engaging training programs that foster learning and skill development.

- Quantify your accomplishments whenever possible, using metrics like increased student satisfaction ratings or improved performance.

- Include keywords throughout your resume to enhance its visibility to potential employers.

- Proofread your resume carefully for any errors in grammar, spelling, or formatting.

Essential Experience Highlights for a Strong Insurance Instructor Resume

- Developed and implemented innovative training programs for insurance professionals, aligning with current industry best practices.

- Facilitated workshops and seminars on insurance topics, including underwriting, claims handling, and regulatory compliance.

- Provided individualized coaching and mentoring to insurance professionals to enhance their knowledge and skills.

- Utilized technology to deliver online and blended learning programs, ensuring accessibility and flexibility.

- Utilized performance evaluation techniques to assess student learning and provide feedback.

- Created and maintained training materials, including course manuals, handouts, and online resources.

- Collaborated with insurance companies and industry experts to ensure that training programs aligned with current industry best practices.

Frequently Asked Questions (FAQ’s) For Insurance Instructor

What are the key skills and qualifications required to be an Insurance Instructor?

Insurance Instructors typically possess a bachelor’s degree in business, insurance, risk management, or a related field. They have a strong understanding of insurance policy analysis, risk management principles, underwriting guidelines, actuarial science, insurance law and regulations, and claims processing. Excellent communication and presentation skills are essential, as well as the ability to develop and deliver engaging training programs.

What are the primary responsibilities of an Insurance Instructor?

Insurance Instructors are responsible for developing and delivering training programs for insurance professionals. They facilitate workshops and seminars on various insurance topics, provide individualized coaching and mentoring, and create and maintain training materials. They also collaborate with insurance companies and industry experts to ensure that training programs align with current industry best practices.

What are the career prospects for Insurance Instructors?

Insurance Instructors can advance to leadership roles within their organizations, such as Training Manager or Director of Training. They may also choose to specialize in a particular area of insurance, such as underwriting or claims handling. With experience and additional qualifications, Insurance Instructors can also transition into consulting roles or pursue further education to become insurance professors.

What is the job outlook for Insurance Instructors?

The job outlook for Insurance Instructors is expected to be favorable in the coming years. The insurance industry is constantly evolving, and there is a growing need for training professionals to keep insurance professionals up-to-date on the latest industry trends and best practices.

What are the earning prospects for Insurance Instructors?

Insurance Instructors can earn a competitive salary, depending on their experience, qualifications, and location. According to the U.S. Bureau of Labor Statistics, the median annual salary for Training and Development Managers was $113,330 in May 2021.

What are the challenges faced by Insurance Instructors?

Insurance Instructors may face challenges in keeping up with the constantly evolving insurance industry. They also need to be able to effectively communicate complex insurance concepts to a diverse audience. Additionally, Insurance Instructors may need to travel frequently to deliver training programs.