Are you a seasoned Insurance Representative seeking a new career path? Discover our professionally built Insurance Representative Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

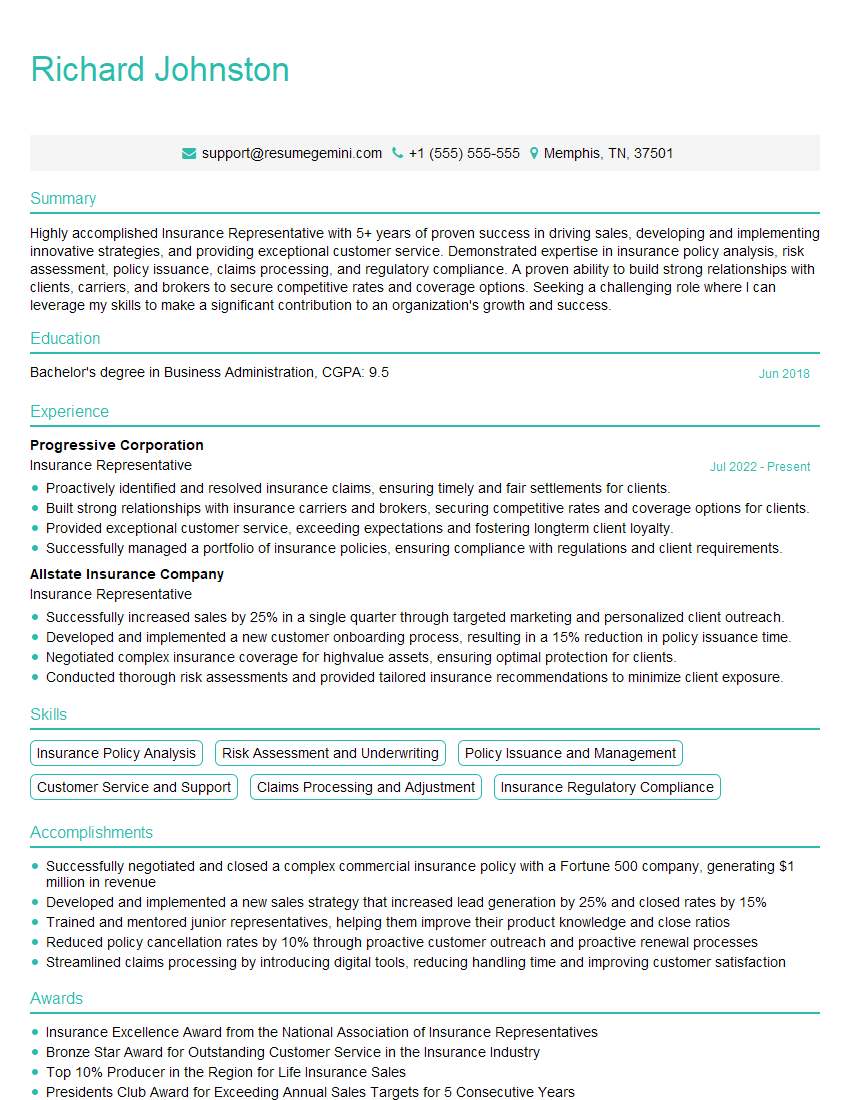

Richard Johnston

Insurance Representative

Summary

Highly accomplished Insurance Representative with 5+ years of proven success in driving sales, developing and implementing innovative strategies, and providing exceptional customer service. Demonstrated expertise in insurance policy analysis, risk assessment, policy issuance, claims processing, and regulatory compliance. A proven ability to build strong relationships with clients, carriers, and brokers to secure competitive rates and coverage options. Seeking a challenging role where I can leverage my skills to make a significant contribution to an organization’s growth and success.

Education

Bachelor’s degree in Business Administration

June 2018

Skills

- Insurance Policy Analysis

- Risk Assessment and Underwriting

- Policy Issuance and Management

- Customer Service and Support

- Claims Processing and Adjustment

- Insurance Regulatory Compliance

Work Experience

Insurance Representative

- Proactively identified and resolved insurance claims, ensuring timely and fair settlements for clients.

- Built strong relationships with insurance carriers and brokers, securing competitive rates and coverage options for clients.

- Provided exceptional customer service, exceeding expectations and fostering longterm client loyalty.

- Successfully managed a portfolio of insurance policies, ensuring compliance with regulations and client requirements.

Insurance Representative

- Successfully increased sales by 25% in a single quarter through targeted marketing and personalized client outreach.

- Developed and implemented a new customer onboarding process, resulting in a 15% reduction in policy issuance time.

- Negotiated complex insurance coverage for highvalue assets, ensuring optimal protection for clients.

- Conducted thorough risk assessments and provided tailored insurance recommendations to minimize client exposure.

Accomplishments

- Successfully negotiated and closed a complex commercial insurance policy with a Fortune 500 company, generating $1 million in revenue

- Developed and implemented a new sales strategy that increased lead generation by 25% and closed rates by 15%

- Trained and mentored junior representatives, helping them improve their product knowledge and close ratios

- Reduced policy cancellation rates by 10% through proactive customer outreach and proactive renewal processes

- Streamlined claims processing by introducing digital tools, reducing handling time and improving customer satisfaction

Awards

- Insurance Excellence Award from the National Association of Insurance Representatives

- Bronze Star Award for Outstanding Customer Service in the Insurance Industry

- Top 10% Producer in the Region for Life Insurance Sales

- Presidents Club Award for Exceeding Annual Sales Targets for 5 Consecutive Years

Certificates

- Certified Insurance Counselor (CIC)

- Associate in Risk Management (ARM)

- Chartered Property Casualty Underwriter (CPCU)

- Certified Insurance Services Representative (CISR)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Representative

Quantify your accomplishments:

Use specific numbers and metrics to demonstrate the impact of your work. For example, instead of saying ‘Increased sales,’ say ‘Successfully increased sales by 25% in a single quarter through targeted marketing and personalized client outreach.’Highlight your skills and expertise:

Use action verbs and specific examples to showcase your proficiency in insurance policy analysis, risk assessment, policy issuance, claims processing, and regulatory compliance.Demonstrate your customer service skills:

Emphasize your ability to build strong relationships with clients and provide exceptional service. Share examples of how you have gone above and beyond to meet client needs and resolve their concerns.Showcase your industry knowledge:

Stay up-to-date on industry best practices and regulations. Highlight your understanding of insurance products, underwriting guidelines, and claims processes.

Essential Experience Highlights for a Strong Insurance Representative Resume

- Analyzed insurance policies to identify coverage gaps and recommend tailored solutions to meet client needs.

- Conducted thorough risk assessments to evaluate potential exposures and develop comprehensive insurance plans.

- Processed and adjusted insurance claims promptly and efficiently, ensuring fair and timely settlements for clients.

- Provided exceptional customer service, exceeding expectations and fostering long-term client loyalty.

- Maintained a portfolio of insurance policies, ensuring compliance with regulations and client requirements.

- Negotiated complex insurance coverage for high-value assets, ensuring optimal protection for clients.

- Collaborated with insurance carriers and brokers to secure competitive rates and coverage options for clients.

Frequently Asked Questions (FAQ’s) For Insurance Representative

What is the primary role of an Insurance Representative?

The primary role of an Insurance Representative is to provide comprehensive insurance solutions to individuals and businesses. They analyze clients’ needs, assess risks, and recommend appropriate insurance coverage. They also process claims, negotiate settlements, and ensure compliance with regulatory requirements.

What are the key skills required for success as an Insurance Representative?

Key skills for success as an Insurance Representative include strong communication and interpersonal skills, analytical and problem-solving abilities, knowledge of insurance products and regulations, proficiency in policy analysis and risk assessment, and a commitment to providing excellent customer service.

How can I enhance my resume for an Insurance Representative role?

To enhance your resume for an Insurance Representative role, focus on highlighting your relevant skills and experience. Quantify your accomplishments, demonstrate your industry knowledge, and showcase your commitment to providing exceptional customer service. Consider obtaining industry certifications to further validate your expertise.

What is the career path for an Insurance Representative?

The career path for an Insurance Representative can vary depending on individual goals and experience. With strong performance and professional development, Insurance Representatives can advance to roles such as Senior Insurance Representative, Underwriter, or Insurance Broker. Some may also pursue specialized areas such as commercial insurance or financial planning.

What are the earning prospects for an Insurance Representative?

Earning prospects for Insurance Representatives vary based on experience, location, and company size. According to the U.S. Bureau of Labor Statistics, the median annual salary for Insurance Sales Agents was $52,490 in May 2021. Top earners can exceed $100,000 per year.

What are the challenges faced by Insurance Representatives?

Insurance Representatives may face challenges such as a competitive job market, evolving regulatory requirements, and the need to stay up-to-date on industry trends. They may also encounter clients with complex insurance needs, requiring them to provide tailored solutions and navigate complex claims processes.